Norfolk Southern's chilly response to CP takeover offer shows deal faces hurdles

Merger would create the largest rail operator in North America, but deal could easily be derailed

Canadian Pacific Railway's offer to buy U.S. rival Norfolk Southern is no sure thing, as the deal must meet numerous regulatory hurdles even if the management of both companies agree to go along.

On Tuesday, Canadian Pacific, led by Hunter Harrison,made official a long-rumoured deal to buy Norfolk Southern for a combination of cash and stock that values the American rail line at more than $28 billion and puts almost $95 US per share in the pockets of its investors.

That's more than a 20 per cent premium to where the shares were earlier this month before word of a possible deal leaked. But despite that markup, Norfolk Southern's management was cool to the offer in its official response, describing it as "lowpremium" in a release on Wednesday.

The Virginia-based companysays it will "carefully evaluate and consider this indication of interest" for its shareholders, but the lack of enthusiasm is a sign the deal is far from done.

Numerous regulatory hurdles

For starters, the company would need the OK of the U.S.Surface Transportation Board or STB, which has been cool to the idea of railway mergers in the past. The last time a major one was proposed, in 1999, between CP's main rival Canadian National and a U.S. line called Burlington Northern Santa Fe, the STB blocked the move and implemented a temporary moratorium on all future Class I railroadmergers.

Class I railroadsincludeseven major rail companies across North America, including CP and CN in Canada andfivemajor U.S. lines, each major players in certain parts of the U.S.:

- BNSFin the Western U.S.

- Union Pacific in the same area

- Florida-based CSX (which CP tried to buy in 2014)

- Norfolk Southern, which covers most of the Eastern Seaboard down into the Gulf

- Kansas City Southern in the southwest

CP is trying to link its Western Canadian-based line with Norfolk's network of lines across 22 states, predominantly in the southeast. The aim is tocreate a sprawling transcontinental networkwith more kilometres of railway than anyone else in Canada and the U.S, with access to the Atlantic, Pacific and Gulf of Mexico coasts.

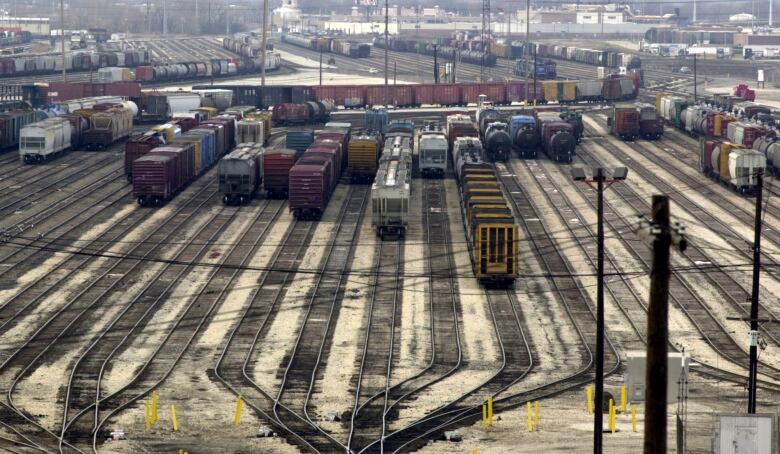

Itwould also give the combined company the option of bypassingthe bottleneck of Chicago, where a large proportion ofNorth American rail traffic passes through. The railway hub hasbecome so overloadedin recent years that it can take more than a day to simply pass through the terminal portionand get a railcar transferred between competing lines.

"Chicago has long been acknowledged as the Achilles heel of North America's Class 1 rail system, a hub that regularly invites the term 'parking lot'during difficult winter conditions," Raymond James analystsSteve Hansen and Daniel Chew said in a noteWednesday.

The proposed tie-up would allow the combined company to bypass Chicago entirely via either CP's routes through Canada, or by connecting CPwith Norfolk's existing infrastructure south of Chicago.

Thatwould begood news for CP andNS, but it wouldalso be good news for the other rail lines,as the shifted traffic would removecongestion in Chicago. Thatwill likely be a key part of thecompany's pitch to the regulator STB, which won'twant to see competition reduced by adeal.

Concessions to win approval

CP's offer includes an unprecedented promise that if its customers are ever dissatisfied by the new company's service or prices, "it would allowcompeting carriers access to operate over its tracks and into its terminals," the Raymond James analysts said.

The proposed deal would also allow customers pick their delivery route, which would curb the practice of "bottleneck" pricing that sees customers pay more because certain areas are overloaded.Winning over customers could go a long way toward securing regulatory approval, transportation consultant Anthony Hatch said.

"Will shippers, historically not the largest member group of the [Hunter Harrison]Fan Club, take this position and become active supporters?" he asked in a note Wednesday.

If so, that might be enough to get it donebutthe STB couldbe reluctant to give their OK to a deal even if it's fine on its own merits, just because that would set a precedent and encourage others to try the same, Raymond James said.

And the STB isn't even the only regulator that needs to weigh in, notes Barry Schwartz, the chief investment officer of Baskin Wealth Management in Toronto.

"The chances of it happeningare slim," he said in an interview. "There'scross-border issues, security issues, safety issues ... the list goes on and on and on," he said.

"CP is going to be keeping lawyers busy," he added, estimating any finished deal would be at least one year away from approval and that's if shareholders themselves agree to the deal, to say nothing of Canadian agencies such as Transport Canada and the union that represents the employees.

And that's assuming that Norfolk Southern even wants to be bought, which, based on the board'swords on Tuesday, is no sure thing. Even they noted the "significant regulatory hurdles" that the deal would need to clear.

But some, at least, think there's a glimmer of hope. "They also didn't say 'no'to the idea, suggesting instead that they will closely evaluate the offer thus leaving the door open to further negotiation," Raymond James said in itsnote.

The investment firm suggests CP, or someone else, could sweeten their offer to as much as $110 per share and still have it be worth their while.

Investors seem to be betting that this story is far from over, as the company's shares were trading below the offer price on the NYSE on Wednesday, changing hands at around $92 per share, well below CP's offer price.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)