Calgary hit hardest by mortgage rules on homes over $500K: CIBC

Designed to cool hot markets like Toronto and Vancouver, but hit weak ones hardest: CIBC analysis

Calgary's struggling real estate market will be hit hardest by the change to Canada's mortgage rules that boosts the minimum downpayment on homes over $500,000.

- Bill Morneau tightens mortgage rules on homes over $500K

- Calgary a buyer's market for at least 6 months:analyst

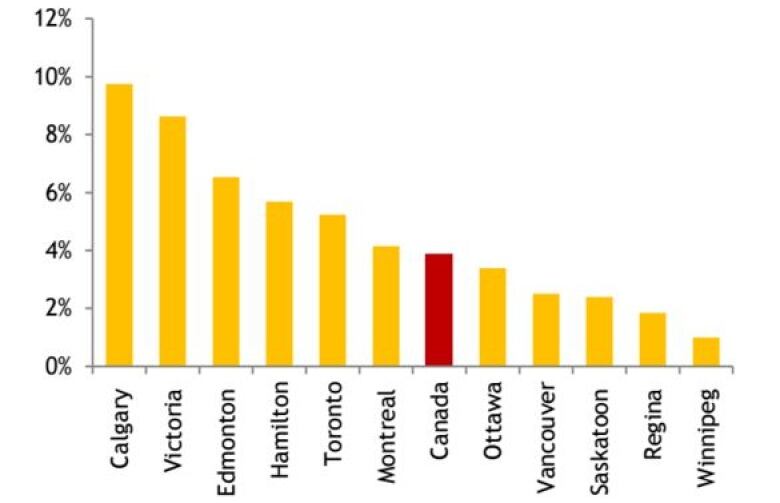

Almost 10 per cent of new home sales in Calgary and seven per cent in Edmonton will be affected compared to four per cent nationally, according to astudy by CIBCWorld Markets.

Under the new rules, buyerswould need to put down 10 per cent on the portion of any mortgage over $500,000.

The federal government announced the change on Friday, in a move designedto protect homebuyers in hot markets like Vancouver or Toronto.

Hits weaker markets

But economists say the down payment hikewill actually hurt weaker markets especiallyCalgary.

We considered the fact that the Alberta situation is challenging- Finance Minister BillMorneau

"The largest impact close to 10 per cent will be on Calgarydue to its relatively large share of high-ratio mortgages not exactly a city that needs additional cooling," wroteCIBCdeputy chief economist Benjamin Tal.

The CanadianHome Builders'Associationalso expressedconcern over the changes, noting that 86 per cent of new single- family homes in Calgarysold for more than $500,000.

"While most buyers of homes costing$500,000 or more already put 10 per cent or moredown, we're concerned when blanket nationalpolicies are imposed because of regionalhousing market issues," saidCHBAAlberta chiefJimRivait.

Ottawa's response

Finance Minister Bill Morneau said the government looked closely at what the changes might mean for the struggling Alberta economy.

"We considered the fact that the Alberta situation is challenging,"Morneau said on Friday.

"We want to make sure that we're doing things that don't negatively impact that market, and in fact, that's one of the reasons why we were very careful about exactly what we did and only impacted those homes over $500,000 up to a million," he added.

Homebuyers are currently required to put down a minimum of five per cent to qualify for Canada Mortgage and Housing Corporation insurance protection that lenders insist on when providing a mortgage worth more than 80 per cent of the home's value.

Starting in February, CMHC will require a 10-per-cent down payment on the portion of any mortgage it insures over $500,000.The five-per-cent rule remains the same for the portion up to $500,000.

Calgary's real estate market has seen a steady decline since the downturn in theAlberta oil industry.

Figures released by Remaxon Thursday predicted a four-per-cent drop in house pricesin 2016, on the heels of a five- per-cent drop in 2015.The average residential sale price in Calgary in 2015 was $461,700.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)