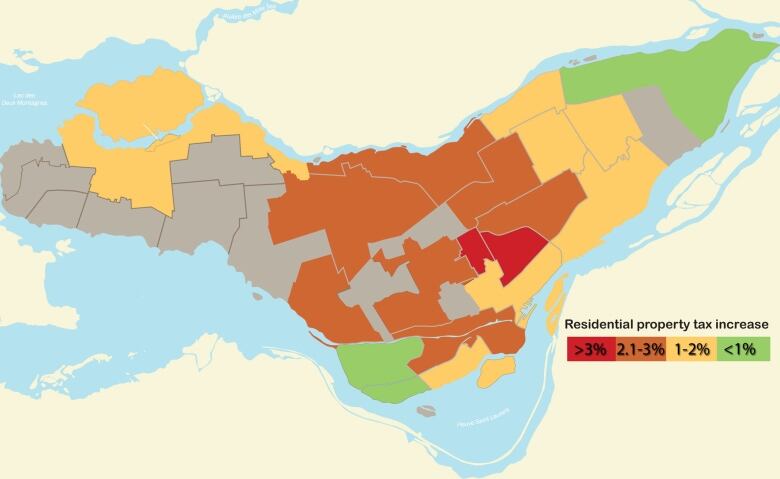

Montreal 2016 budget: Property tax increases by borough

Montreal residential property owners will see an average increase of 1.9 per cent on their property taxes, but the specific rates vary widely by borough. Here's a breakdown of the hikes.

PlateauMont-Royal and Outremont see largest hikes, LaSalle the smallest

Montreal residential property owners will see an average increase of 1.9 per cent on their property taxes as part of the 2016 budget, but the specific rates vary widely by borough.

Here's a breakdown of the averagehikes by borough, includingthe increases in both city taxes and borough service taxes.

Note thatwithin each borough the increases alsovary by property type. They are generallyhigher for single-family homes and lower for condominiums and multi-family dwellings.

- Ahuntsic-Cartierville:2.2 %

- Anjou: 1.6 %

- Cte-des-NeigesNotre-Dame-de-Grce: 2.5 %

- Lachine: 2.4 %

- LaSalle: 0.2 %

- L'le-BizardSainte-Genevive: 1.0 %

- Mercier-Hochelaga-Maisonneuve: 1.1 %

- Montral-Nord: 1.0 %

- Outremont: 3.3 %

- Pierrefonds-Roxboro: 1.0 %

- PlateauMont-Royal: 3.7 %

- Rivire-des-PrairiesPointe-aux-Trembles: 0.5 %

- RosemontLa Petite-Patrie: 2.3 %

- Saint-Laurent: 2.3 %

- Saint-Lonard: 1.1 %

- Sud-Ouest: 2.2 %

- Verdun: 1.7 %

- Ville-Marie: 1.3 %

- VilleraySaint-MichelParc-Extension: 2.1 %

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)