Alberta's aging population is a fiscal time bomb

'There are no easy options,' says economist Trevor Tombe

In politics, vision and long-term thinking are scarce commodities.

A limited, narrow focus on the next election dominates. From quarterly deficit numbers to manufactured political "controversies" to smears and counter-smears. Our short-term focus neglects very real fiscal challenges ahead.

For Alberta, those challenges are massive. And we're not ready.

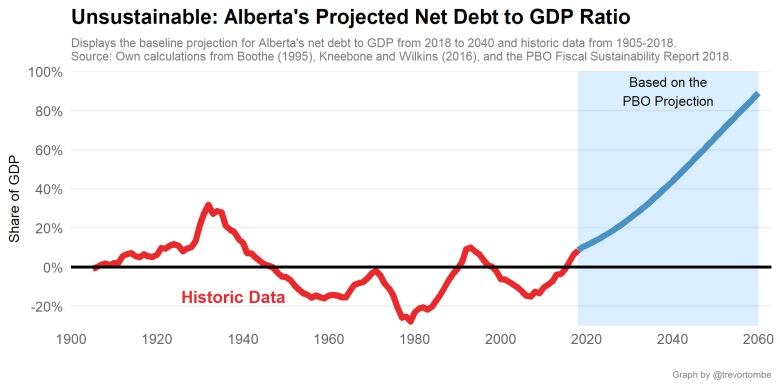

Each year, the federal Parliamentary Budget Office estimates long-run budget pressures for each province.

Their latest report, released Thursday, estimates that while Alberta's deficit will shrink over the coming few years, that won't last. Spending will exceed revenue each year from now until the end of the century. From 2020 onwards, each year will be worse than the last. Public debt in Alberta will exceed $100 billion by 2021, and exceed $1 trillion by 2051.

This is unsustainable, and frightening. By the mid-2030s, Alberta's net debt may exceed its historic peak of a century earlier during the depths of the Great Depression when the province actually defaulted on some of its debt.

To fill this hole, Alberta must either raise revenue, lower spending, or deploy some combination of the two.

The size of the required adjustment is large equivalent to 2.3 per cent of our economy.

There are no easy options. For perspective, the required action is equivalent to an immediate and permanenteight-per-cent sales tax or shrinking government operations by roughly 15 per cent.

These forecasts are not just abstract number crunching. They reflect very real, very practical problems. One of the biggest is Alberta's aging population.

And we're already seeing its effects.

The cost of getting older

An aging population strains our budget from both sides.

Revenue will fall as retirements increase and economic growth slows. And spending will rise dramatically as health care becomes more costly.

First, the spending.

Health care is already a massive part of government. Last year, every single dollar of provincial taxes paid by every single Alberta person or business was not enough to pay for health care.

Seriously. Let that sink in.

All the income taxes. All the gas taxes, cigarette taxes, insurance taxes. All the carbon taxes. All provincial property taxes. All of it totalled $20.8 billion last year, though we spent $21.2 billion on health. And it's going to get worse.

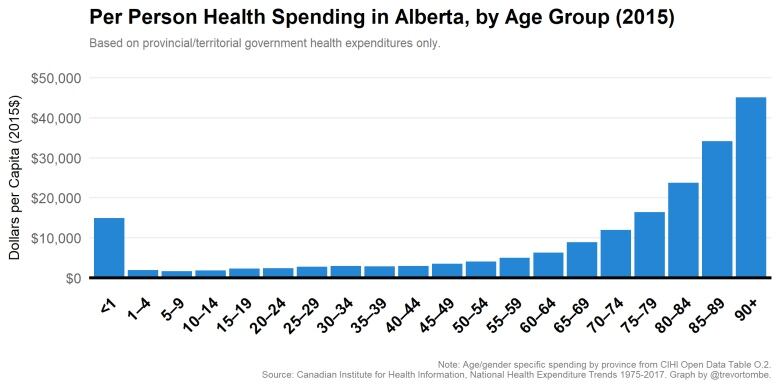

By the mid-2040s, one in five Albertans will be over the age of 65. And nearly fourper cent will be over the age of 85 a share nearly triple what we see today. This matters a lot. Health-care spending rises dramatically with age.

Let's look at that.

In the late 1990s, roughly 35 per cent of public health-care spending was spent on those aged 65 or over. Today, it's just over 40 per cent.

But over the next 25 years, if things remain as is, that share could rise to more than 60 per cent.

Again. Let that sink in.

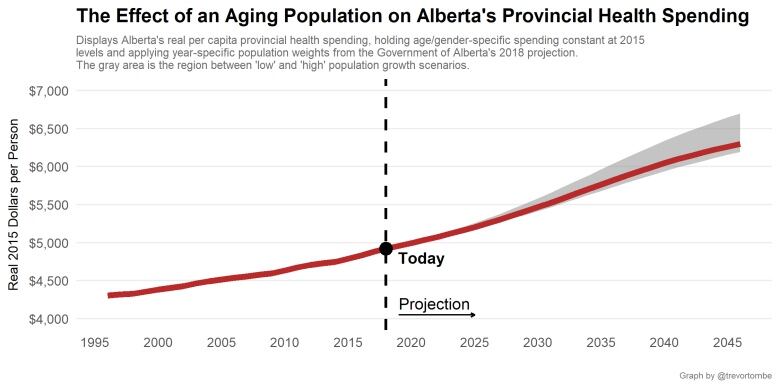

We're already seeing the effect of aging today. We currently spend about $5,000 per person on health care. But if our population was as young today as it was in the late-1990s, we'd only be spending $4,400. In a very real sense, our now-older population costs us an extra $2.6 billion more in annual health spending.

And it's going to get worse.

Fast forward 25 years. Alberta's Healthcare costs are set to rise another 30 per cent. Never mind health-care inflation, rising drug costs and so on. This is just from an aging population, alone.

It's an increase that today would be equivalent to roughly $6 billion per year. To fund that, Alberta would require the equivalent of a 50-per-cent increase in income taxes.

Fewer taxpayers and a slowing economy

Compounding pressures from rising spending is lower provincial revenue.

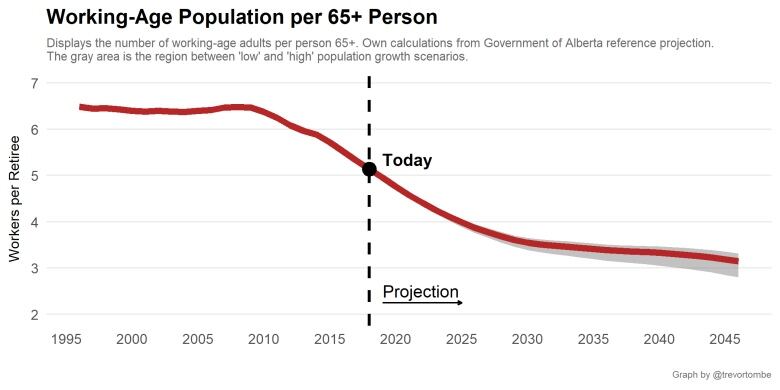

Today, every person over the age of 65 is supported by five working age adults.In the next 25 years, this will fall to three.

Fewer workers means fewer taxpayers and a smaller economy.

Now, of course, retired individuals still pay some taxes.

While they may have a low income, they pay sales taxes on the goods they buy and property taxes on the homesthey own.

In recent research, three of my colleagues at the University of Calgary economists Daria Crisan, Ken McKenzie, and Jack Mintzestimate that most taxes paid by those aged 70 and older are sales taxes.

This is a problem for Alberta. As workers retire and earn less income, they'll pay less income tax. In all other provinces, though, retired individuals will still pay provincial sales taxes on their consumption, cushioning some of the blow to provincial coffers. But Alberta has no sales tax, so the taxes an individual pays falls more sharply with age here than elsewhere.

More broadly, the economy, too, will slow.

Today, roughly 72 per cent of Albertans 15 and over had a job or were looking. As our population ages, that will fall to two-thirds by the 2030sa level not seen in Alberta since the early 1970s, when women's labour force participation was significantly lower.

This matters. Fewer workers means a smaller economy.

We need long-term thinking

Even if the government's plan to balance the books by 2023 holds, or if the opposition UCP's similar goal of 2022 works out, the challenge remains. The fiscal pressures throughout the 2020s will be immense.

Difficult decisions will need to be made. New and innovative approaches to health care may be necessary. And these efforts must be sustained over decades, not years.

Both government and opposition parties have a role to play. Albertans need clear and specific policy options to debate. We also need full information about the problem. It will be complex and difficult, but a mature and honest conversation today is needed.

In areport earlier this year, Alberta's outgoing auditor general, Merwan Saher, sounded a similar alarm.

"Longer-term thinking and debate is not a question of political ideology. It is simply common sense," he wrote.And, "considering the impact of today's decisions on future generations of Albertans, [it] is not just important but without question the right thing to do."

Let's let that sink in, too.

This column is an opinion. For more information about our commentary section, please read thiseditor's blogandourFAQ.

Calgary: The Road Aheadis CBC Calgary's special focus on our city as we build the city we want the city we need. It's the place for possibilities. A marketplace of ideas. Have an idea? Email us at: calgarytheroadahead@cbc.ca

More from the series:

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)