Q&A: Carole James on school tax and asking owners of $3M homes 'to pay a little bit more'

Homeowners in Point Grey rallied against increase to tax this week

Finance Minister Carole James says the B.C. government is not backing down from the controversial increase to the school tax.

The tax is an additional 0.2 per cent on the value a home valued at more than $3 million dollars, or 0.4 per cent for a home more than $4 million.

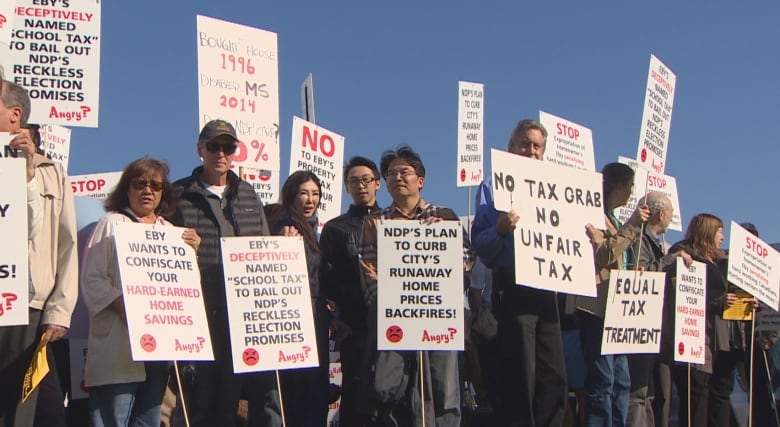

This week, hundreds of homeowners in Point Grey, one of the most expensive neighbourhoods in the province, voiced their opposition to the increase at a rally at a local park.

James said in an interview with On The Coast host Gloria Macarenko that despite the opposition, she was committed to the tax increase.

Listen to the full interview:

Did you expect this kind of opposition to the tax?

Certainly when you bring in change, not everyone's going to be happy about the change you're bringing in. But in fact, the tax on houses worth more than $3 million is part of a 30-point housing plan we're bringing in to address the crisis that is in place for British Columbians.

We know there's a crisis when employers tell us they aren't able to recruit people because they look at the real estate page and they go and work somewhere else. We believe it's a crisis and it has to be addressed.

We're asking people whose houses are worth more than $3 million to pay a little bit more.

When you look at the value of homes, when you look at the additional resources that have been gained from those homes, we believe people can afford to pay a little bit more to be able to provide support to help build affordable housing.

Here in Vancouver with the property values skyrocketing, why should people pay a higher tax rate when their incomes may not match the rapid growth of housing values?

That is true. There's no question there have been people who have been in their homes for decades.

There are options to defer the property taxes. Those are in place. They can defer their tax if they don't feel in that year they have the income to be able to pay it.

Will you take another look at the tax?

No. The tax has passed already. It's going ahead.

Will we continue to monitor how we're doing on affordable housing? Yes, we will. There are outside factors that impact housing in our province: interest rates, changes the federal government may make to mortgage rules.

We will be watching closely over this next year and if we need to make adjustments, we will make adjustments.

This interview has been condensed and edited for length and clarity.

With files from CBC Radio One's On The Coast

If you are interested in housing affordability, check out CBC's new podcast,SOLD!Host Stephen Quinn explores how foreign investment in real estate divides community, class and culture. Find itatCBC PodcastsorApple Podcasts.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)