Lutheran Church officials admit misleading investors about funds' financial troubles

Alberta Securities Commission orders fund administrators to pay back $500,000

Five people involved with the operations oftwo now-insolvent Lutheran Church-Canadainvestment funds havebeen ordered to pay $500,000 to investors after admitting to withholdingcrucial financial information.

The Alberta Securities Commission (ASC) launched an investigation in 2015after two investment funds operated by Lutheran Church-Canada,Alberta-British Columbia District, dissolved into bankruptcy.

A settlement agreement was reached Wednesday with five individual respondents, who have been ordered to pay a total of $500,000 into a fund to distribute to investors.

The five respondents admitted to breaching Alberta securities laws by making statements they knew, or ought to have known, did not state all of the facts required.

"This settlement provides an opportunity to increase the amount available for distribution to harmed investors many of whom are elderly in a timely manner," ASC executive director David Linder said in a news release Thursday.

As a result of the settlement, a hearing scheduled to start Friday will not go ahead.

- Monitor for failed Lutheran investment funds to remain in place

- Legal dispute escalates over faltering Lutheran Church investment funds

A copy of the settlement agreement lays out the details of how the funds were administered.

The respondents were Donald Robert Schiemann, Kurtis Francis Robinson, James Theodore Kentel, Mark David Ruf and Harold Carl Schmidt.

Schiemann, a Lutheran minister based in Stony Plain, was the director of the Alberta-British Columbia District from 2000 to 2015.The others either sat on boards or were part of the executive team that administered the investment funds.

The district was set up as a registered charity in 1944. Its purpose was to support congregations in Alberta and British Columbia in advancing the Lutheran Church's religious mission.

It controlled two funds: the Church Extension Fund, created in 1920, and the District Investment Fund, formed in 1996.

For decades, members of the Lutheran Church, many of them seniors, were encouraged to invest in the funds. The money was used to help build churches, schools and retirement communities.

The funds ran into financial troubles after investing in a development called Prince of Peace in the mid-1990s, according to the agreement.

- District Lutheran President says he 'bears responsibility' for financial mess, promises review

- Alberta-B.C. chapter of the Lutheran Church faces financial crisis

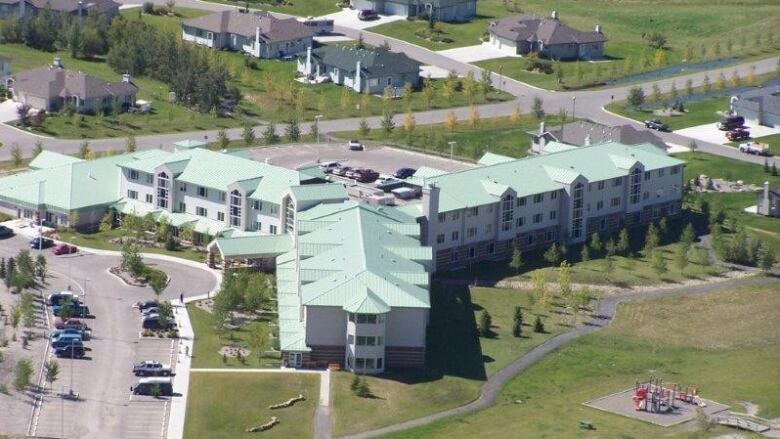

The real estate project, located east of Calgary, includes a church, school, retirement home and dementia-care facility.

But investors weren't told that most of their money had been loaned to Encharis Community Housing and Services (ECHS), the corporation that controlled Prince of Peace.

By 2012, about 97 per cent of the district's loan portfolio was tied up in mortgages taken out by ECHS.

The corporation made no payments toward the principal of the loans, didn't produce any financial statements, and didn't have enough assets to secure the loans.

"As a result, there was significantly higher risk of losing their money than investors were told when they made their investments," the ASCsaid in its release.

At the start of insolvency proceedings, investors claimed total losses in the two funds of more than $127 million.

But "a significant portion" of the claims has since been returned, and investors are now estimated to be short about $27 million, the settlement agreement said.

In addition to the $500,000 penalty, the respondents have also been ordered to pay $100,000 to cover a portion of the cost of theinvestigation, as well as the commission's legal costs.

They have also been banned from managing or trading securities in Alberta, and fromconsulting on the securities market.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)