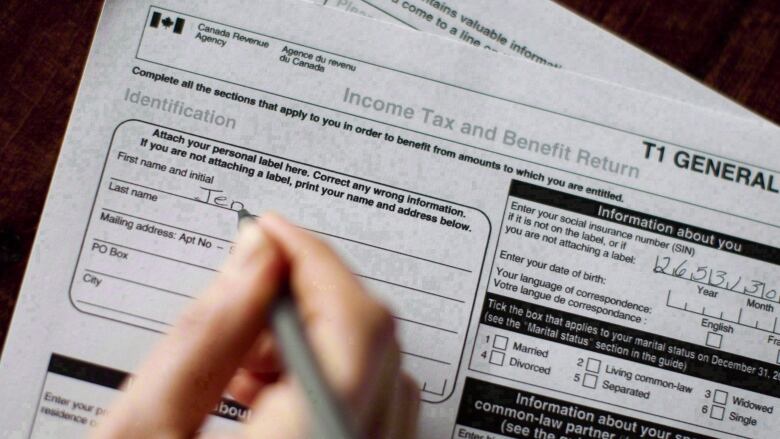

Quebec wants Ottawa to allow people in the province to file a single-tax return

Feds reportedly not on board, but province's finance minister vows to 'take up the fight'

TheQuebecgovernment will ask Ottawa for the power to collect federaltaxesin a move that could reduce paperwork for companies and individuals who would only have to file a single tax return instead of two.

Members of the National Assembly adopted a unanimous motion this week calling on Ottawa to allowQuebecto administer a single-tax system, but it's still unclear how much money would be saved.

Also uncertain is whether bureaucratic redundancies would be more easily reduced if Ottawa took over the province's tax administration, as it does for the other nine provinces and territories.

While federal authorities have said publicly they are willing to discuss givingQuebecfull tax-collecting powers, Montreal's La Presse reported Thursday a government source said the federal Liberal government opposes the idea.

That news prompted Parti Qubcois deputy leader Vronique Hivon to declare in question period that Ottawa is "acting in a cavalier and disrespectful manner toward Quebecers.''

Finance Minister Carlos Leito responded by saying the government will "very soon'' send an official letter to Ottawa on the subject.

"It takes times, these are complex issues ... and yes, we will take up the fight,'' Leito said.

Only province with independent tax office

Quebecis the only province to have a tax department that is completely independent and distinct from the federal government's.

The province has also collected the GST inQuebecfor the federal government since the early 1990s.

Hivon saidQuebecwould save $600 million if it received full, federal tax-collecting powers, but a spokesperson for the party did not return a request for details on how that figure was calculated.

Ewan Sauves, a spokesman for the Coalition Avenir Qubec, said in an email his party doesn't have a precise number, but estimates the province would save "several hundred millions of dollars.''

Audrey Cloutier, a spokeswoman for Leito, said the government doesn't have a specific number either, but added that ifQuebecreceived full federal tax-collecting power, "one element must be maintained.''

"It all has to be done without compromisingQuebec's fiscal autonomy,'' she said. "If there is a single tax return, it must be administered byQuebec.''

The position of the province's main parties contrast with the conclusion of aQuebecgovernment report in 2015 that looked at finding efficiencies in the state's public programs.

Change would yield savings: report

Lucienne Robillard, who held office at the provincial and federal level for the Liberals, headed the committee that created the report.

It statedQuebecwould receive almost $400 million in direct savings if it handed over its tax-collecting power to Ottawa.

The province would, however, be deprived of about $700 million in tax-evasion collection that was conducted by the provincial revenue department, it added.

Robillard's report recommendedQuebec"seriously consider the option of transferring its tax administration operations to the federal government.''

That recommendation was quickly shelved, however.

Robillard also noted in her report that her recommendation would hit a nerve inQuebecsociety.

"The commission emphasized the sensitive nature of the issue,'' the report stated. "The setting up byQuebecof an independent tax administration was a striking illustration ofQuebec's determination to achieve autonomy, during the period immediately preceding the Quiet Revolution.''

Alexandre Laurin, director of research at the C.D. Howe Institute, said he agrees with the report.

"I don't deny there are some cost savings for eliminating duplication,'' he said. "I think what makes more sense is for the Canada Revenue Agency to take on administratingtaxesforQuebec.They already do it for free for the nine other provinces.''

He said he's skeptical Ottawa would give anything up toQuebecwithout getting something in return.

"I'd be extremely surprised if this happens,'' he said.

The debate has surfaced a few days after the federal Conservatives inQuebecpassed a resolution aimed at eventually combining federal and provincial tax returns into a single form collected and administered by the province.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)