Familiar shopper scam becoming increasing sophisticated

Scammers make things difficult for legitimate mystery shopper companies

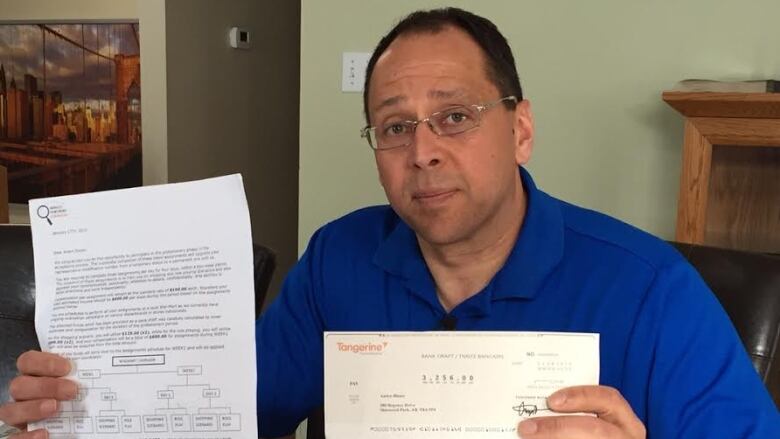

A man in Sherwood Park, Alta., is one of the latest victims of mystery shopper scammers who have likely ripped-off Canadians for millions of dollars this year alone.

Andre Blazey said when the Bank of Montreal called to say the cheques he deposited from "Service Checkers Canada" were bogus, leaving him on the hook for $5,000, he felt like his world was falling apart.

"I sat there and cried," Blazey said. "I sat there and thought, 'Is this it? How do I overcome this?'"

Blazey said he thought he was picking up some part time work to help him through tough times but wound up having to ask his family for money to bail him out.

"All your life working for wholesome people, good companies, real business, and to be defrauded$5,100. To fall for this is embarrassing."

Scammer seemed professional, victim says

Blazey said he was familiar with legitimate companies that used mystery shoppers to audit customer service in stores, hotels and other retail businesses and regularly saw their reports when he was employed in a workwear store.

"I would read them and try and improve myself as an employee providing customer service," he said.

He found several online ads from people recruiting mystery shoppers, but answering the one from Service Checkers proved to be a costly mistake.

He called the number in the ad and spoke at length about the job with someone who called himself Kevin Grey.

"The questions he asked me were bang-on in the marketing world," Blazey said.

He said Grey told him Service Checkers had been hired to assess the quality of service at a Walmart in Sherwood Park.

He was a sent a bank draft along with a flowchart outlining his assignments for two weeks, which included making small purchases and noting the state of the store's washrooms, whether the aisles were clear or cluttered, and if the staff were all wearing name tags.

Later he was to return and pose as a customer looking for a television to assess the salesperson's knowledge of the products.

He was told he would make $100 per assignment and could expect to make $600 per week.

"I thought that this was the real deal," Blazey said.

Bank manager didn't spot anything wrong

Blazey says he met with the manager of a Bank of Montreal branch in Sherwood Park and showed her the bank draft and letter that Service Checkers had sent. He said the bank manager didn't spot anything wrong.

"She did tell me that a friend of hers was a mystery shopper for a period of time but didn't get paid as much," Blazey said.

Blazey opened a separate account, deposited the bank draft and began working on his undercover assessments.

After he completed the assignments he reported his findings to Kevin Grey and got his next assignment.

That assignment was to "test" the customer service at the Western Union desk in the same Walmart by wiring $901 using some of the money he'd been sent.

Over the next two weeks Blazey received more bank drafts and continued working on his "assignments", about half of which were supposedly testing money transfer services.

Then he got a call from the bank saying the first bank draft had bounced.

"I was in state of disbelief, " he said. "Oh boy, what the hell's going on?"

A second draft bounced soon after. "Kevin Grey" stopped taking Blazey's calls and Service Checkers' Ottawa address turned out to be fictitious.

Bank won't reimburse customer

Blazey asked his bank to reimburse him, believing the branch manager should have spotted the fraud or at least made sure the bank drafts were real.

BMO refused, saying Blazey had specifically requested the bank not hold the drafts and that he had "misrepresented the facts" by not disclosing that much of the money would be used in wire-transfers.

Blazey said he told the branch manager "it would be nice to have the money as soon as possible", but that be believes a bank should have rules to follow, regardless of what a customer asks for.

Blazey denied misrepresenting what the money would be used for, claiming he was only told about about the wire transfers after his meeting with the branch manager.

"I relied on their expertise, " Blazey said. "I've been a BMO customer for 25 years."

A BMO spokesman declined to comment and referred Go Public to the letter the bank had sent Blazey.

Blazey has appealed to the Bank of Montreal's Ombudsman who is still investigating.

'They've made the scam better'

While the mystery shopper scam has been around for several years, scammers are becoming increasingly sophisticated and are catching new people according to police and the legitimate mystery shopper industry.

The scam that caught Blazey had him doing the sort of assignments legitimate mystery shopper companies use regularly.

It also lacked some common red flags, such as poorly-written English, that marked previous versions, according to Cameron Watt, board member of the Mystery Shoppers Providers Association.(MSPA)

"What they're trying to do is make (the scam) seem legitimate because not all the assignments are wire transfers," Watt said. "They mix in some other stuff to make it seem like it's real."

Like money counterfeiters, the scammers seem to have adapted and removed some of the warning signs that have identified them in the past, according to Det. Bill Allen with Edmonton Police.

"So this is what they've done, is they've made the scam better," Allen said.

Watt says scammers make it difficult for legitimate companies to attract people to work for them because they often masquerade using legitimate companies' logos and websites.

Despite their increasing sophistication, Watt says one iron-clad rule remains.

"Mystery shopping companies don't send you money in advance and don't ask you to send your money anywhere," he said.

Even though the Canadian Anti-Fraud Centre says Canadians lose tens of millions of dollars a year to cheque scams like this, Blazey said police have told him they won't even investigate because the scammers vanish as quickly as they appear.

"They're not like you or I who work hard every day for our money and live a simple life," he said.

"People like this need to be locked up."

The letter is similar to legitimate mystery shopper reports he'd seen in the past, Blazey said. (PDF KB)

The letter is similar to legitimate mystery shopper reports he'd seen in the past, Blazey said. (Text KB)CBC is not responsible for 3rd party content

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)