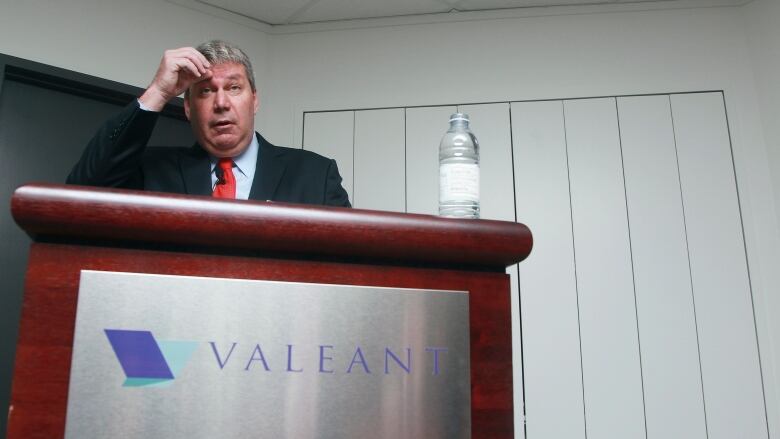

Valeant CEO Michael Pearson to be deposed in U.S. Senate drug probe

The chief executive officer of Valeant Pharmaceuticals is now slated to be deposed Monday by U.S. politicians looking into big hikes in drug prices.

Michael Pearson didn't comply with a subpoena to give adeposition on AS, prompting Valeant to issue a statement earlier this week saying it had asked him to co-operate with members of the U.S. Senate's special committee on aging.

"We look forward to hearing Mr. Pearson's testimony," the committee's chair, SenatorSusan Collins, and ranking member SenatorClaire McCaskill said in a statement. "This deposition and investigation are about better understanding the dramatic price increases we're seeing for decades-old prescription drugs and how those prices are affecting consumers."

- Valeant Pharmaceuticals gets default notice from debt holder

- Valeant asks CEO Michael Pearson to co-operate with U.S. Senate

- Valeant shares fall again as CEO subpoenaed by Congress

- Valeant under scrutiny for doubling price of assisted suicide drug sold in U.S.

After Pearson missed last week's deposition, Collins and McCaskillsaid they intended to begin contempt proceedings against him.

Collins and McCaskill's statement Wednesdaysaid Pearson is also under subpoena to appear before the committee ata hearing scheduled for April 27.

The announcement came a day after Valeant said ithadreceived a default notice from a debtholder, which was identified by the Wall Street Journal asCenterbridge Partners LP. The bondholder filed the default notice because Valeantis late filing its annual report.

Under the terms of the debt, the company has until June 11 to file the report. The Laval, Que., company said it is on schedule to file it by April 29 with Canadian and U.S. securities regulators.

CitiResearch analysts said bondholders could force accelerated repayments if Valeantdoesn't file the report by June 11, and Moody's Investors Service cut its rating on the company'sspeculative grade liquidity rating by one notch and put its otherratings under review for a downgrade.

Once a stock market high flyer, Valeantis now grappling with about$30billion in debt, and faces three federal probes into itsaccounting and business practices.

With files from The Associated Press

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)