Tax filing moving onto cellphone

Canada Revenue Agency now supports cellphone access with MyCRA

For most people, it's hard to imagine doing their taxes on their mobile phone.Tiny screens, fat fingers, multiple forms and complex math do not seem a good combination.

Yet filing via mobile is increasingly an option, especially for those who leave it to the last minute.

Last year 10,172 returns were filed on mobile software, according to Canada Revenue Agency. And a total of 23million returns came via electronic filing, any of which may have been partly completed via cellphone.

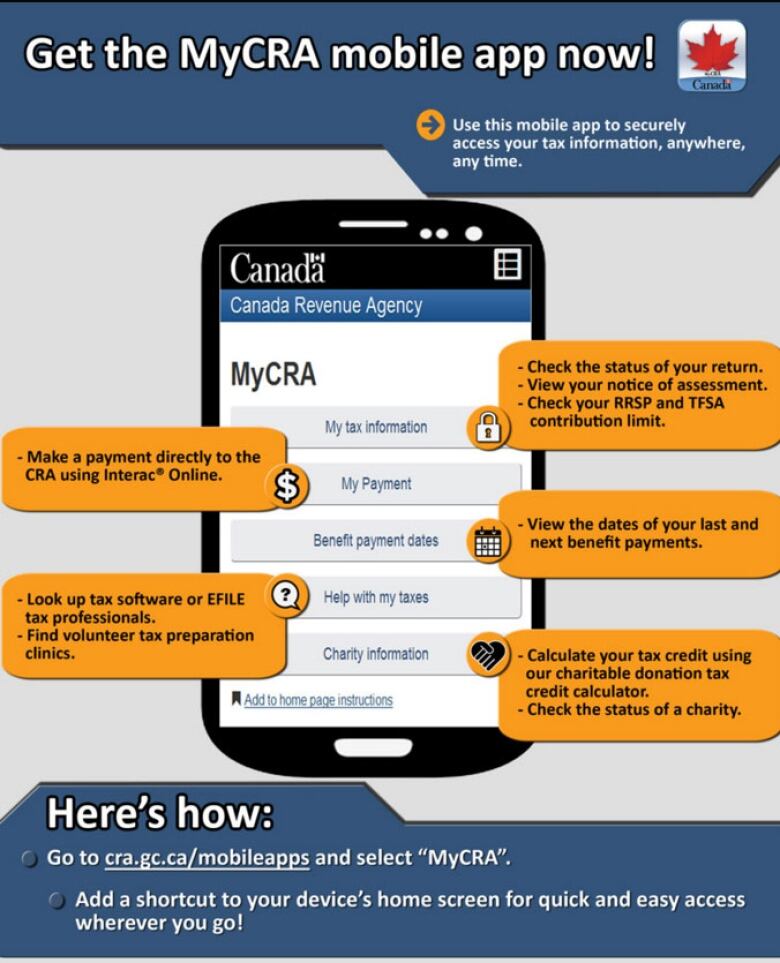

New CRA mobile app

For 2015, the options for filing via cellphone have gotten better and the CRA is for the first time offering support service for mobiles.

Like CRA'sMyAccount service, it provides online access to one's notice of assessment, tax return status, benefit and credit information, and toRRSP and TFSA contribution information on the CRA site. It is protected by the same password.

This year, the tax agency has certified Fastneasytax for Android and TurboTax for Android and iPhone. In addition, there are certified iPad apps from Fastneasytax, TurboTax, SimpleTax and TaxFreeway. Some of these programs are free.

"People who are just out of college in their 20s they think absolutely nothing of doing their taxes on a mobile device," said Todd Stanley, general manager of TurboTax Canada.

For a simple, basic return, it's a matter of entering a few figures and filing electronically.

But even people who need a desktop or a laptop and their paper forms stacked up beside them are still doing some of the work on mobile, perhaps starting work on their cellphone on the train home before sitting down to spend the evening with the general return.

Stanley said about 14 per cent of TurboTax customers used mobile access last year.

Start on mobile, finish on desktop

TurboTax offersa free mobile app for Android or Apple this year that supports most tax Canadian tax situations, except in Quebec.

Stanley said the app is optimized for a cellphone, but isalso made to adapt to a desktop ortablet.

"Any time you use the application, it's going to fit perfectly on your mobile device screen," he said, pointing out the different screen sizes on mobile phones, from the smallest Apple to the largest Android on the market.

Unlike the popular TurboTax web software, the appdoesn't guide users through a series of questions, but presents a series of forms to fill out. It also supports CRA's Autofill function.

Fastneasytax, created by a small Ontario partnership, is free for people who make less than $20,000 and $9.99 for anyone with a higher income.

People who make less than $20,000 often have very simple tax situations and may be in the position where they cannot afford a laptop or desktop, said Raj Ray, one of the founders of Fastneasytax.

Software walks you through

The Fastneasytax mobile interface walks people through a series of questions to help them complete the tax form, he said.

Fastneasytax has had mobile apps since last year and upgraded this year to link to the CRA's Auto-fill function.

Anyone who signs up for MyAccount with the CRA can use Auto-fill to download much of their information automatically including information from T4s, T4As, T5s and RRSP receipts. Software makers have been collaborating with CRA to create a securedownload function fromthe CRA site.

That makes filling out tax information faster and more accurate, as CRA has the most accurate figures. The software takes care of all the calculations.

If you have an amount owing, you can visit:http://www.cra-arc.gc.ca/mkpymnt-eng.htmlfor a full list of payment options. Refunds can be deposited directly into your account.

Corrections

- An earlier version of this story said 2.1 million returns came via electronic filing. The correct figure is 23 million returns came by electronic filing and 2.1 million used web-based software, according to the Canada Revenue Agency.Mar 15, 2016 2:07 PM ET

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)