Tax hikes for businesses outside downtown core blamed on vacancy rates

Coun. Ward Sutherland says he'll be asking city council to stop doing a re-assessment every year

The tax burden shift to business properties outside of the downtown Calgary area is expected to continue.

Downtown property values fell by $4 billion last year, resulting in big tax hikes for businesses outside of the city's core.

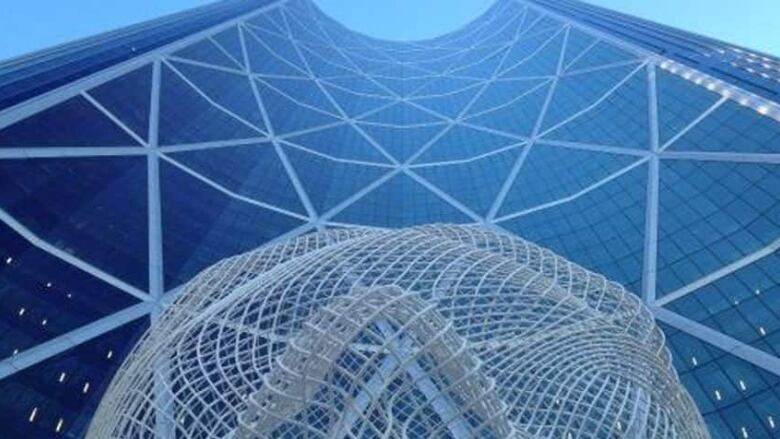

The rising vacancy rate in office towers is directly linked to the drop in downtown property values.

- Calgary home values drop 4% while non-residential properties decline 6% in 2017 assessment

- Calgary office vacancy rate headed for 30% as oil price downturn persists

A couple of new highrises will be completed this year, adding to the available space, so expect land values downtown to keep dropping, said Greg Kwong, the regional managing director with commercial real estate firm CBRE.

"With the vacancy rate right now at the end of the year around the 25 per cent level, we expect to move to 27 to 28 per cent. You can assume that property values will come off a little bit more before the end of the year."

It means the tax burden for business properties will likely continue shifting outside the core.

Coun. Ward Sutherland says he'll be asking city council to stop doing a re-assessment every year.

"We should be really doing assessments over a three-year period, once every three years rather than every single year. It would get rid of these severe fluctuations and have more guarantee of what your taxes are going to be."

Changing the assessment rules would require approval from the provincial government.

Expect layoffs, says Calgary Chamber

The shift in the tax burden from downtown offices to business properties outside the coredemonstrates why the City of Calgaryneeds to find new revenue sources, saidAdamLegge, president of Calgary Chamber of Commerce.

"It just doesn't mesh with economic cycles," Legge said.

"When a business is having a down year, they're still taxed on the value of their asset, and if that's assessed at a higher level, then they end up paying higher tax. It's the only level of government that you don't tax a company based on the nature of its performance."

Several thousand business property owners are looking at tax hikes of more than 10 per cent this year at a time when they can least afford it, saidLegge.

He expects some willhave to layoff staff or cut investment in order to pay their tax bills.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)