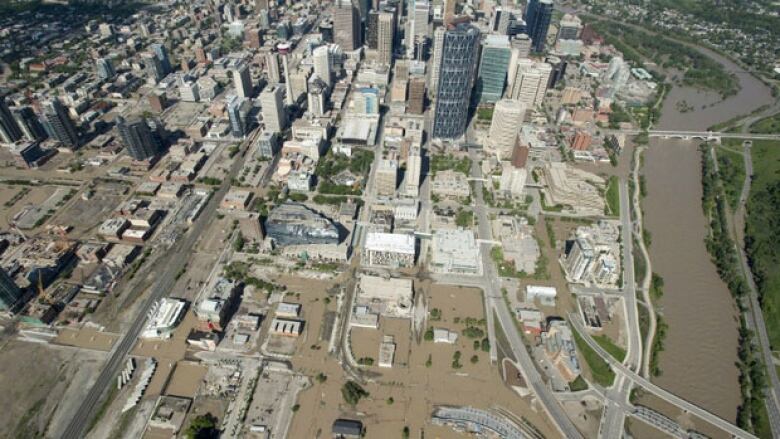

Alberta home insurance costs spike post-flood

June 2013 flood caused more than $5 billion in damage

It's been nearly eight months since large parts of southern Alberta were covered by floodwater and now many residentsare seeing the impact on their insurance bills.

The flooding in Alberta caused more than $5 billion in damage. So far, more than $1.7 billion in insurance claims have been paid out but insurance companies are trying to protect themselves by passing on the extra costs of things like flooded basements to consumers.

- Have your insurance costs dramatically risen?Email CBC Calgary at calgarynewstips@cbc.ca.

"It used to be just adark, musty place where you put your grandma's preserves," said Bill Adams with the Insurance Bureau of Canada.

"Now, it's one of the most comfortable places in the house and of course, when water gets into those rooms, it gets very costly very quickly."

For many Albertans, that damage and the risk it could happen again is causing steep hikes in premiums, higher deductibles and smaller benefits.

However, Adams says the frequency, severity and cost of extreme weather in Canada is increasing and companies are having to make larger payouts.

As a result, getting sewer back-up coverage or any kind of coveragecould become more difficult in future.

Companies set stricter criteria for coverage

After having three and a half metres of water in their Elbow Drive home during the flood, Mike Bregazzirecently got a rejection letter from his insurance company.

"When it came to claim time, things were handled and I think handled well," Bregazzi said. "When it comes to renewal time, not so well."

Their Royal Bank insurance covered most of the renovations to their flooded home but then their company sent them a rejection letter, declining to offer them continued coverage.

The company says it now sets stricter criteria for what properties it will insure, including repair history and frequency of claims.

Bregazzi sent the company documentation of his flood mitigation efforts and it eventually reversed its decision.

By then,Bregazzi had already decided to take his business elsewhere but other Albertanscould have to face a similar decision.

"I think Canadians that are getting insurance renewals in the mail are seeing the manifestation of a number of things that are coming together," Adams said.

"We're getting much more severe weather events more frequently and it's causing a lot more damage."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)