Canadian LNG prospects keep getting worse as prices tank and red tape delays projects

It's possible no export facilities are ever built in B.C., expert suggests

Originally published May 3

By now, B.C. should be rolling in cash from its burgeoning LNG industry tens of thousands of new jobs, billions in potentialroyalties and a roaring economy with all the new investment into the province.

Instead, it'sstill waiting for ground to breakon any new facility, or even a final investment decision for an LNG plant.

While several liquefied natural gas (LNG) plants are proposed, they have all struggled to get off the groundas they wait for regulatory approval, delay making spending decisions, or cancel plans altogether.

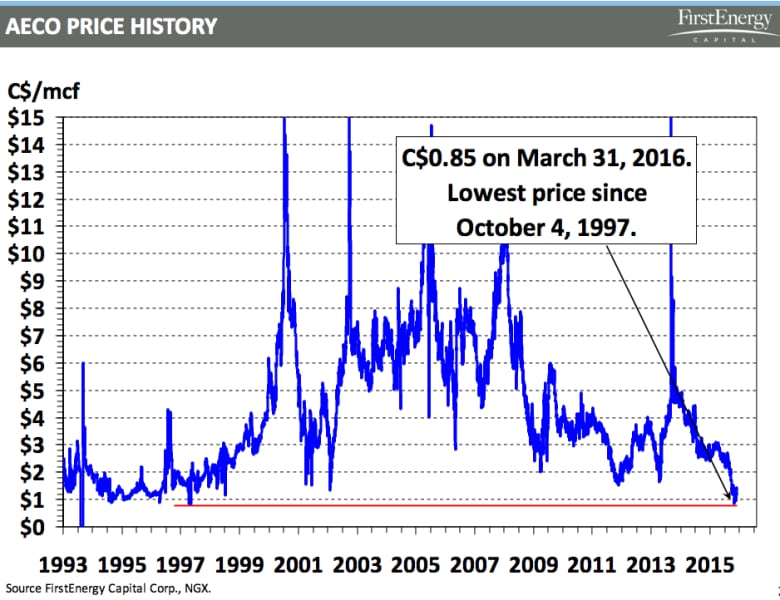

Canada is still behind the 8-ball- Martin King, FirstEnergy Capital

A collapse in global LNG prices is the main culprit for why so many Canadian LNG export projects are in limbo or no longer make economic sense.

"A lot of these projects should have been off the ground or under construction. It doesn't seem to be happening," said Martin King, a commodities analyst with Calgary-based FirstEnergy Capital.

- B.C.prosperity fund to get $100M contribution, but not from LNG

- Christy Clark still trying to deliver on her LNG promise

There is a growing possibility that no companies make final investment decisions on LNG projects until at least 2020, said King.

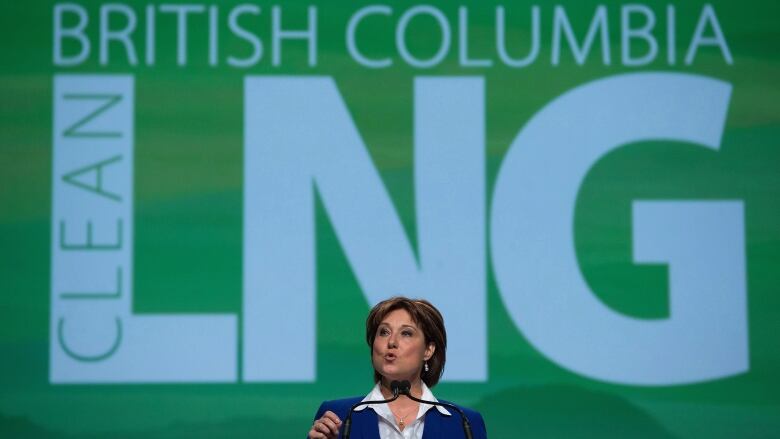

LNG delays have put B.C. Premier Christy Clark under considerable pressure.She charismatically praised LNG as an industry that would bring incredible wealth to B.C. money topay off all of the province'sdebt and create a $100-billion prosperity fund.

The province would startcollecting LNG revenues, Clark had told voters, by 2017.

Global LNG prices have fallen by more than 50 per cent in the last few years, bringing down the enthusiasm of LNG on the West Coast.

"They are just not high enough to invite more capital to the sector," saidenergy economist Kenneth Medlock, with Rice University.

MedlockthinksB.C. may never see any commercially viable LNG facilitiesconstructed.

"It is a distinct possibility. I think if something were to happen it would be 15 or 20 years down the road when there is actually enough demand. Absent that, I just don't see it," said Medlock.

Strong headwinds

The LNG facilities face competition from the United States and Australia, both of which are already exporting natural gas.

The Canadian projects will have to keep costs low, which could be difficult because they are planned for remote locations on the coast. Pipelines are necessary since gas fields are on the east side of B.C., Alberta and Saskatchewan.

Shellhas deferred itsdecisionon its proposed plant, while AltaGashas cancelledits DouglasChannel LNG project.

The Pacific Northwest LNG facility is considered the best bet to be built. The NEB has approved the project, so it's now up to the federal government to make a decision. The government could make an announcement as early asmid-summer on the $36-billion project, according to aBloomberg report on Tuesday.

Several First Nations oppose the project and have not settled with Pacific Northwest LNG.

"Canada is still behind the eight-ball in terms of getting these projects off the ground," said King. "It's still really iffy right now."

Natural gas market struggling

In the meantime, the woes continue for natural gas producers. Prices are near 19-year lows.

Companies want to export natural gas because world prices arehigher than in North America.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)