Former Sears employees worry about lost severance, possible reduced pension

Company undergoing restructuring says it is 'not able to make payments to certain creditors'

Sue Earl is still reeling from news that Sears has cut off her severance payments. She saysshe stands to lose upwards of $20,000.

"I feel robbed," says Earl, who did everything from work in the children's department to handle catalogue orders during her 38-year career at Sears.

"It's another slap in the face," addsthe 64-year-old. "Especially when they reach out after you've left and snatch that money back from you."

We're mad as hell.- Sue Earl

Earl was laid off when the Sears store where she worked,in Cobourg, Ont., shut down in March three months before the department store chain announced it would close 59 stores and lay off 2,900 staff as part of a court-supervised restructuring process. When those workers lose their jobs, they won't receive severance.

On the day it filed for bankruptcy protection, Sears also informed previously laid-off workers like Earl it was axing their severance payments.

"We're mad as hell," says Earl, who has kept in touch withfellow ex-employees. "We've supported Sears with positiveattitudes, and this is how we're treated."

Pensions in peril

Earl also fears losing thousands of dollars from her pension as part of the restructuring process. "I just feel helpless," she says.

Sears has a court hearing next week where the company will request permission to haltboth its retiree benefit payments along withspecial payments it has madefor some timeto top up the underfundedpension fund.

Many of Sears' 16,000retirees fear if the companyis allowed to stop making pension contribtions, they will receive reduced pensions. They also don't like the idea of losing their medical, dental and life insurance benefits.

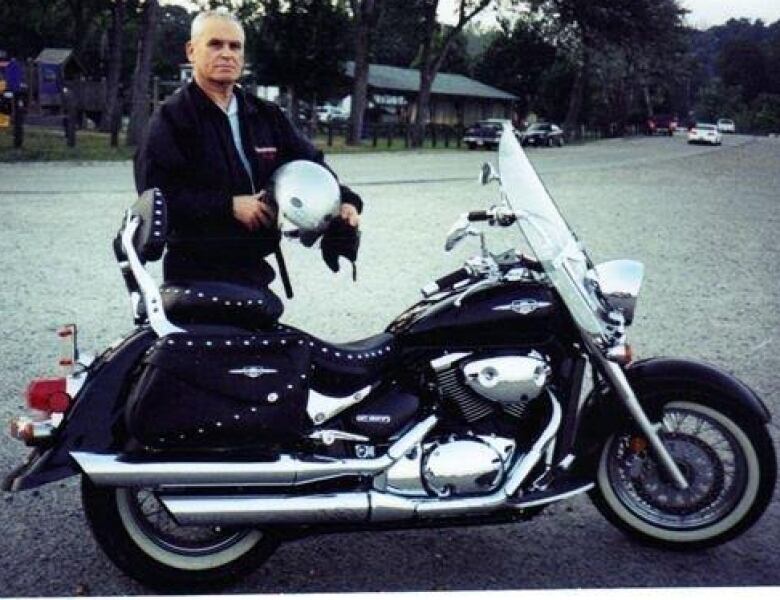

"We don't have any rights under this court protection," says Joseph Moczulski, who worked for Sears as a long-haul truck driver for more than 35 years before retiring in 2004.

"It will be a hardship," says theSt. Thomas, Ont. resident of the possibility of losinghis medicalbenefits. Both Moczulski and his wife are diabetics.

"We were promised that from the company," says the 73-year-old. "They don't care about the years we put in."

Employees at back of line

Sears Canada told CBC News that deep financial troubles left the iconic retailer with no choice but to seek court protection from its creditors while it restructures. As part of the court proceedings, Sears said it's not able to make payments to a number of stakeholders, including laid-off employees owed severance.

As far as retiree benefits and pensions are concerned, Sears contends it's too early to predict what will happen and claims employee pension payments may not be compromised.

The retailer also said ex-employees who feel they're entitled to more compensation can make a claim as part of the bankruptcy proceedings.

Butfor most, that could be a futile endeavor.

It's unlikely employees will recover their losses, says Toronto labour lawyer Lior Samfiru. That's becausewhen compensation is doled out in these situations, secured creditors like banks get priority.

"Whenever a company is under creditor protection, employees are at the back of the line," says Samfiru, with Samfiru Tumarkin LLP in Toronto. "If it yields something and I highly doubt that it wouldit would be small, small pennies on the dollar."

He adds that what the retailer is doing is perfectly legal. "It's easy to demonize Sears here, but at the end of the day, Sears is acting in accordance with our bankruptcy laws."

'Disgusting behaviour'

While it's following the letter of the law, Earl believes Sears cutting off payments to workers could hurt the department store's image.

"I think Sears is shooting themselves in the foot," says the former employee.

Evenstore customers have complainedon the retailer'sFacebookpageabout the elimination of workers' severance.

"Canadians won't stand for that. Just as well to close up all the stores when you take that stance," posted one person.

"Disgusting behaviour by a shell of a once great company," commented another customer.

Moczulski agrees Sears was a good company. "They'd do anything to keep us happy," he says about working for the retailer. "You just wouldn't believe how fantastic it was."

And that makes it all the more difficultfor the retiree to witness Sears' downfall, which could end up costing him as well.

"I'm saddened about it, about how a company so great went downhill so fast," he says.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)