Canadian Tire tells wife of ailing customer to pay his $18,000 debt, despite credit card insurance

Canadian Tire settles after Go Public makes inquiries

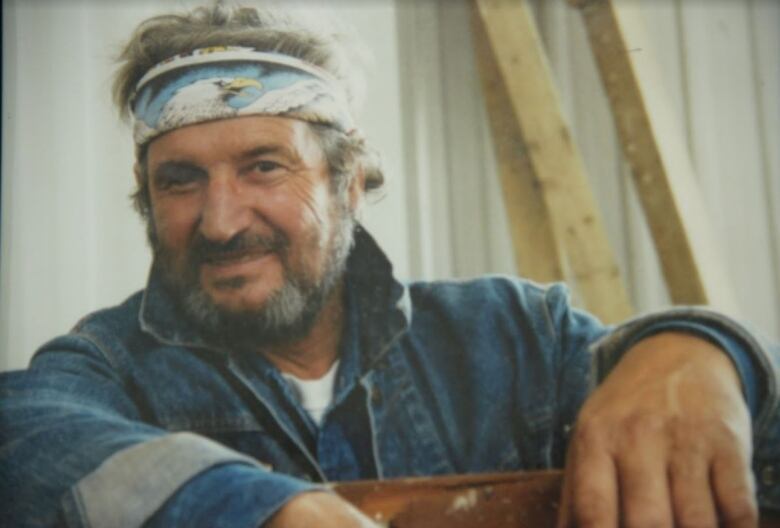

Almost 30 years ago, George Graves signed up for a Mastercard athis local Canadian Tire store. He was also sold insurance on that credit card,designed to help with payments in the event a cardholder loses their job, becomes disabled or gets sick.

"My husband paid for Credit Protector insurance all these years in case something bad should happen," says his 72-year old wife,Jolante Graves.

"Now it's happened, and the company doesn't want to live up toexpectations."

George Graves, 84,a farrierfrom Addison, Ont.,had a stroke in February that put him in long-term care and quickly led to vascular dementia.

"I thought we'd be OK because of his credit card insurance," his wife told Go Public.

It's estimated that millions of Canadians payfor insurance on their credit cards.

But financial experts say the product is pricey, carries numerous conditions to qualify for coverage and often doesn't pay out. In many cases, the insurance will only cover the minimum monthly payment not the entire balance.

"Credit card protection is fantastic for the banker, usually horrible for the consumer," says personal finance expert Kerry Taylor,from Vernon, B.C.

- Been wronged? Contact Erica and the Go Public team

In the months following her husband's stroke, Jolante Graves says he became unable to recognize her and couldn't read or write.

She says employees from Canadian Tire Bank repeatedly phoned her at home, demanding she pay her spouse's outstanding credit card bill, which wasabout $17,000. She had not co-signed for the credit card, and had no obligation to pay it off.

"They have been evasive, rude and unkind," Graves wrote in an email to Go Public. "This is causing me a lot of distress."

Graves saysshe told them her husband haddementia, and was unable to file a claim on his own, but because the policy was in her husband's name, she was told by bank officials that they could only deal with him.

In July, a letter arrived from Canadian Tire Bank, saying her husband's overdue account was being "escalated to our Credit Recoveries Department," anddemanded immediate payment.

George Graves died four weeks ago.

Canadian Tire settles

Two days after Go Public contacted Canadian Tire Bank, a spokesperson phoned Jolante Graves and apologized for the harassing phone calls.

He also said that although her husbandwould have to make the insurance claim, he was willing to erase the debt which hadgrown to over $18,000 if she agreed to keep the deal confidential.

She signed a confidentiality agreement, but CBC had already interviewed her.

Canadian Tire turned down a Go Public request for an interview, and instead emailed a statement, saying, "We take any concern raised by our customers seriously and in this particular case, we were able to quickly resolve the matter."

WatchCBC's investigative consumer program Marketplace (8 p.m. Friday onCBC-TV) as they take hidden cameras into the big banks to reveal how customers get pitched credit card balance protection insurance.

Go Public asked how much George Graves had paid in credit card insurance over the years a recent Mastercard statement from Canadian Tire Bank showed that he was paying about $105 a month for insurance.

A bank spokesperson declined to say how much Graves had paid in premiums "for privacy reasons,"but in a letter to JolanteGraves, a senior representative wrote, "the amount of creditor insurance premiums paid was far less than the amount of debt that Canadian Tire Bank has forgiven."

He also wrote that Canadian Tire "has processes in place" to make customers "aware of how their credit protection insurance coverage could apply" and that these processes were followed.

Coverage 'extremely narrow'

Taylor has examined the fine print on insurance contracts for a number of credit cards, and says she'd never buy such a product.

"It generally doesn't help the consumer," says Taylor. "It's just an expensive product that they're adding to their debt load and the premiums are extremely high."

Canadian Tire charges $1.10 per $100 balance a month for its Credit Protector product (which decreases to 59 cents per $100 when the cardholder turns 80). That means that the average customer with a monthly balance of $2,500, who doesn'tget the discount, pays$27.50 a month for insurance,or $330 a year, plus taxes.

Taylor sayswhat policies actually cover is "extremely narrow."

Oftenpeople who buy credit card protection think they have unemployment coverage, but learn theydon't qualify because many insurance companies require the cardholder to be working for one employer for a minimum of 25 hours a week.

"If you're someone like me in the gig economy, I'm not going to be covered, because I have multiple jobs and none of them add up to 25 hours a week," says Taylor.

George Graves didn't qualify for unemployment coverage.

He was still working as a farrier, shaping and fitting horses with shoes,when he was sold the insurance on his credit card, but he didn't have one employer for 25 hours a week.

His wife also couldn't collect on the life insurance included in the coverage, because that stops paying out at age 80.

"With a standard life insurance or disability policy, someone is going to ask you questions about your health, your age, your gender, what kind of work you do and so on," says Taylor.

"It's all on paper, so they can figure out what your risk is for making a claim, and charge the correct premium. That underwriting doesn't exist with credit card insurance."

Taylor says people get better protection if they pay for life and disability insurance.

"Get the underwriting," she says, "so you know if your illness will be covered or not."

She also recommends people create their own emergency fund.

"That way, if you get sick or injured, you can cover your minimum monthly payments yourself," says Taylor.

'People don't understand how it works'

"A credit card is a high interest product, initially meant for safety and convenience," says Scott Hannah, president of the Credit Counselling Society."They're not designed to carry a long-term balance, that's the problem."

He says counsellors at his office often hear from people who get into credit card debt and are surprised to learn the insurance they've been paying fordoesn't cover them.

"It's not until they hit financial trouble that they find out they never qualified to begin with," says Hannah, noting that many consumers don't read the fine print before they sign up for credit card protection plans.

'He would be devastated'

George Graves died unaware of the controversy that surrounded his outstanding credit card debt.

"I'm glad he never knew," says his wife. "He would be devastated. He bought that insurance for peace of mind."

She's glad Canadian Tire settled the disputeover her husband's Mastercard, but says the retailer has lost her as a customer.

"They will never see me set foot in their blasted store again," says Graves. "If I want to buy something, I'll go somewhere else."

With files from EnzaUda

Submit your story ideas

Go Public is an investigative news segment onCBC-TV, radio and the web.

We tell your stories and hold the powers that be accountable.

We want to hear from people across the country with stories you want to make public.

Submit your story ideas atGo Public.

Follow@CBCGoPubliconTwitter.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)