Why Google is turning itself into Alphabet

Search engine giant restructures to exist under new holding company

Say hello to a $500-billion company you've probably never heard of. On Monday, Google announced it would drastically alter its structure and convert itself into a holding company, called Alphabet Inc.

At first blush, nothing much is going to change. Google shareholders will get one new share in Alphabet for every Google share they currently own when the switch is finalized in December. But beneath the surface, it's a big deal and a fresh start for the company.

So, why did Google do it? Let's spell it out.

- DON PITTIS: Google X's dilemma is that the 'wow' factor has to pay

- Why Google is buying a crazy collection of seemingly unrelated companies

While the name Google is best known as a search engine, GoogleInc. is actually a multi-headed beast that dabbles in many things. The company also owns Android, the most popular mobile operating system in the world, currently installed on more than a billion wireless devices.

The company also owns all manner of Google-branded apps including ubiquitousemail serviceGmail, Google Earth, Google Docs, the Chrome web browserandGoogle Maps.

Then there's YouTube, the world's most popular video website, which has long been a confusing add-on that seemingly has little to do witheverything else Google does. But YouTube is actuallynowhere close to the strangest company that Google owns.

Alphabet soup

Googlealso owns Nest, which makes web-connected thermostats for homes and is fast becoming Google's toehold into the smart home market. And don't forget Calico, a life science company with the ambitious goal of extending human lifespanswell past where they currently end.

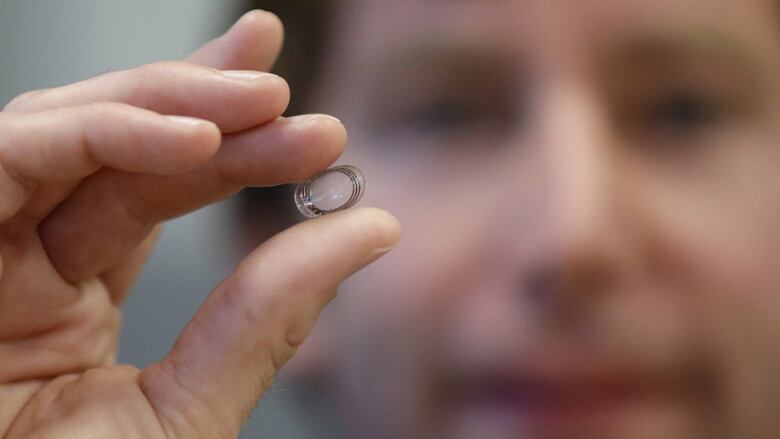

Then there's the really fun stuff. Most of that is kept in a division called GoogleX, which is where the company works on what it calls its "moonshots" self-driving cars, cancer-fighting wristbands, an update to Google Glasses that uses contact lensesand the next generation of drones.

These are the products that tend to capture the public's attention, but makethe investment community wince, because they all have multibillion-dollar price tags and no profits as of yet. But that, too, may change, one technology analyst says.

Individually, many of those moonshots might fizzle out, but when you put them all together, "in the aggregate of all these businesses and ones the public doesn't even know about the probability of them finding something new is virtually guaranteed," Morningstar analyst Rick Summer said in an interview with CBC News.

Whatthey're saying is: "We want tobe like GeneralElectric."Technology analyst Rick Summer

That's why the real genius of Google'smove is separating the businessthat Wall Street loves the search engine with ad revenues from the ventures that have yet to pay off.

"They are aware that they've got this hodgepodge of companies," said Roger Kay, an analyst at Endpoint Technologies Associates. "Maybe it's better to sort them out a bit and make it clearer which ones are bringing in the bacon and which ones are science projects and which ones are long-term bets."

Betting on alpha

The move will likely change nothing for users of Google products. But from a corporate perspective, it's aimed at winning over investment bankers. Which is why it's probably no coincidence that it comes only months after Googlepoached itsCFO Ruth Porat from Morgan Stanley by offering her $70 million worth of stock options.

Silicon Valley tech companies are used to stealing talent from each other, but poachingfromaninvestment bank was a sign Google was gearing up to stop acting like a startup and more like a financial conglomerate.

"Investors should grow increasingly confident that Ms. Porat is developing an early shareholder-friendly track record," said theJapaneseinvestment bank Nomurain a note to clients Tuesday.

Nomura also saidthe move should make the company more efficient from a tax perspective, and could make it easier for the parent to bring home the roughly $70 billion that Google has stashed away overseas, because it's in no rush to pay Uncle Sam's tax bill on that cash.

Effectively, Google is splitting the company into separate units and nominating Android's CEOSundar Pichaito run the core search, Maps, YouTube and mobile businesses, while leaving co-founders Sergey Brin and Larry Page to pursue the more entrepreneurial long-term bets they know and love.

It's a model very similar to the one used by Berkshire Hathaway, whichWarren Buffett turned from a local insurance company in the 1960s to a multi-headed conglomeratethat owns a veritable googol of subsidiaries; everything fromplanes and trains, to restaurants and underwear lines each with its own CEO.

Forming the newparent company Alphabet should make it a lot easier to acquire promising startups by offering new talent the chance to be CEOs of their own units and also make it a lot easier to spin out successes that do well and outgrow their holding company, just like Berkshire Hathaway does, or General Electric.

"Whatthey're saying is 'We want to be like GE or a venture capital fund," Summer said.

"The proper structure is goingto be good for these what they call 'moonshot' businesses," PiperJaffrayanalyst Gene Munster told Reuters, "because it gives investorsa sense that all these projects they don't know a lot about are in better hands."

At least in the short term, investors appear to be cheeringGoogle'smove to transform itself, as the company's sharesgainedmore than five per cent to $699.43 on theNasdaq.

No Alpha-bits

Google may have given birth to Alphabet Inc. on Monday, but don't expect it to become a household name.

According to theU.S. Patent and Trademark Office, there are at least 103 trademarks registered in Americathat include the word "alphabet" or some close variation, spanning everything from toys to game to clothes, alcohol and food. Indeed, German automakerBMWowns the trademark for the term "Alphabet" and the website alphabet.com for a business unit it owns that deals with vehicle fleet services for clients.

Patent disputes are familiar territory in the tech world, and the search company made it clear on Monday it has no intention of rolling out any "Alphabet"-themed companies or products.

"We are not intending for this to be a big consumer brand with related products," Page wrote in a blog post announcing the move. "The whole point is that Alphabet companies should have independence and develop their own brands."

So despite Google's big switch, the only Alpha-bits you're likely to see for a while will be of the cereal variety.

With files from Reuters

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)