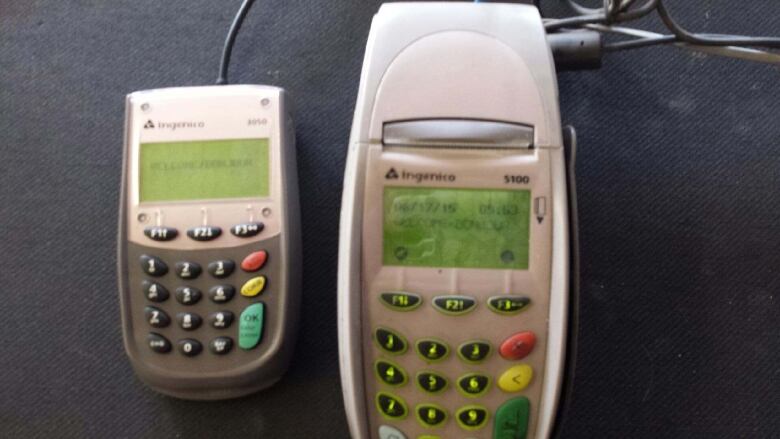

Supplier of credit-debit terminals gouging small businesses, owners claim

Unauthorized bank withdrawals cost businesses thousands, owners say

Canadian small business owners looking to save money on credit and debit card transactions say the company they signed with ripped them off, in some cases for thousands of dollars.

Several business-owners told CBC's Go Public that Canada BankCard Systems (CBS) took money from their bank accounts without adequate explanation, several times a month sometimes several times on the same day.

They say Canada BankCard was difficult to reach when problems arose, it didn't explain the withdrawals adequately, only partial refunds were ever offered in one case with an NSF cheque and that one small business owner was told lawyers would be involved if she didn't drop her complaint.

It's like beating your head against a stone wall.- Glen Prosser, business owner

The Better Business Bureau of Central Ontario gives the company an "F" rating because of unanswered complaints, according to Cameron Crassweller, vice-president of marketing and communications.

Canada BankCard, officially 1745108 Ontario Inc. of Burlington, is listed as a PCI-accredited credit service provider, meaning companies such as Visa, along with the Canadian government,recognize it as qualified to collect, store and transmit the financial information of hundreds of thousands of people.

Canada BankCard president Tina Doiron said the company's contracts provided merchants with lower rates and included pre-authorization to collect the fees.

She said any merchant who has concerns can contact her. Doiron has not responded to a request for an interview to address the specific complaints in this story.

Unexplained withdrawals went back years, business claims

Glen Prosser, who operates a small-engine repair business in Lloydminster, Sask., said the sales rep for Canada BankCard promised him lower costs and no hidden fees when he signed in 2010.

In November 2014, Prosser began going through four years of bank statements after noticing pre-authorized withdrawals he didn't understand.

In some months Canada BankCard had made withdrawals for hundreds of dollars, taken in increments of $47.20, $70, $75 or $88.32 at a time, sometimes four times on the same day.

Prosser said his business account has had over $13,000 in withdrawals that Canada BankCard hasn't adequately explained and which he feels are unauthorized.

He said it has been difficult and frustrating trying to get anyone from Canada BankCard to explain the charges.

"It's like beating your head against a stone wall. I literally could not get anywhere. They won't phone me back," he said.

Prosser eventually received three refunds: an international money order for $225, and two company cheques one for $1,500, another for $833.46.

Prosser said it's shocking a company with access to people's bank accounts would bounce a cheque.

"In my mind, it's almost like dealing with a bank, but obviously their cheque's no good."

Anna Norets, administrator of a health clinic in Mississauga, Ont., said two different Canada BankCard sales reps called her every day for two weeks in 2013.

Norets said although the clinic hada contract with Canada BankCard since 2005, the callers told her she needed to sign a new contract because the company that processed their debit transactions had gone into receivership and the transactions wouldn't go through any more.

"I thought it was really fishy," Norets said. "They were very urgent and unprofessional."

After Norets called the debit processing company and discovered it wasn't in receivership, she began looking to replace Canada BankCard.

However, Norets saidfor nine months after the clinic's contract with Canada BankCard expired, the company continued to withdraw money from its bank account.

The charges stopped in January.

Heather Colvin operates a pizzeria in Black Diamond, Alta.

In 2011, Canada BankCard told Colvin if she continued to complain about what she considered unauthorized withdrawals from her account, the company would have to suspend her service and call its lawyers to investigate.

"I was angry. I was a little scared, but I more felt violated. I felt like they were taking advantage of a little mom-and-pop business, and there was nothing I could do about it," Colvin said.

Kathy Murray of Windsor, Ont., said the debit machine Canada BankCard provided wouldn't accept chips, and although the company replaced it, it continued to charge her for two machines.

She said she would no sooner get an unauthorized charge stopped than it would start again.

I thought it was really fishy. They were very urgent and unprofessional.-Anna Norets, administrator

"I'm usually a fighter," Murray said.

"I don't put up with things like this and I've done whatever I could. [But] you can only fight back so much."

Robert Watson said his fishing lodge in northern Ontario is being charged for a credit card terminal it didn't want and returned in 2013.

Watson tried for several months to get the charges stopped, but said the last response from Canada BankCard was an email in October 2014 a promise to respond within two days, signed by portfolio manager Michael Kimberley.

In June 2015, Watson was offered a chance to save money by switching his credit services to Gift Cards International.

Gift Cards International has the same address as Canada BankCard, and the new offer was also signed by Michael Kimberley.

No avenues of appeal, business owners say

The Financial Consumer Agency of Canada has a mandate to supervise payment card networks, but "cannot provide redress on individual cases," according to a spokeswoman.

The FCAC said merchants can complain to their banks, to the credit card companies (VISA, MasterCard, etc.) or to their "acquirer" the bank or institution that processes their transactions.

In this case, the acquirer is Elavon, a subsidiary of US Bancorp.

Although Canada BankCard advertises itself as an Elavon partner and uses its logo, a spokeswoman for Elavon said it has not been a partner since April of this year.

Gift Cards International says it's a partner with First Data, oneof Elavon's competitors.

The NDP's critic for small business said the government should investigate complaints such as these.

Brian Masse, MP for Windsor West, likened the country's card payment system to a city that licenses a restaurant, then never inspects it.

"Right now, it's public shame or court action," said Masse.

Masse said disputing claims like these on their own is a drain on a company's productivity.

Prosser said it has certainly been a drain on his.

"If we had a wage of $20 an hour for the time we've put into this, I can't believe the bill we'd have."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)