Oil export pipelines: Will Canada ever build another?

Pipeline companies struggling to earn support from government, regulators and the public

The fateof new oil pipelines in Canada is in asorry state.

The imperilled Northern Gateway project.The Obama-rejected Keystone XL venture. The protest-filled Trans Mountain expansion. And the suspect political support around theEnergy East proposal.

With theoil market in a severe downturn and stiff opposition greeting every pipeline proposal, there is debate overwhetherthis country will ever break ground on new export pipelines.

We runthe risk that we missed the window of opportunity.- DaveCollyer,formerCAPPpresident

Even veteransof the oilpatcharen't certain of the answer.

"It's a legitimate question," said DavidCollyer, the former president of the Canadian Association of Petroleum Producers (CAPP)."It's not out of the realm of possibility."

- Oilpatch stares intoabyss, tries to make sense of its future

- Suncor-Canadian Oil Sands deal asign of shakeups to come

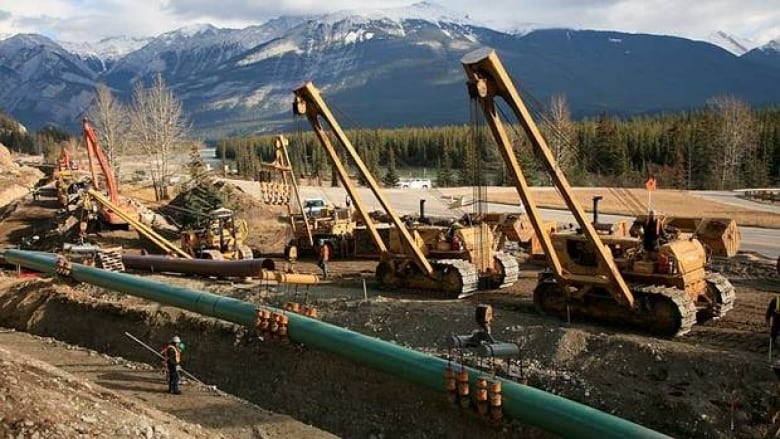

The merits of using pipelines are clear: they are the safest, most cost-effective and least carbon-intensive method of transporting oil. The risks are just as indisputable: spills are rarebut can be catastrophic, causingsignificant damage to the environment, especially around bodies of water.

Alberta is craving a new avenue to export its oil, which would allow the province to receive global prices for its crude, rather thanselling it at a discount.

Whether oil prices are above $100 US a barrel, as they were in 2014, or sitting atless $30 US a barrel, like now, every dollar less that the province receives, compared tomarket prices, makes a difference.

Struggling to build

For the better part of the last decade, export-pipeline proposals have struggled tomeetthe bar set by government, regulators and the public. With Keystone XL and Northern Gatewaystalled, the oilpatchstill has highhopesthatthe Trans Mountain and Energy East proposals will one day be built.

"I find it ironic, frankly, that in the same time we've been having this debate in Canada about new pipeline construction,"saidCollyer. "The United States has built a lot of new pipelinesthey have approved oil exports in the U.S., and they have grown production in the U.S. that has exceededCanada in that time."

- Interactive map highlightsCanada's energy pipelines

- Trudeau victory means uncertain future for pipeline projects

Canada is at apoint where we needto decide whether the benefits ofpipelines are worth the risks. It's very unlikelythat anypipeline project will ever be perfect,cruisingits way through the regulatory process withouthiccupor resistance.

"You and I both know there will be some set of challenges and the real test, looking forward 20 years, is what are we going to do with oil and gas pipelines?" saidMichalMoore,an economist with theUniversity of Calgary'sSchool of Public Policy.

He expects, at some point, there will have to be a Supreme Court ruling to decide some of the First Nation issues facing pipeline proposals.

If [Trans Mountain]does not proceed, we are leaving a lot of money on the tablefoolishly.- GlenHodgson,Conference Board of Canada

But considering the oil-price crash, Moore wonders ifthere still is going to be a market for heavy oil and whether a pipeline project is viable low oil prices continue past the proposed construction dates.

"The jury is out on that one," he said.

The projects are not cheap. TransCanada's Energy East, for example, could cost nearly $16billion to build.

Northern Gateway

Enbridge'sproposalto ship Alberta oil through northern B.C. is considered a long-shot, at leastin the near term.

While it received federal approval in 2014 under the Harper government, it was stillsubject to 209 conditions recommended by the National Energy Board and further talks with aboriginal communities.

Keystone XL

After seven years of delay, the long road for TransCanadaended in rejection as U.S. President Barack Obamaturned down the Keystone XL project in early November 2015.

While the company couldpropose the project once again, it iscurrently focused on taking the U.S. government to court, hitting Washington with a lawsuit and a NAFTA claim.

Thepipeline would have extended from Hardisty, Alta., to U.S. Gulf refineries inTexas.

Trans Mountain

Kinder Morgan worked underthe radarfor years on Trans Mountainas projects like Northern Gateway and Keystone XL stole headlines. ButTrans Mountain is no longer in the shadows.

If any of the four export pipeline projects were togoahead, experts would put their money on this one.

"Trans Mountain, we think, will still go ahead despite some roadblocks," said Martin King, a commodity analyst with FirstEnergy Capital.

"The other big one is Energy East ...we'll see how it goes with getting through the regulatory process."

The Trans Mountain pipeline expansion a twinning of the systemalready in placewould generate 34,000 jobs a yearand $18.5 billion in revenues for federal and provincial governments over the first 20 years of operation, according to the Conference Board of Canada.

"If this project does not proceed, we are leaving a lot of money on the tablefoolishly," said the conference board's chief economistGlen Hodgson.

Energy East

Another of TransCanada'sproposals is just as ambitious:trying to ship oil from Alberta across the country to New Brunswick.

Analysts generally think the Energy Eastproject has a legitimate shot at being constructed as much of the pipeis already in the ground.The company wants toconverta natural gas line.

But the project has its challenges, too. It can beawfully difficult to make everyone happy along a4,600-kilometreroute spanning six provinces. There are already concerns inManitoba,OntarioandQuebec.

TransCanadamight find Quebec to be the biggest challenge. The company recently scrapped plans for an export terminal in the province, which decreases the pipeline's economic benefit to Quebec. On Thursday, mayors from Montreal and the surrounding areaannounced theiropposition to the pipeline.

Future outlook

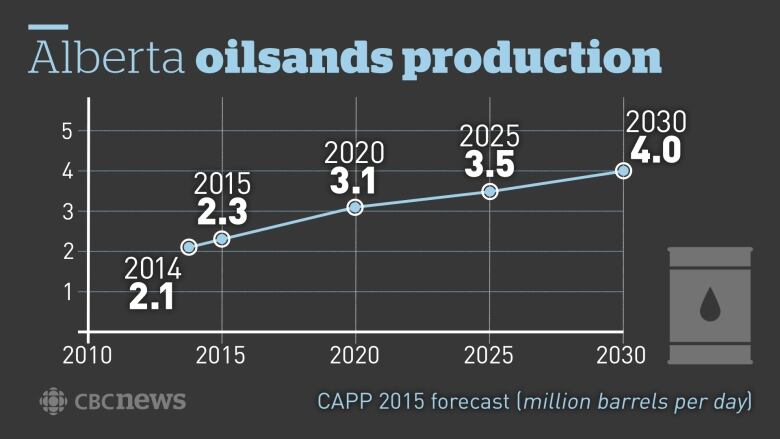

While export capacity in Canada is currently not a big problem, theoilsandsare expected to grow substantially over the next few decades. Withoutnew pipelines, the oil will need to go somewhere, which could translate tomore crudeloaded on trains.

Experts wonder if the crude-by-rail industrywill have to grow substantially beforepipelines are seen as more desirable.

"Maybe that's the end game. Maybe there has to be proof that this oil will move one way or another. Maybe it takes five years to get there," said Paget.

And if the federal government decides pipelines are in the public interest, Ottawa will also have to find a way to balance all the competing interests.

As TransCanada proved withKeystone XL, runningupa $2-billiontab alone on during theproposal stage, it's not cheapto introduce new export projects.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)