Alberta's carbon tax brought in billions. See where it went

NDP's carbon tax was expected to bring in $2.6B by end of March. Here's where that money is going

Alberta's carbon tax is a hot button issue in thisprovincial election, with many divided on the costs and benefits.

The province unveiled its Climate Leadership Plan (CLP) in 2015, just undera yearafter theNDPgovernment came to power. Although the party, now seeking re-election,didn't mention a carbon taxin its2015platform, the levycame out ofa volunteer panel led by economist Andrew Leach during the CLP'screation.

It even hadthe blessing of large oil companies, whichurged the province to pursue a carbon tax in 2015 something big oil is still doing today.

That's how the carbon tax came about.

But it didn't actually come into effect until Jan. 1, 2017. When it did, there was a lot of misinformation, with some Albertansconsidering a move out of province.

The carbon tax, or levy as it wasdubbed by officials,started at $20 per tonne, increasingto $30 a tonne the following year. The plan was to continue raising it, but that was halted by Rachel Notley after bumps in the pipeline road for Trans Mountain.

"Until the federal government gets its act together, Alberta is pulling out of the federal climate plan," NDPLeader Rachel Notley told reporters last August.

So that's where we stand today.

The Alberta government's websitesays the carbon tax should only costdirectly, on average,$286 for single people, $388 for couples and $508 for couples with two children.

But that doesn't count other indirect costs, like a grocery store passing on its costs to consumers. Those indirect cost estimatesranged from $75 to $110 per household.

Single peopleearning less than $47,500 a year, or families earning less than $95,000 a year, receive a full rebate to help offset costs of the carbon levy.

The provincial carbon tax websitecontains a predictionthatabout 60 per cent of Alberta households would get full or partial rebates, and they would be mailed or deposited directly by the Canada Revenue Agency (CRA) in four quarterly payments in January, April, July and October.

Revenue

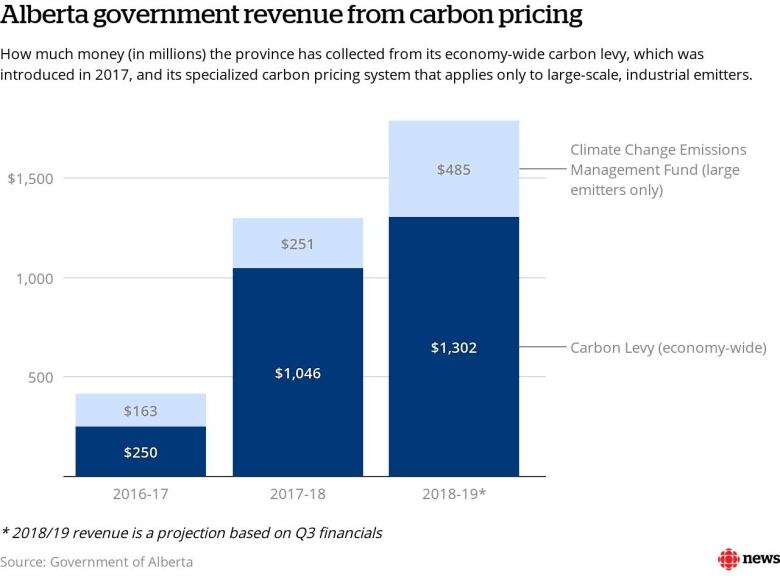

So how much did the carbon tax bring in?Well, as of March 6the province estimated it would generate $2.6 billion by the end of the third fiscal quarter,or end of March.

There's also aseparate system of carbon pricing for large-scaleindustrial emitters called the Climate Change and Emissions Management Fund(CCEMF) which brought in $899 million in the same time. That fund was put in place bythe Progressive Conservatives in 2009 under Ed Stelmach.

Here's how the yearly revenue breaks down.

2016-17 revenue:

- Carbon tax: $250 million.

- CCEMF: $163 million.

- Total: $413 million.

2017-18 revenue:

- Carbon tax: $1.05 billion.

- CCEMF: $251 million.

- Total:$1.23 billion.

2018-19 forecast revenue:

- Carbon tax: $1.3 billion.

- CCEMF: $485 million.

- Total: $1.785 billion.

Spending

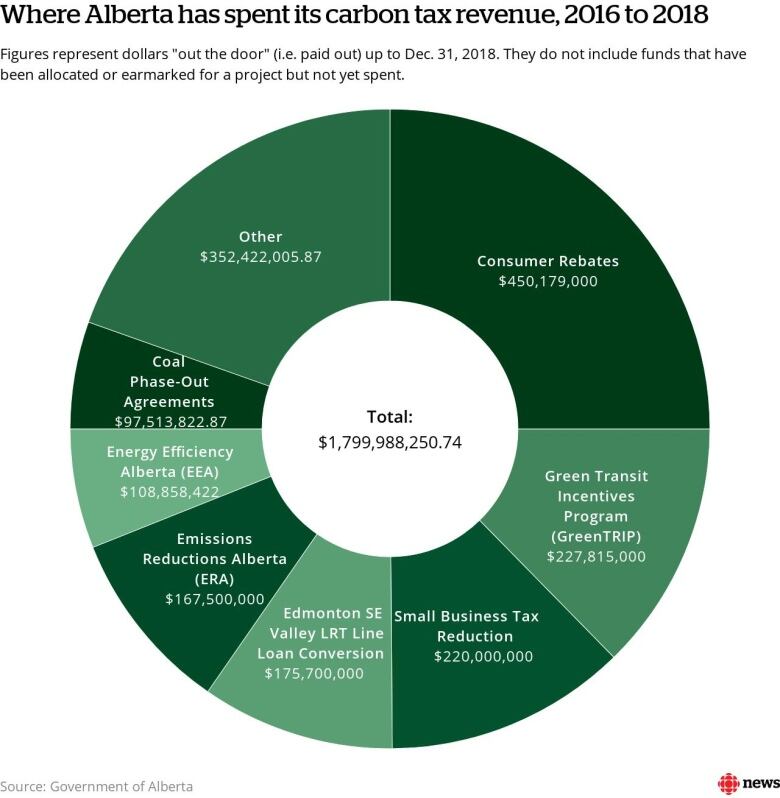

Here's how much money has been spent, to date. The figures are current up to Dec. 31, 2018, and don't include funds that have been earmarked for a project but not yet paid out.

Money spent:

- 2016-17: $276 million.

- 2017-18: $1.1 billion.

- 2018-19:$414 million (spent and budgeted so far).

These numbers may change in some areas, such as rebates and the small business tax cut. Those expenses for the remainder of the 2018-19 fiscal hadn't been added to those totals.

Figures provided by the Alberta government forecasted carbon levy rebates to climb to $525 million in 2018-19, bringing the total in rebates to nearly $1 billion by the end of March. The small business tax cut wasestimated to cost $415 million in the same time frame.

When asked why totals for revenue and spending were not fully lining up, the province saidmoney was being earmarked forprojects and programsthat are still in progress of being paid out, or selecting successful recipients, or as of yet unannounced.

"[It's] notapples-to-apples comparison," said government spokespersonMatt Dykstra,before the March 19 election call.

He pointedtowardadditional projects announced on March 13 a few days after CBC News received the provincial spreadsheet of carbon levy spending. When asked, the department was unable to update the spreadsheet because an election had then been called.

Energy Efficiency Alberta

Nearly $169 million has also been dispersed through Energy Efficiency Alberta through various programs, grants, financial incentives and rebates. This includes money for:

- Energy-saving renovations of homes, businesses and non-profit organizations.

- Installation of residential and commercial solar-power systems.

- Point-of-sale discounts on devices like programmable thermostats, water-saving fixtures and LED lights.

- Grants for education and training.

- Energy audits of homes.

Energy Efficiency Alberta tracks where these funds have gone based on postal code.

You can explore that data in the interactive map below. The darker the area on the map, the more dollars that have flowed there.

Zoom, scroll and click on the map to see more detail:

(Can't see the map? Click here for a version that should work on your mobile device.)

Emissions Reduction Alberta

In addition the carbon levy that the NDP government introduced, there's also thatseparate price on carbon that applies only to large-scaleindustrial emitters put in place under the PCsbutsince been amended by the NDP.

So if large emitters can't reach their emissions targets, they pay into a fund that can turn back around and fund technology projects that could help the emitter reach that target.

Much of the money collected from these large-scale emitters goes back into the industry through grants for research and innovation projects aimed at reducing greenhouse gas emissions through technology.

These grants are doled out by an agency called Emissions Reduction Alberta(ERA), which distributes the funds on a project-by-project basis. It was formerly known as the Climate Change and Emissions Management Corporation.

"The largest part of our portfolio has been around cleaner oil and gas, with electricity coming in second," said the ERA's Steve MacDonald, addingthere is a variety of work underway.

He says, for example, they are taking a closer look at methane in the oilsands, industrial process efficiency,bio-logic electricity and sustainable transportation.

"We've playedin a broad space and we will continue doing that," saidMacDonald, pointing towards the goal of reducing 43 million tonnes of CO2 by 2030.

Since 2009, approximately $500million has gone to support dozens of projects.

"Those projects we've invested in are valued at $4.3 billion, so incredible leverage there from an economic view," he said. "Our money has helped accelerate these projects and added a significant amount of jobs and basically investment in Alberta's GDP."

Projects that qualify could technically be out of province, as long as benefits are guaranteed to be felt here at home. Often the ERA will make a request for pitches on a topic, such as methane.

Then a team dives into the applications to select the most promising technology. The ERA pays after the project delivers so the process can be audited.

MacDonald pointed to one project that is looking to fully reduce water use forin-situ bitumen extraction, and the large-scale solar project near Brooks that he says is bringing multiple benefits to nearby communities.

"They'resolutions that the world are looking for in so many ways.... We talk about sectors oil and gas, electricity and the biologics area the solutions in one area are also applicable theother sectors," he said.

Here's the fulllist:

You can sort the columns by clicking or tapping on a column header. Or use the search function to find a particular project or grant recipient:

More information on each project is available here.

Is it working?

Alberta emitted 38 per cent of Canada's GHG emissions in 2015, the highest in Canada.

The NDP's climate plan wants to reduce greenhouse gas emissions by 50 megatonnes by 2030. They say it's on track.

With phasing out coal in Alberta, the NDP say less than half of electricity generation in Alberta was generated from coal power in 2018 for the first time which they sayhad a big impact on emissions.

But they want to take that higher.

The NDP want tophase out pollution from coal-generated electricity by 2030, partly with help from transitioning to natural gas,and have 30 per cent of Alberta's electricity come from renewable resources, such as wind, hydro and solar, in the same time period.

Rachel Notley told CBC News in a year-end interview the province tripled the amount of renewable energy being used last year in Alberta through its climate leadership planand the carbon pricing it generates, as opposed to the amount of renewable energy being used in Alberta over the previous 20 years.

When asked if there was a decrease inemissions since the implementation of the carbon tax, Notley said she hadn't been prepped with that information, but her staff sent the following statement afterwards:

Last year alone, we saw the reduction of 11 megatonnes of greenhouse gas emissions, roughly the annual emissions of Newfoundland. Right now our Climate Leadership Plan is paving the way for emissions reduction of 43 megatonnes by 2020, which is double the annual emissions of Manitoba. In 2017, Albertans saved almost three million tonnes of greenhouse gas emissions because of our energy efficiency programs this is equivalent to taking 110,000 cars off the road for one year.

Speaking Monday in Edmonton, Notley was a bit more conservative with her estimate on the impact, saying it was closer to seven megatonnes.

The UCPbelieves the carbon tax is not doing anything to cutgreenhouse gases, and that it's killing jobs. This statement, provided by Aaron Stokes who helped craft the UCP's carbon tax plan, says they feel that way because of its impact on the economy.

The removal of the carbon tax will directly reduce industrial costs of production based on the type of energy and the share of that energy used in the production process. As production costs fall, the competitive position of Alberta's industries improve and lead to stronger export growth as some of the cost savings will be passed onto customers. Industries will have to invest more to meet the additional demand and will generate positive impacts on construction employment over the analysis period (2019-2024). The supply linkages amongst industries will generate additional demand in other industries that will lead to further job gains more broadly across the economy.

But the NDP says its leadership plan as a whole has "directly supported" 5,000 jobs in 2017-18, and they believe it could generate another 20,000 positions in the future.

UCP Leader Jason Kenney says his first piece of legislation, if elected, would be to scrap the carbon levy. The UCPalso claim the money is flowing into general revenues and that its party could still support all the funding commitments made to projects, such asLRT lines in Calgary and Edmonton,without it.

And that would be even while paying for a promised court challenge against the federal carbon tax that could take years.

Using carbon tax money for anything outside the climate leadership plan is actually illegal, according to the NDP.Dykstra sent along the following statement in his capacity asan Alberta Environment spokesperson before the election:

CLP revenue must be used for CLP policies and programs by law.Section 3 of theClimate Leadership Actrestricts the use of the carbon levy to: a) greenhouse gas reduction or climate adaptation initiatives, and b) rebates or adjustments for consumers, businesses and communities (including tax rate reductions, like the small business tax reduction), or to make payments necessary under our government's four-year electricity rate cap.

Carbon tax politics

Rachel Notley is running in this electionon the carbon tax, and has brought it up many timesin lobbying efforts for Alberta's energy industry across Canada.

Before the election call, Environment Minister Shannon Phillips was asked by the Calgary Heraldwhich made the first request for carbon tax revenue and spending earlier this yearwhether she thought the NDP did a good enough job at marketing what the NDPcalls the benefits of the carbon levy.

"It's a relatively new program that has all come about in less than three years, so that's a normal and natural thing," she told the Herald at the time

Sheacknowledgeda possible disconnect between the obtuse carbon tax and the more tangible solar panel on a community centre nearby or instant energy efficiency rebates at a home hardwarestore.

So where do the other parties stand? Well, we know the UCP would get rid of it.

So would theFreedom Conservative Party, based on past comments by its leader,former Wildrose-turned UCP candidate Derek Fildebrandt.He tweeted back in 2016 that he wanted the tax repealed, although that goal isnot specifically outlined in the new party's platform.

The Alberta Party agrees with them, and would cancel the NDP carbon tax for families, small business, farms, non-profit organizations and municipal governments. However, like under the UCP's plan, large industrial emitters would still be taxed.

The AlbertaLiberals would introduce a carbontax of their own, that they claim would be closer to revenue-neutral.

But even if Alberta stops charging for carbon, there's always the federal government.

Despite legal challenges, Ottawa has implemented its own carbon tax in provinces that don't have their own.

So the carbon taxwill most likely remain a hot button issue, regardless of the outcome of the election.

- See the NDP's climate leadership plan progress report and other datacompiled before the election call in March

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)