What the federal budget means for Albertans: economist Trevor Tombe

For good or ill the deficit is a policy choice

Government budgets are a unique opportunity.

At no other moment are so many tax and spending items changed, or so many lives affected.

For a new government the first budget is particularly important. It sets the tone, defines prioritiesand marks a departure from the past.

- Alberta's $1B request unclear from today's federal budget, says Notley

- Liberals spin big deficits to fund new child benefit, infrastructure

At over 270 pages, this firstTrudeaugovernment budget offers a lot to digest and many details to be worked out.

Here's a quick take on the budget, what the big changes are, and what it means for Alberta.

For many Alberta families, especially those out of work, there are items to like. But there are some large open questions around where the new federal infrastructure spending will go.

The deficits

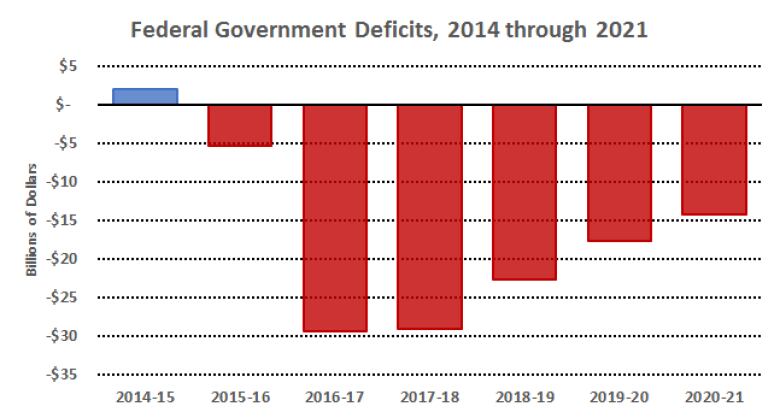

By now you've seen the headlines: a $29.4-billion deficit. At roughly 1.5 per centof Canada's economy, it's large, but manageable. But the red ink doesn't stop there.

After next year, the government is forecasting a $29-billion deficit in 2017/18. Another $23 billion in 2018/19. Then in 2019/20, a further $18 billion.

Over the next five years there will not be a single year in which we will see a deficit below the $10 billion level the Liberals committed to during the election campaign.

In some (small) ways, this is beyond their control.

Canada's economy will likely grow by 1.4 per centthis year,down from a previous forecast of 2.2 per cent.

As the economy shrinks, so do revenues. Each percentage point drop in overall economic activity translates into a roughly $5-billion hit to the budget.

But the deficit is for good or ill also a policy choice.

First, the government has changed some taxesmainly lowering them for a middle-income tax bracket while increasing them on the highest. On balance, this will decrease government revenue and increase the deficit.

Second, spending is up.

It's up for infrastructure, housing, public transit, First Nations communities and many other areas. Overall, the government will spend over $20 billion more next year than this year.

Roughly speaking, the higher deficits over the next five years can be explained as 60 per centdue to higher spending and 40 per centbecause of lower revenues.

Should these large deficits be cause for alarm? Concern, yes. Alarm, no.

Reasonable people can debate the merits of various spending measures, but to increase spending without increasing revenue is generally not wise. That being said, the overall debt will remain fairly steady around one-third of Canada's economy.

So, if the government sticks to this plan, then there is no reason to be concerned about the sustainability of Canada's debt.

The effect on the economy

Will these deficits stimulate Canada's economy? Will they have any effect on Alberta's economy? To both questions, the answer is only a bit.

The government estimates its measures will increase Canada's overall GDP by 0.5 per centin the first year and 1 per centin the second. They also claim to create or "maintain" 43,000 jobs next year and 100,000 jobs the year after.

I am deeply skeptical. These are based on fairly optimistic assumptions about how government spending affects the economy.

The reality is that there's no strong evidence to suggest government spending will boost the economy very much. And even if this budget does have an effect, we won't really know. Estimating exact cause and effect on this is notoriously difficult.

So, while any particular infrastructure project or tax change may be laudable (or not) on a case-by-case basis, to claim such measures will broadly stimulate the economy is just not supported by the evidence.

What's in it for Alberta?

After a very difficult year, the Alberta government, and indeed manyAlbertans, were looking to the federal government for help. In some ways, it's there; in others, it's less clear.

There are two ways to think about howAlbertanswill be affected by this budget. The first is as individuals. The secondis through the provincial economy generally. Though the two are linked.

Albertans(like all Canadians) will be affected in different ways depending on their own individual circumstances. For example, families with children (mainly those whose incomes are below $150,000) will see higher child benefit payments under a new system.

For the province as a whole, we can look to the announcements around infrastructure dollars and changes to EI.

Let's start with EI.

Twelve regions of the country experienced a sustained increase in unemployment by more than two per cent last year.

Here in Alberta, the unemployment rate in Calgary is 8.4 per cent, up from 4.6 per centat the beginning of 2015. It's even worse in northern Alberta, where unemployment now exceeds 12 per cent.

TheNotleygovernment had wanted help. And the Feds found it in some EI reforms.

Under the changes, unemployed workers in all Alberta regions (except Edmonton, which has weathered the storm fairly well) will have longer EI benefits. For most workersabout five weeks more for some others, up to 20.

This is no small change.

Money from the EI program will flow from the federal government into the pockets of many Alberta households. A benefit to individuals, though also to the economy through the resulting increased household spending.

The Alberta government estimates this change is worth roughly $380 million. Think of this as a 0.1 per centboost to Alberta's economythrough its hardest hit workers.

What about infrastructure? This is trickier.

Only for public transit do we know where the money will flow: it will follow the riders. As Alberta is roughly 10 per centof total public transit riders, we're likely to see $350 million over the next five years.

Elsewhere, the budget is less specific. With so many billions on the table, many will want their share. The federal government should move quickly to figure out who gets what.

What about further direct support to Alberta's government?

We recently received over $250 million as a stabilization fund payment and some were calling for more. There are even calls to reform the equalization formula.

The feds didn't bite. And rightly so. Alberta's fiscal capacity (our ability to raise money) is higher than any other province yes, even now.

Our provincial deficit, while concerning, is something we have every ability to deal with on our own. To ask other regions of the country to help pay the bills of the still richest province, would be a very odd move for the federal government to take.

Final Thoughts

The budget rests on two pillars: support for the middle class, and creating jobs and economic growth.

On creating jobs and economic growth, there is far more hope than substance. It's tricky for governments to "create jobs,"rather than just shift them between sectors.

As for "middle class" support, the tax changes, EI adjustments, child benefits changes and other measures, all will improve the situation for many families.

- Alberta's $1B request unclear from today's federal budget, says Notley

- Liberals spin big deficits to fund new child benefit, infrastructure

So they probably hit the mark there.

What's missing is the revenue to back it up. Deficits as far as the eye can see is not advisable. We'll have to wait for future budgets to see the plans if any to pay for all these new measures.

Calgary at a Crossroads is CBC Calgary's special focus on life in our city during the downturn. A look at Calgary's culture, identity and what it means to be Calgarian. Read more stories from the series atCalgary at a Crossroads.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)