5 potential warning signs of a Canadian downturn: Don Pittis

Is Canada's economy swerving off the road to recovery?

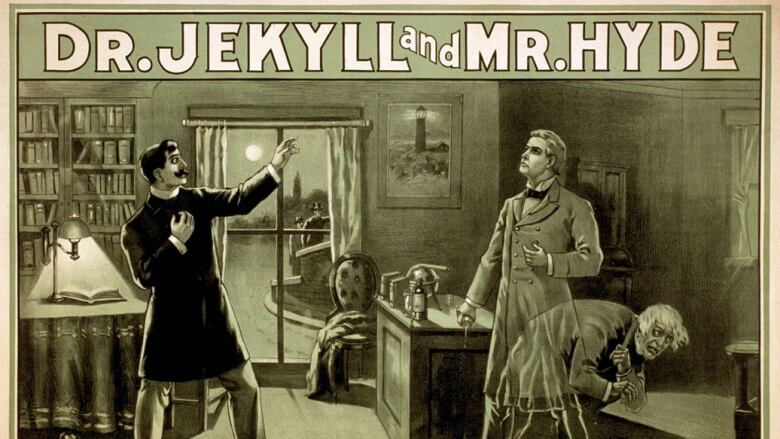

Downturnshappen. Everyone knows it. And while there were happy signs earlier this year, now,as Bank of Canada governor Stephen Poloz prepares his latestrelease oninterest rates tomorrow, there are growing indications that Canada'sDr.Jekyll economy is showing a littleMr. Hyde.

Here are some symptoms we should watch for.

1.U.S. rate rise

Despite somegloomy U.S. statistics and warnings from the influential investment bankGoldman Sachsto get out of stocks and into cash, the people guiding the U.S. Federal Reserve seem cautiously optimistic. Minutes of a recent Fed meeting released last week showed the U.S. central bank is preparedto raise interest rates in June.

While higher rates couldhurt the price of existing bondsand knock down stocks in the short term,signs of an increaseddemand for labour and capital would signal that the U.S. has turned acorner.

For Canadians, however, whose debt loads have hit new heights, higher U.S. interest rates and their inevitable impact on Canadian commerciallending ratescould make us feel poorer.

2. Housing crater?

The painful bankruptcy of Canadian home builderUrbancorp and pressure forgovernments to intervene in what many are calling an affordability crisishave some commentators worried that Canadian real estate is at a peak.

Despite evidence that real estate is amajor driver of jobs and the economy, ominous warnings are easy to dismiss because they have been offered so often. This time, however, we have real evidence thatmarkets outside Vancouver and Torontohave begun to weaken.

And although he wasn't talking about real estate, Poloz had an ominouswarning of his own at aMilken Institute conference earlier this monthwhen he said, "There's a crater under every bubble."

3.Oil and fires

A rise in oil prices from below $30 US a barrel to about $50 would seem good forCanadian producers, but the market is hard to read.

Canada's biggest oil companies may have hadpockets deep enough to wait till other worldproducers were driven out of the market. At $50, the globe'slowest-cost producers may begin gearing up once again, meaning high-cost Canada will have more competition.

And will oil prices stay high? Uncertainty abounds.

4. Failed industrialrecovery

Despite a strong showing in the automotive sector, new manufacturing capacity has not appeared, and a strongerloonierising with oil prices is not helping as much as expected.

And while both Poloz and Finance Minister Bill Morneauhave expressed their faith in fiscal spending, the jury isstill out on whether that will be enough to spur new private sector innovation and investment.

5.Banking retrenchment

Bad debts in the oil sector and shrinking revenue due to competition from online upstarts are among the worries for Canadian banks that report their results this week.

Above all, banks need to lend, andtheywould likely be thrilled tolend to support the surge in output thatPoloz has been predicting. But they need the borrowers. If fiscal spending fails to restart the economy soon,some are predicting Poloz willcut rates later this year. However, the bank governor has warned that the impact of cuts is losing its power.

"What we know for sure is when interest rates are this low,the next move in interest rates has a smaller effect than it had when you were up at two[per cent]," he said at the Milkenevent.

Despite some reports to the contrary, Polozhasnot ruled out negative interest rates if all else fails, but the bitter side effects of thatstrategy in Japan may meanthat is an elixireven Mr. Hyde may be reluctant to swallow.

Follow Don on Twitter@don_pittis

More analysisby Don Pittis

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)