Alberta-B.C. chapter of the Lutheran Church faces financial crisis

Investment fund's cash shortage may require liquidation of assets

Problems with an investment fund administered by the Alberta-British Columbia chapter of the Lutheran Church of Canada may force the church to sell assets such as buildings, churches and schools.

In a letter to investors sent Jan. 5 the president of the Alberta.-B.C district says the investment fund has been suspended and is not able to fully pay back investors.

The news has left congregations and pastors with many questions.

I certainly know that the perception is that trust has been broken, said Michael Schutz, a pastor with Concordia Lutheran Church in Penticton, B.C.

Schutz said he started receiving calls from members of his congregation shortly after they received the letter from Rev. Donald Schiemann, president of the Alberta-B.C. district.

Many of the pastors CBC News contacted for this story refused to comment, instead issuing this statement.

Some told CBC they didnt want to be interviewed, fearing reprisal from the church for speaking out.

'Something is broken'

After talking with the leadership within his own church Schutz chose to speak about the situation.

I think its important to acknowledge that something is broken and we as Christians, part of what it means to be a Christian is to acknowledge our brokenness, said Schutz.

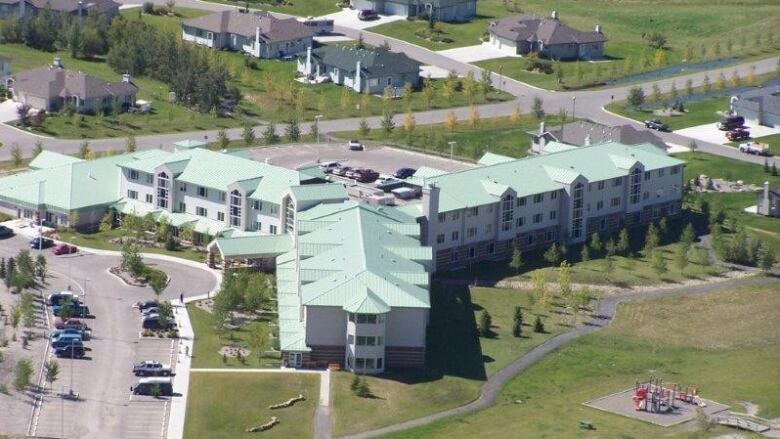

Investors of the Church Extension Fund (CEF) are now being asked to consider two options: liquidate the districts assets immediately or allow investors to receive payments from Prince of Peace Manor and Harbour,just east of Calgary, a project that was built in the 1990s with investment from the fund, while also selling off assets.

Full payment could be received, but the time line for recovery could be longer than liquidation, said Schiemann in the letter to investors.

Sources close to the Alberta-B.C. district say the Church Extension Fund ran into trouble when it was used to fund the Prince of Peace Manor and Harbour east of Calgary in the 1990s.

On its website, the Prince of Peace Village calls itself a thriving community for seniors and their families to call home. It includes a church, a K-9 school, a supportive living facility for seniors and a dementia care facility.

How much of the investors money went into the project isnt clear.

The letter to investors says the Church Extension Fund is holding deposits valued at $95.89 million with estimated withdrawals by investors of $929,000 per month. The fund currently has a total of $7.8 million in cash and marketable securities.

The rest of the fund is invested in assets whose collective value falls below the total deposits of $95.89 million, reads the letter.

The letter goes on to say that if withdrawals remain the same, the CEF will have a cash flow shortage in the spring of 2015.

The trouble with the investment fund reaches beyond individual investors, and depending on which option investors choose, it could affect propertiessuch as churches and schools.

Emergency fund established

A newsletter issued to parents whose children attend the Prince of Peace Lutheran Schoolassures parents the current financial crisis will not disrupt the school year. The newsletter says the entire Prince of Peace Manor and Harbour facility has been financed by the investment fund.

The president of the Concordia Lutheran Seminary in Edmonton is also concerned. He refused an interview, but in a lengthy statement posted on the seminarys websitesaid that about $898,000 of the seminarys assets are invested in the fund and we are deeply affected by the CEF situation in real financial losses.

In an email statement, district president Schiemann, who also wrote the letter to investors, said he will not be speaking publicly about the investment fund until after the investor meetingson Thursday and Friday.

The church says it hasset up an emergency fund for investors who rely on CEF interest payments to meet basic living expenses.

Meanwhile, the president of the Lutheran Church of Canada, Rev. Robert Bugbee, says the national church does not have the financial resources or expertise to assume control over the districts financial situation and that it is not in a position to explain how the problem developed or how it could be fixed.

Those who are counselling members of their congregation through this rocky financial time remain optimistic a solution will be found.

What it all means for the future of the district isnt clear.

The church is the people, the church is not buildings, the church is not investment funds, the church is the people who have been given this wonderful gift of faith by God to gather together and receive from God and worship, that will go on, said Schutz.

The investment fund began in 1921 as an internal savings and loan program, because banksat that timewere not lending money to churches.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)