$80M condo complex stuck without insurance in Fort McMurray

Lougheed Estates has been without insurance since Dec. 31, 2019

An $80-million condominium complex in Fort McMurray has been denied coverage, leaving the buildings uninsured since Dec. 31, 2019.

Lougheed Estates, built in 2006, is a complex with 227 units, mixed between three apartment-style buildings and a section of townhouses.

Kathy Bowers, owner ofFort Management, the company that managesLougheed Estates, said she is fighting to find an insurer, but the process has been trying.

"Unfortunately,Lougheed does have some claims history, so it's been difficult to find anybody to take them on."

Bowers said the condo has had $2.4 million in claims since the 2016 wildfire, with $1.65 million of that attributed to the fire.

Last year the company paid $390,000 in insurance premiums, up from $135,000 the year before.

The Lougheed isn't the only condo her company manages that has struggled to get insurance coverage.

"Some of the premiums have doubled," she said. "So it's putting these residents in a crisis situation, where they're just handing their properties back to the bank. They have no other choice."

"If our government doesn't step in and regulate it, it's not going to get better."

Fort Management began taking steps to mitigate the number of claims in 2019. They hired an HVAC company to monitor the equipment and an onsite manager to walk the property and look for risks.

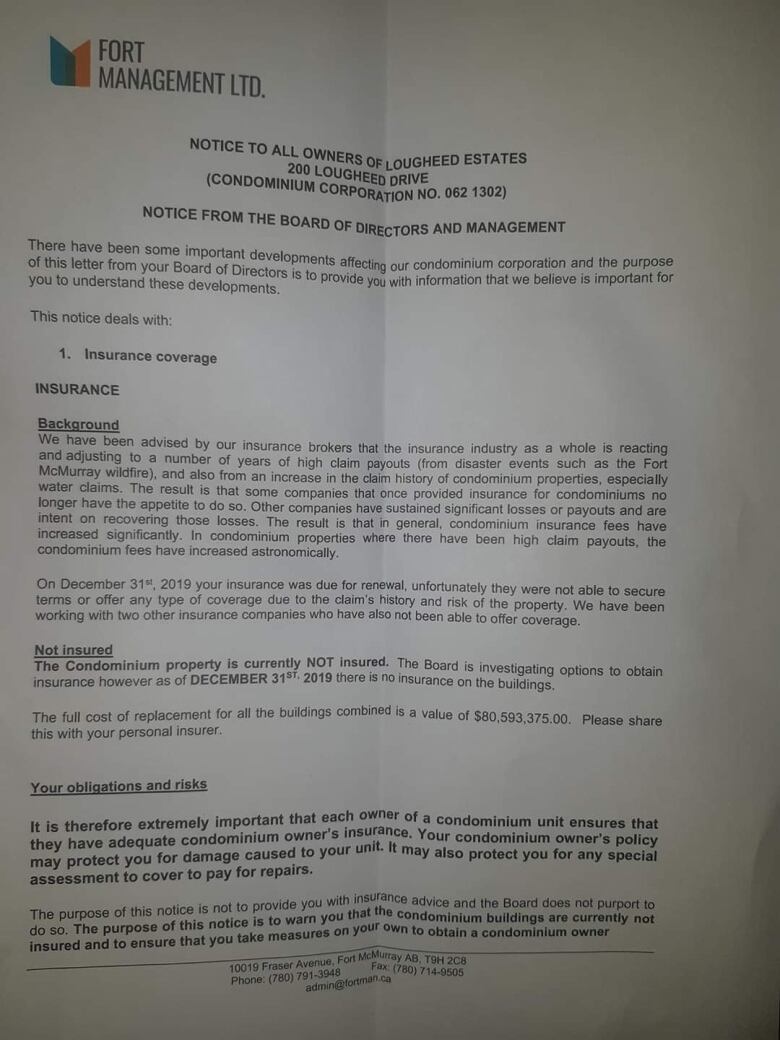

The condo board sent a letter to homeowners in early January, warning them their properties aren't insured.

"I've been on the phone since we sent the letter," said Bowers, who admitted that owners are angry and frustrated.

She has recommended owners go back to their personal insurers and ask for extra coverage.

'It's going to be unsellable'

Shauna Ciezki and her father bought two townhomes at Lougheed as an investment in 2006. She lives in Calgary and has always rented out the units.

"Initially it was going really, really well," said Ciezki.

She had both the units up for sale in 2016, but one wouldn't sell and sat vacant for a year.

When she got the letter from the condo board in January, she said, she tried to get individual unit insurance on her townhouse. Before that she relied on the condo corporation's insurance and tenant insurance.

But her bank wouldn't give her individual unit insurance, because the complex itself wasn't insured.

"It's a little bit like a hamster in a wheel," said Ciezki, who isstill trying to get insurance for the townhouse.

"I'm extremely worried," she said. "Basically, it's going to be unsellable."

Jodi Whalen, a mortgage broker in Fort McMurray, said if condos don't have insurance people won't be able to transfer their mortgages.

Anyone trying to buy an uninsured condo won't be able to get a mortgage for it.

"Insurance is always required," said Whalen. "You wouldn't be able to get a mortgage on it with no insurance, because there's nothing backing the security should something happen to it."

She said the government needs to step in and regulate insurance companies so owners aren'tput in this predicament.

MLA Tany Yao said he has been working with the government to get support and find a solution.

"I think that it's going to take a long time to deal with," he said. "I think you're going to see more accountability to individuals who have repetitious issues around their habitation."

He has heard from manyconstituents about the issue, including mayor and council.

"I'm hoping that the insurance industry will be able to address this issue and come up with a fair resolve, because otherwise they risk shattering an entire multi-billion dollar industry."

In an emailed statement, Treasury Board and Finance spokespersonJerrica Goodwin said the department is working with the Insurance Bureau of Canada to find a solution.

Goodwin said the government was happy to hear insurance bureau is hiring a risk manager to help condo corporations access insurance.

No easy answer

Rob de Pruis, director of consumer and industry relations for the western branch of the Insurance Bureau of Canada, said Lougheed is the only condo complex he's aware of in Alberta that is currently without insurance.

He said the bureau is working a find a solution, but condo corporations need to mitigate risks to avoid accidents like pipes bursting in the cold.

There is no simple solution to reducing condo insurance premiums, said de Pruis.

"There's some really big global economic factors that are also coming into play here as well that we may not have as much control over."

That's paired with local risks, for example, with Fort McMurray surrounded by boreal forest and some homes in a flood zone.

Seven out of 11 of Canada's costliest insured events have all taken place in Alberta.

He said the IBC has already put a call out for applicants for a risk manager, and they hopeto have the position filled in about a month. As well, the bureau is creating a national task force to look into problems in the insurance market and come up with recommendations.

He said they're hoping to have that report in roughly one year.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)