Montreal property assessments up 5.9%

Real estate agent attributes lowest increase in decade to change in mortgage rules

Montreal homeowners are gettingthe lowest increase in property assessments seen in the last 10 years.

Property assessmentsare up an average of 5.9 per cent.

TheGreater Montreal Real Estate Board had predicted aan increase of fiveper cent for single-family homes and duplexes and afourpercent increase for condos.

"Five per cent is very little, very moderate," said Paul Cardinal, director of market analysisat the Quebec Federation of Real Estate Boards.

By comparison, between 2002 and 2005, residential properties in Montreal increased in value by 47 per cent.Between 2005 and 2009, they went up 21 per cent.

Changes cast 'chill' over housing market

Cardinal attributed the development inpart to achange in mortgage rules.

"In 2013, the maximum amortization period dropped from 30 years to 25 years. That cast a chill on the Quebec housing market," he said.

"We continued to see a slowdown in sales in 2014 ... But in 2015until today, the market is growing again."

Montreal's new property assessment roll will be based on property valued on July 1, 2015 a value that reflects market conditions.

Property values are used as the basis for calculating property tax.

However, an increase in value does not automatically translate into an equivalent increase in property taxes.

Montrealhomeowners will know how the new rollwill affect them when the 2017 budget is unveiled, but Montreal Mayor Denis Coderre has already pledged not to raise taxes more than the rate of inflation.

French flock to Plateau

Condoowners in the PlateauMont-Royal borough will only see an assessment increase of about threeper cent, according to the transactions made between 2012 and 2015.

That's almost 10 times lower than the last roll's hike, which was 27 per cent.

But the market is getting back on track thanks, in part, to an influx of buyers from France, say some real estate agents.

"Ten years ago, 20 to 30 per cent of our sales were with European or French clients. Now, in the last two or three years, 50 to 60 per cent of our clientele is European, more precisely French," said Benot Maunie, a real estate broker with Via Capitale du Plateau Mont-Royal.

Drop in Outremont

Based on data fromthe Quebec Federation of Real Estate Boards, the prices of single-family homes in Outremont have gone down by about 4 per cent.

In 2015, they sold for an average price of $1.1 million, compared to 2012's pricetag of $1.2 million.

Meanwhile, boroughs that should see increases include:

- Ville-Marie: 25 per cent.

- Cte-des-NeigesNotre-Dame-de-Grce: 13 per cent.

Market picking up in Southwest, Verdun

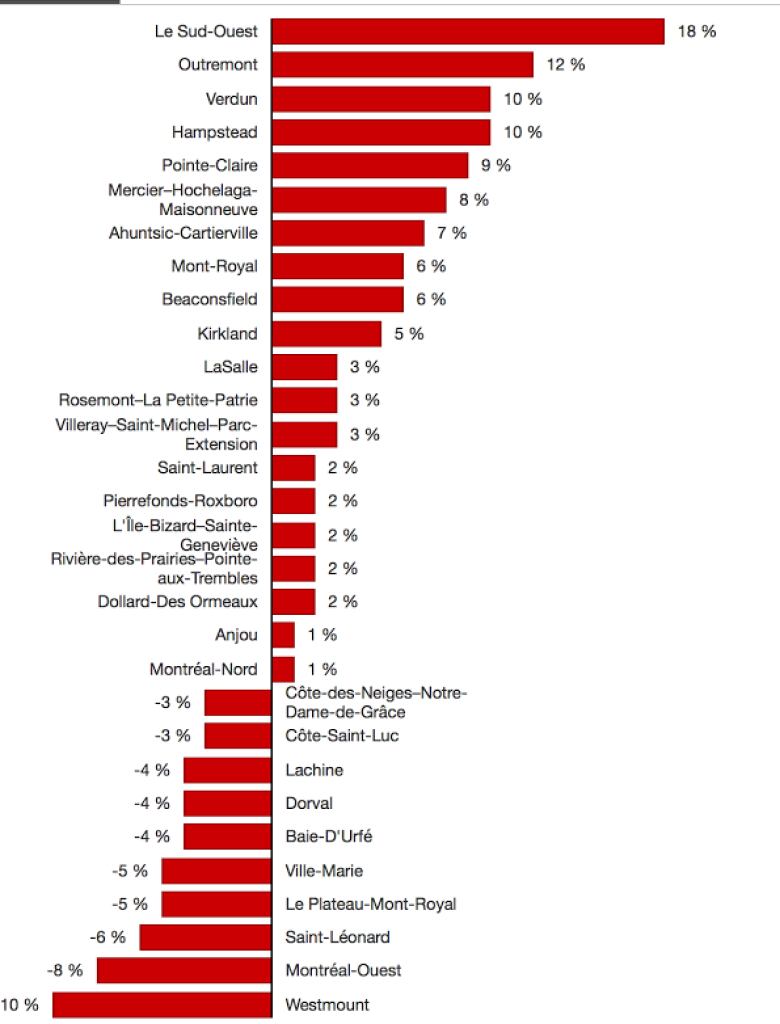

Last year alone, the price of a single-family home the Southwest borough has risen by an average of 18 per cent.

Outremont and Verdun are seeing spikes of 12 per cent, while Hampstead's property values are on the rise by 10 per cent.

However, these values will not be reflected in today's assessments.

They will come into play for the next valuation rollin 2019.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)