Albertans divided on remedy for coming 'fiscal reckoning,' says poll

Support grows for tax hikes, but Albertans not united on best way to balance books

EDITOR'S NOTE: CBC News and The Road Ahead commissioned thispublic opinion researchin May as the lockdown in Alberta was eased. It follows similar research conducted in March, just as the social and economic shock of COVID-19 was becoming apparent.

As with all polls, this one is a snapshot in time.

This analysis is one in a series of articles to come out of this research. You can find links to the previous stories at the bottom of this one. More stories are to follow.

Alberta Finance Minister Travis Toews was decidedly optimistic when he announced the province's budget at the end of February.

"I believe that 2020," he predicted, "has the potential to be a turnaround year for the economy in this province."

And the assured confidence wasn't just rhetorical. The governing United Conservative Party (UCP) made a bullish bet that Alberta's oil would fetch a whopping $58 per barrel this year.

Fast forward a few months to a much more pessimistic, post-pandemic reality, and oil, also hit hard by a price war between Russia and Saudi Arabia, is trading at around $40 per barrel.

That's blown a big hole in the new government's election promise to balance Alberta's books by 2023.

This year's expected $7-billion deficit has almost tripled to $20 billion. And Premier Jason Kenney warns of "a great fiscal reckoning" to come.

But how bad can it get?

Tough economic times to come

Canada's top central banker predicts a "prolonged and bumpy" course to economic recovery. And Kenney himself concedes the pandemic triggered recession could be more pronounced in Alberta given the collapse of oil prices.

The Conference Board of Canada, in fact, forecasts Alberta will see its economy shrink by an historic seven per cent this year.

All this uncertainty has led oil and gas companies to dramatically slash capital spending in Alberta. The Calgary office towers that housed the energy sector's headquarters were already hollowed out by the province's stubbornly sluggish economy and an unemployment rate that hovered consistently above the national average.

Even with economies around the world ramping up in the wake of coronavirus, energy demand is not expected to return to normal and may never recover to pre-pandemic levels, warn oilpatch leaders.

Economist Ron Kneebone with the University of Calgary's School of Public Policy remains pessimistic about oil prices rebounding to a level that would alleviate the fiscal pressure facing the province.

Even without a pandemic-ravaged economy, Alberta was in economic trouble, says Kneebone.

"I think Alberta, even without COVID, moved to a new lower level of growth, a new lower level of economic prospects for the long term," he told CBC News.

"I don't see the oilpatch coming back to anywhere near what it was before."

Take away the high prices for oil and you have Jason Kenney's "fiscal reckoning" on the horizon.

Making the province's ends meet is not complicated. It's just math.Options range from:

- Spending cuts.

- Revenue increases (raisingtaxes).

- A combination of spending cuts and revenue increases.

Each of these options hasits pros and cons (detailed later), and each hasvarying degrees of public support.

Public attitudes toward spending and taxes

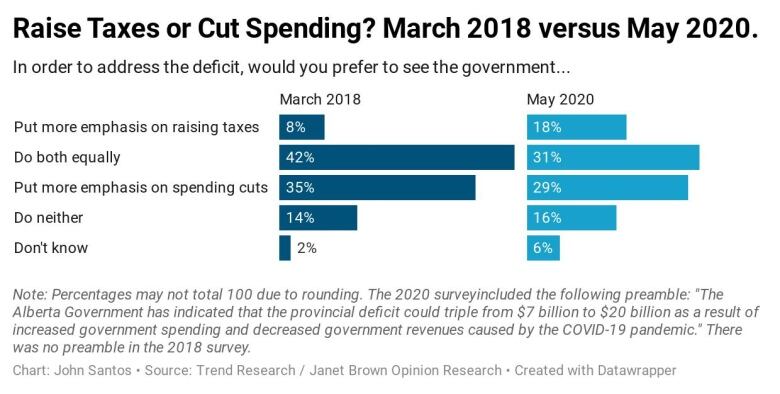

The CBC News Road Ahead 2020 polls shows the public is divided on how best to slay the deficit. The public's eagerness for spending cuts and aversion to increasing taxes havealso changed since CBC News asked similar questions in 2018.

Fewer than two in 10 (18 per cent) of Albertanswant the government to put more of an emphasis on tax hikes, according to the May 2020 poll. About one in three (29 per cent) want more emphasis on spending cuts. Almost a similar number (31 per cent) want both spending cuts and tax hikes equally to end the red ink.

Sixteen per cent of Albertans, according to the most recent poll, say neither tax hikes nor spending cuts are preferable. Six per cent of those surveyed didn't answer or didn't know.

Notably, support for tax hikes hasrisen 10 percentage points since CBC News asked the same question in 2018.As well, support for slashing government spending has dropped by six per cent.

Albertans are not unified on the best path to put finances back in the black.

"It's going to be a delicate balancing act for any government," said pollster Janet Brown, of Janet Brown Opinion Research, who conducted the poll for CBC News.

More cuts to public spending will likely not go over well with Albertans. Remember, the UCP delivered its budget at the end of February. Spending cuts featured prominently in that plan.

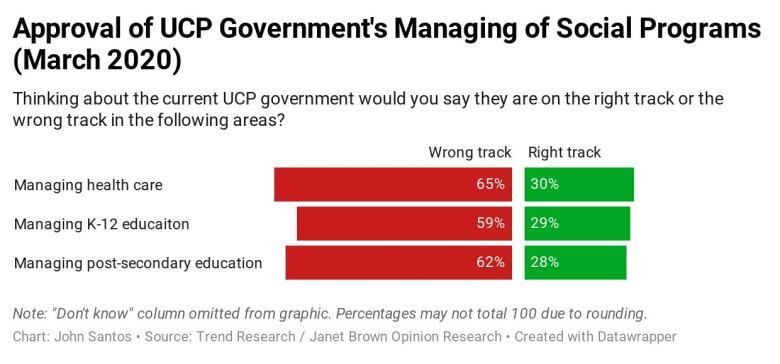

In March, as the pandemic was taking hold and people began sheltering in their homes, the CBC News poll found that nearly two-thirds (65 per cent) of Albertans thought the UCP was on the wrong track when it came to handling health care.

Similarly, 62 per cent of Albertans didn't approve of the new government's handling of post-secondary education. And 59 per cent of the people surveyed did not like the way the government was dealing with K-12 education.

This all suggests recent UCP cuts to health and education were not popular.

Undoubtedly, as Kenney and the UCP tackle Alberta's growing deficit, they will take flak from both sides of the political spectrum. The left will charge that any future spending cuts are too draconian, and the right will contend the party has not gone far enough.

Threading this political needle will not be easy.

So, what can the UCP do?

Let's consider the positives and negatives of the possible policy options.

Cutting spending

The UCP promised to eliminate Alberta's deficit.It seems unlikely that the new government will want to preside over more massive levels of borrowing.

Before he became premier,Kenney vowed to cut Alberta's public spending to match British Columbia's, which he said was about 20 per cent less per person.

In February, the UCP's budget pledged to reduce operating expenses over the next three years by 2.5 per cent. The government slashed jobs and public sector compensation.

The budget came just months after the government's "blue ribbon" panel recommended cutting operating spending by $600 million a year and substantially curtailing capital spending to balance the budget by 2022-23. The panel wasn't allowed to consider increasing provincial revenue.

The UCP welcomed the report enthusiastically.

So, more spending cuts seem inevitable.

"It's time," saysKneebone, to "start thinking seriously about the willingness of Albertans to continue to accumulate those deficits and pay the higher interest costs that come with them."

Already, Kenney, the former head of the Taxpayers Federation, has warned that a looming $20-billion deficit means Alberta won't be able to "insulate everyone."

That's one side of the ledger.

In the other column, there's the potential of more revenue from increased taxes.

Time for a provincial sales tax?

While CBC News' polling suggests Albertans are warming to the idea of a provincial sales tax, Kenney has promised not to impose a PST on goods and services unless a majority of Albertans vote for the idea in a referendum.

Generally, economists like the idea of a PST.

Albertans, of course, already pay a federal Goods and Services Tax (GST).Ottawa gets all that money.

A PST of four per cent, either alone or as part of a harmonized sales tax (HST) with the GST, could raise billions in revenue and help Alberta balance its budget by 2024.

"If you want to raise revenue," says U of C economist Trevor Tombe, "then there's no more efficient or stable source of it than a sales tax."

Noted economist Jack Mintz, who is leading the province's advisory council on economic recovery, has advocated a value-added tax (an HST, specifically) for the past decade.He's even published academic papers championing the tax as the "right choice for Alberta."

Kneebone stresses that all the tourists from around the world who flock to the province's Rocky Mountains each year would, after all, pump a lot of money into the province's bank account if Alberta adopted a value-added tax.

"This is free money, and we should be picking it up and taking it," saidKneebone.

But mayberaising taxes isn't enough.

A balanced approach

Faced with shrinking resource revenues and a ballooning deficit, Saskatchewan opted in recent years to raise taxes and cut spending.

This even-handed approach gets high marks from economists.

"A balanced approach is usually the least harmful," saidKneebone.

Alberta's fiscal challenge is big, stressesTombe.

"We're going to need to all collectively contribute to addressing that challenge, and that means spreading the burden, spreading the responsibility as broadly and as equitably as we can," saidTombe.

After all, Alberta has been here before.

For its time, Don Getty's government ran massive deficits in the late 1980s and early 1990s.All that red ink eventually became unpopular. In 1993, the provincial election became a war over deficit spending, with the opposition Liberal leader Laurence Decore promising "brutal" cuts, and premier Ralph Klein pledging "massive" cuts.

Klein won and proceeded to slash public spending, convincing many Albertans that belt-tightening was required provincewide.

Dubbed the Klein Revolution, the popular premier declared Alberta debt free in 2004.

Kneebone says the UCP could take a page from Klein's political playbook and try to convince Albertans that everyone needs to sacrifice to balance the province's budget.

"He sold us all on that," saidKneebone. "We all had a problem and we all had to be part of the solution."

Kneebone cautions that slaying the deficit doesn't have to be done overnight and not even in a single government's term.

He advocates taking as long as a decade to get back in the black.

"We have the fiscal room to be able to do this over a five- or 10-year period. That will reduce the pain," he said.

So, there are options, but they all come with potential political consequences.

The politics of deficit

In an interview with Postmedia in April, Kenney evoked Winston Churchill, saying that during this unprecedented challenge for Alberta, "it is the responsibility of leadership at a time like this to show strength and certainty."

And Kenney has channeled his political hero during the pandemic, calling on Albertans to come together in a wartime battle to fight the virus.

The language and the reality of dealing with deficits, combined with a downturn in the economy make for tricky politics in Alberta.

Historically, Albertans have been debt averse. And grumpy voters have turned on premiers take Don Getty and Rachel Notley, for instanceunlucky enough to govern during recessions.

Incumbent governments get credit for good economies, and blame for bad ones, stresses University of Calgary political scientist Melanee Thomas.

"Governments," she added, "geteither rewarded or punished for what happens with the economy, even if they can't actually control what happens with the economy."

While the UCP holds a strong majority lead in CBC News' most recent poll, it will now have to contend with Alberta's dire economic situation and how it spends taxpayers' dollars.

Political communication expert David Taras thinks the economy will make or break Kenney politically.

"This could be the ugly dirty 20s in Alberta. And if that's the case, then this is a government that could be in a lot of trouble," said the Ralph Klein Chair in Media Studies at Mount Royal University.

The fallout could take a while, though, says Taras.

Taras believes it will take time for the reality of the UCP's February budget to sink in.

"When the smoke clears, and kids go back to school and students go back to university, and people go to hospitals, they're going to see the effects of these cuts and they're going to have to pay more."

"It's at that point the incendiary point where the government's policies will really become real," said Taras.

And it's also at that point that Albertans' attitudes about the best options for dealing with the province's deficit could change.

Data from two surveys are reported in this story. The May 2020CBC Road Ahead survey was conducted between May 25 and June 1, 2020, by Edmonton-based Trend Research under the direction of Janet Brown Opinion Research. The survey sampled 900 respondents, randomly selected from Trend Research's online panel of more than 30,000 Albertans. The sample is representative of regional, age and gender proportions in Alberta. A comparable margin of error for a study with a probabilistic sample of this size would be plus or minus 3.3 percentage points, 19 times out of 20. For subsets, the margin of error is larger.

The March 2020 survey was conducted between March 2 and March 18, 2020, by Edmonton-based Trend Research under the direction of Janet Brown Opinion Research using a hybrid methodology. This survey sampled 1,200 Albertans, randomly selected by phone, and representative along regional, age and gender factors. The margin of error was plus or minus 2.8 percentage points, 19 times out of 20. For subsets, the margin of error is larger. The March survey used a hybrid methodology that involved contacting survey respondents by telephone and giving them the option of completing the survey at that time, at another more convenient time, or receiving an email link and completing the survey online. Trend Research contacted people using a random list of numbers, consisting of half land lines and half cellphone numbers. Telephone numbers were dialled up to five times at five different times of day before another telephone number was added to the sample. The response rate among valid numbers (i.e. residential and personal) was 13.2 per cent.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)