Loonie could brace for a return to 'Dutch disease' if oil stays strong: Don Pittis

GDP and other indicators show Canadian currency could be set to strengthen

This week's startling jump in economic growth was due to just one thing.

As economists and commentators fretted over a trade war with the United States andconcerns that Europe and Mexico might be making deals that excluded Canada, the Canadian oil industry was on a tear.

Almost exactly four years since the Canadian petroleum industry went from hero to zero as oil prices plunged, investment in the Alberta oilsands and the Atlantic offshore industry are on the rise again.

And despite a stubborn unwillingness of theCanadian dollar to budge off its lows, there are reasons to think it may follow oil up.

Oil on the rise

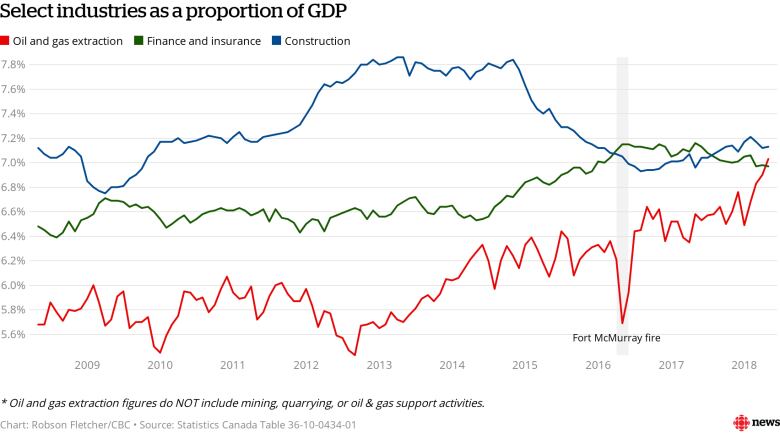

According tofigures released this week by Statistics Canada, construction was still the biggest driver of the Canadian economybutremained relatively flat.

A surge in oil and gas investment, meanwhile, meant the sector beat out the sagging banking and insurance industries to take second place at sevenper cent of the economy.

Investment in the oilsands is up 14 per cent in the last year, hitting an all-time high.

There are, of course, many qualifications,including a statistical quirk in the comparison between sectors.But Canadians have their own way of confirming the surge in global demand for oil:thecost ofa tank of gasis headingback toward 2014 levels.

There are no guarantees in the oil and gas business. As has been observed many times in the past, an industry that cannot foresee a decline in prices from about $100 in 2014, to about $30twoyears later cannot be trusted to know the future.

Oil has been off its recent highs of more than$70 US,but since hitting its 2016 lows, the trend is undeniable:In the last year alone, oil prices have marched steadily higher.

In itslatest Global Risk Radar report, the Swiss banking giant UBS contemplated the global economic impact of oil prices at $120 USa barrel, giving such an event a 20 to 30 per cent probability in the next six to 12 months.

"During previous episodes of large oil supply shocks, global equities fell about 15 per centon average, but recovered within six months," said theUBSreport.

Running out?

That kind of supply shock would require a major collapse in output by a large supplier, caused by something like an outbreak or escalation of conflict in the Middle East. (As one commentator pointed out, such scary events are for scenario planners and risk testers.)

But fresh evidence suggestsoil demand and prices will remain strong.

Several reports suggest that Saudi oilthe bottomless pit for satisfying global demandcannot expand production quickly or easily. Data crunchedyesterday fromBloombergNews shows crude output from both Saudi Arabia and Russianeared record peak levels in July.

China and India, meanwhile, are consuming record amounts of oil from Iran. And the huge reserves in Venezuela lay idle as the country's economy continues its tailspin, with its inflation rate heading toward 1 million per cent.

It is a well-accepted fact that the earth has plentyof oil. Even as oil prices and investment in new production declined, output continued to grow.

What we are seeing nowmay be a signthat as underdeveloped economies catch up with Europe and North America in energy use, andthe developed world heads into a U.S.-led economic growth spurt, production just hasn't been keeping pace.

At any moment, supply and demand are in balance.Under-producing by just a littlepushes prices up, giving the signal it is time to invest.

Back on track

If this analysis provestrue, the Canadian oil industry is back on track. If it can befinished before the next oil slump, the Trans Mountain pipeline expansion will be a great taxpayer investment purely in financial terms.

Ironicallyand painfully, for some thisnew oil-and-gas boom comes just as forest fires and deadly heat waves offer new evidence of the impact of burning fossil fuels.

But even countriescommitted to fighting climate change aresomehowcaving into the economic pressure to produce and consume more oil.

As my colleague Pete Evans reported last month, fears of the effects of trade sanctions have so far cured Canada'sDutch diseasethe tendency that thecurrency of a small economy, like ours,will rise as oil exports grow.

Interestingly, a similar phenomenon has been observed among other so-called petrocurrencies.

Dislocation between #oil and oil linked currencies is getting wider pic.twitter.com/45SD2dwrsX

—@chigrlAs well as sparking debate, the widening spread between the price of oil and oil-linked currencies has someforex traders rubbing their hands, imagining the killing to be made once the individual forces holding the loonie and its companionsdown begin to weaken.

Currencies share with oil a reputation for refusing to follow any analytical script, insteadheading off with minds of their own. But it would seem reasonable that anyone wanting to do something that benefits from a low loonie selling a company to a foreign buyer or moving cash to Canada to investshould consider doing it while they have the chance.

In the longer run, the prediction that worsening climate damage to our one and only Earth willconvince people to leave fossils fuels in the ground may finally prove true.

Despite the latest blast of heat and flame, the current political and economictrend seems to be heading in the opposite direction.

Follow Don Pittis on Twitter:@don_pittis

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)