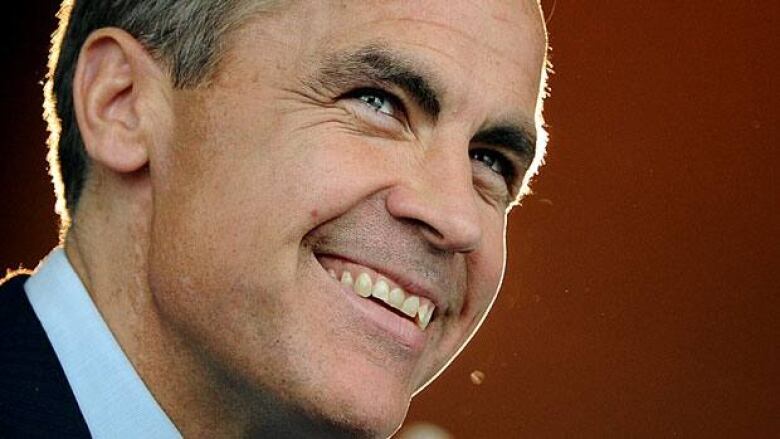

Carney defends Bank's approach on rates

Bank of Canada governor Mark Carney is defending the way the central bank sets interest rates, noting that it can be used to address a wide range of situations. I

In a speech in New York, Carney said Friday that low interest rates over a prolonged period of time can cloud financial judgments and prompt companies and people to carry too much debt for too long.

But, he said the central bank's framework allows for flexibility to address the concerns.

While the first line of defence is regulation and supervision, Carney said monetary policy can also be used to address imbalances that may have economy-wide implications.

"A virtue of flexible inflation targeting is that if the regime is credible, the inflation target can anchor inflation expectations while leaving room for policy-makers to occasionally use monetary policy for financial stability purposes," he said.

Carney noted that Canadian banks are reinforcing their balance sheets to meet the Basel III requirements ahead of schedule and the federal government has tightened home mortgage financing rules to help prevent consumers from borrowing more than they can handle.

The central bank recently completed a review of its monetary policy framework and reaffirmed its position on inflation targeting.

Rateat 1% for more than a year

Under its framework, the bank aims to return inflation to a medium-term target while limiting volatility in other areas in the economy.

However Carney noted that flexibility in the time it takes to return inflation to the target rate cannot be arbitrary and needs a clear and transparent approach.

The U.S. Federal Reserve has said that its fed funds rate is expected to remain at exceptionally low levels at least through late 2014.

"Extraordinary forward policy guidance within a flexible IT framework helped the Bank of Canada provide additional stimulus when it was needed and should help the Fed do the same. The Fed's experience with a published interest rate path in conventional times, when they return, is something we will watch with interest," Carney said.

The Bank of Canada's key overnight rate has been set at one per cent for more than a year.

Inflation edged up in January to 2.5 per cent, boosted by an increase in gasoline prices, however the underlying core inflation ratewhich excludes volatile items such as some fresh food and gasrose to 2.1 per cent, one tick higher than the Bank of Canada's target.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)