OPINION | In 2020, Alberta joins the 'have nots'

For the first time in 55 years, province becomes a net receiver in the federation

This column is an opinion from Trevor Tombe, an associate professor of economics at the University of Calgary.

A long-time staple of Alberta political culture is no more. At least for now.

For the first time in 55 years, Alberta will be a net receiver in the federation.

And like so much else today, we have COVID-19 to blame.

Typically, owing to our high income and young population, the federal government tends to raise more in revenue from Alberta taxpayers than it spends here.

Most federal taxes, after all, are on our income and consumption, so it's natural that high income individuals (and regions with many high income individuals, like Alberta) pay more.

And most federal spending is on transfers, with especially generous payments to elderly individuals. So it's also natural that young individuals (and regions with many young individuals, like Alberta) receive less.

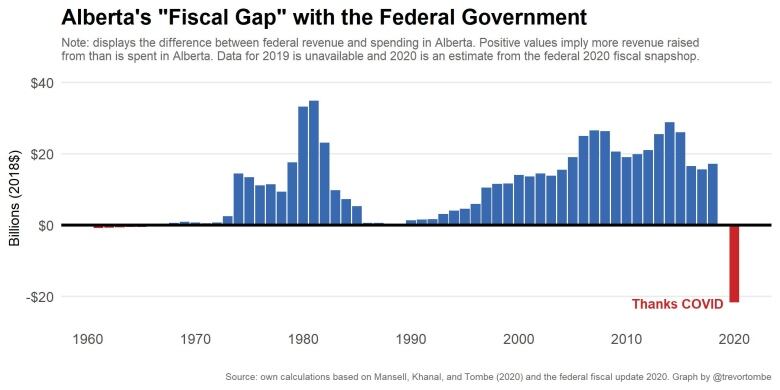

This "fiscal gap" normally hovers around $20 billion. Over the past decade, it's averaged $21 billion per year with the overwhelming majority (nearly $19 billion) due to Albertans being richer and younger, on average, than other Canadians.

Based on recent analysis by myself and co-authors Robert Mansell and Mukesh Khanal, which we published last month, I plot this data below.

Some years there is rough balance. You have to squint to see any imbalance at all in the 1960s and late 1980s, for example. But every year since 1965 the federal government raised more from Alberta taxpayers than it spent here. Alberta's governments (past and present) rarely miss an opportunity to remind everyone of this.

These gaps do not obviously reflect "unfair treatment" of the province, as some are quick to claim. They reflect Alberta's strengths. And when circumstances change dramatically, so too can these imbalances. We'll see that in a big way this year.

My own (admittedly roughbut not crazy) estimates for 2020 suggest a dramatic reversal: Alberta and Albertans will be a "net receiver" of roughly $22 billion through the federal budget. This is the large negative red bar in the graph.

What's behind this shift? Massive federal spending on emergency measures to individuals and businesses, combined with much lower income and sales tax revenues raised from taxpayers. Alberta disproportionately benefits (in a narrow fiscal sense) from both.

Federal emergency spending

Direct federal responses to COVID-19 deployed well over $230 billion through a wide variety of programs: the Emergency Response Benefit ($80 billion), the Emergency Wage Subsidy ($82 billion), partially forgivable loans to businesses ($14 billion), larger GST credits ($5.5 billion), larger child benefit payments ($2 billion), oil and gas subsidies to clean up orphan wells ($1.7 billion), and so much more.

Including the tax deferrals, every single Canadian benefited from the unprecedented scale and speed of federal responses to COVID-19.

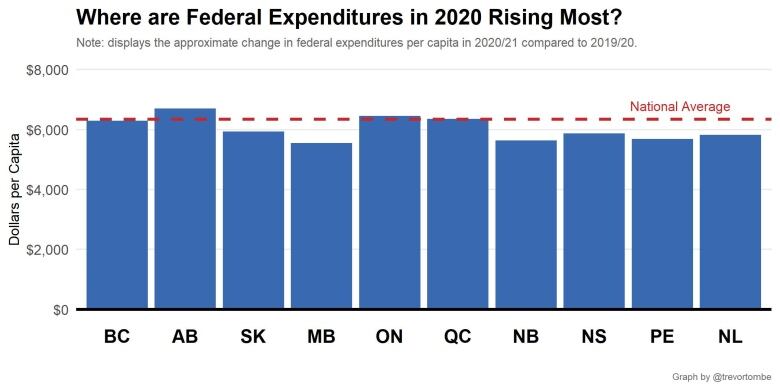

While we cannot yet be sure, I approximate how this spending is distributed across provinces.

Without going into detail, I allocate spending on programs like the emergency benefit and wage subsidies according to CERB applications, other emergency measures on a roughly per-capita basis, and oil and gas support mostly to Alberta.

Overall, federal spending in Alberta will rise by over $6,700 per person compared with a national average of slightly over $6,300. This is mostly, but not entirely, due to the $1.2 billion earmarked for the oil and gas sector in Alberta.

Lower federal revenue

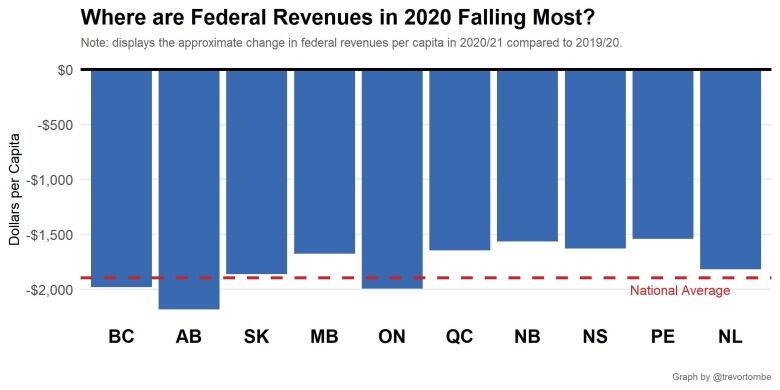

Federal revenues are also likely to drop substantially this year.

The government collects most of its revenues from income and sales taxes. Last year, of the $341 billion in federal revenues, $285 billion came from personal and corporate income taxes, the GST, customs duties on imports, excise taxes and so on.

With social distancing and other public health measures to combat the pandemic, incomes and spending have fallen off a cliff.

This is hopefully short-term, but the fiscal challenges in 2020 are difficult to overstate. The government expects total revenues to decline by over $70 billion.

Based on where the federal government revenue is raised, I approximate how those revenue declines may be distributed across provinces. There is fairly good data on this for personal and corporate income taxes, and for GST revenues, but I have to make some judgment calls for the minor revenue sources.

Overall, I estimate that federal revenue raised from Alberta individuals and businesses will decline by nearly $2,200 per person (on average). That's a larger drop in revenue than any other province and 15 per cent larger than the national average.

The value of a federation

Combining both the revenue declines and spending increases, Alberta may see the gap between federal revenue and spending fall by nearly $9,000 per person (or from positive $4,000 per person to negative $5,000) That's nearly $40 billion overall equivalent to over 11 per cent of the entire provincial economy.

This fiscal shock absorber helped cushion much (though of course not all) of the pain associated with COVID-19 and the resulting economic lockdown. As bad as things are, they could have been much worse.

To be sure, Alberta is not unique in this. In fact, there is no year on record where all provinces were net receivers from the federal budget, as will be the case in 2020. But Alberta benefited more than others I estimate $650 per person more than the national average.

This is natural. Federations allow us to pool risks. When a province's economy is strong and its incomes are high, it will naturally contribute more than other provinces. The reverse is true when conditions deteriorate.

Even after years of disappointing recovery from an incredibly deep recession, Alberta's economy remained stronger than any other. Recognizing this is not defeatist or anti-Albertan.

We can and should strive for greater heights. But we have to recognize our strong position in Canada relative to other provinces if we're to have any hope of understanding why fiscal balances are what they are.

The pandemic may have upended the typical patterns, but it's also starkly revealed the value of being part of a broader whole.

When the current crisis passes, and grievances directed at Ottawa are inflamed once again, we should keep this value in mind.

This column is an opinion. For more information about our commentary section, please read thiseditor's blogandour FAQ.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)