Fort McMurray homeowners frustrated about rebuilding process

Lawyer, contractor advise homes still standing in hardest hit areas should still be inspected

The enthusiasm to rebuild homes after the FortMcMurraywildfire has givenway to frustration for some residents.

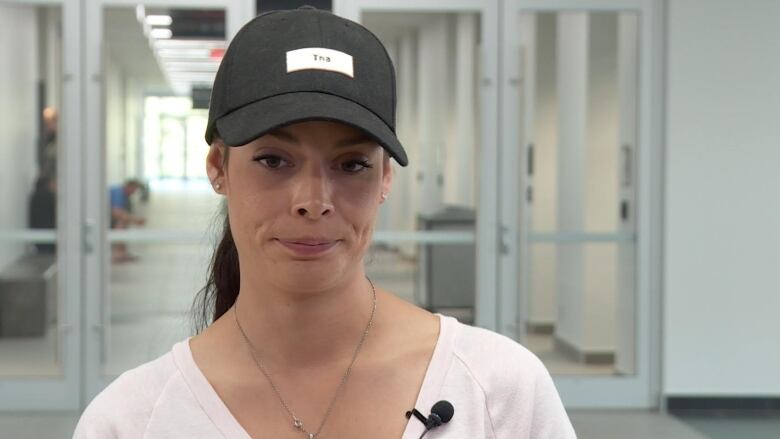

"You really don't know who you can trust, that is the biggest thing in FortMcMurrayright now,"saidMacKenzieCadieux,who lost her home inAbasand.

Cadieux and other residents from fire-ravaged communities attended a forum at Shell Place on Wednesday evening,where a lawyer and a contractor answered questions.

"One of the first few comments that was given to me as a sign of hope was, 'Oh, at least you get to rebuild a new house the way you want to,'"Cadieuxsaid."I don't want to rebuild a new house. I like my house the way it was, and this to me is a lot of aggravation in my daily life."

Insurance questions

Residents had questions about demolitions, permits, damage assessments and insurance.

Presenter and lawyer Terrence Cooper said people need to first understand their insurance policies.

Cooper said it's critical residents understand terms like "guaranteed replacement costs," because that means insurance companies will rebuild their homes as long as the new home has the same specifications as the one destroyed.

He alsorecommended that owners get insurance companies to break down in simple language what's required of them in order to get compensation.

But most of all, the FortMcMurraylawyer said, residents shouldn't necessarily settle for the first offerthey receive.Instead, they should negotiatethe best settlement that covers their living expenses, demolition and rebuilding costs.

"Don't settle anything unless you have a significant strategic advantage," Cooper said.

Inspect partially damaged homes

Owners who will returnto homes that sustained minor damagewereurged to have their homes inspected and tested as soon as possible.

"The minute they say, 'You can go back in,' if any of you have been getting any compensation (for living expenses), the insurance companies are going to cut it off," Cooper said.

"If you move back in, even though there areproblems, then you basically have said that there are no problems that prevent me from living in the house."

Contractor PaulMcLeod, another presenter, recommended tests that homeowners in the worst affected areas should do.

"You can have an abatement test (for asbestos) done," saidMcLeod, owner ofVanconServices. "You can have a heavy-metal test. Obviously, there was a lot of heat and smoke melting all kinds of things around your home. You can also do ground sampling."

May's wildfire destroyed or damaged 2,793 homes or apartments, and a total of 3,200 units cannot be re-occupied, according to July estimates from the Regional Municipality of Wood Buffalo.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)