Don't expect oil prices to get less volatile anytime soon: forecast

Deloitte forecast predicts WCS will be at $53.95 Cdn per barrel for 2019

Western Canada's energy market is looking at more uncertainty into 2020, according to the latest energy forecast from Deloitte's Resource Evaluation and Advisory group.

"I think there's some cautious optimism ... knowing [that] there will be some volatility in the next couple quarters," said Andrew Botteril, a partner with the firm.

The forecast notes that until pipeline constraints ease and non-U.S. markets open up, prices will likely stay low.

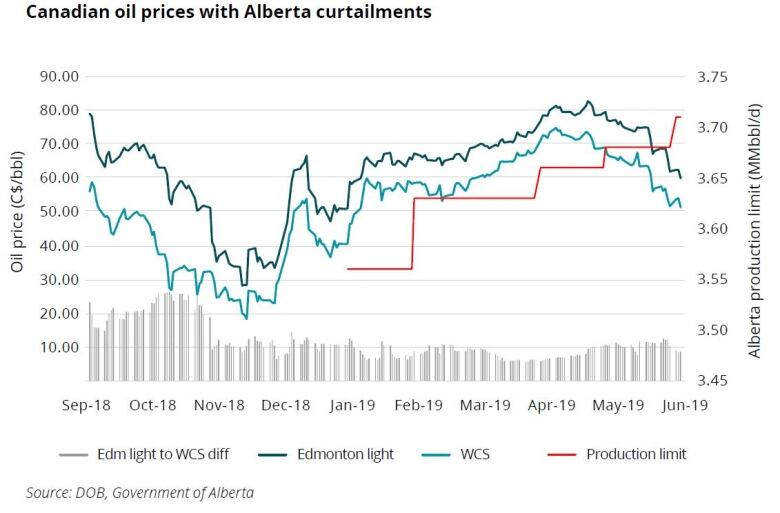

It's predicting Western Canadian Select will be at $53.95 Cdn per barrel for 2019, and West Texas Intermediate will be at $55 US ($72 Cdn).

And the industry will be watching and waiting formore details about how long production curtailments will extend, and for the government to say whether it will proceed with crude-by-rail contracts.

"I think there's a lot of trepidation in the industry about where further investment and growth might come from," Botteril said.

The provincial government says Alberta crude will have averaged 3.71 million barrels per day in June, according to the forecast.

That's a five per cent drop from average production in the last quarter of 2018.

Botteril said the curtailments have done their part so far to maintain "relatively firm pricing," but that they won't last forever, and there's no great confidence in pipelines coming through in the short term.

Construction starting on the Trans Mountain pipeline expansion will be a big catalyst for confidence in the sector, he added.

The company is also predicting Canadian natural gas prices will remain low as long as there's limited export markets, and production is expected to decline as producers delay capital spending.

With files from Elizabeth Snaddon

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)