Irving Oil's ocean-floor purchase stirs up property tax controversy

Province says low assessment of undersea parcel reflects market, but councillor has doubts

Properties under the sea are often associated with a cartoon character in square pants, but a parcel in Saint John Harbour is becoming a real life sponge for controversy.

The land, which covers two square kilometres of ocean floor near Mispec Point, was sold by the New Brunswick government to Irving Oil Ltd. for more than $800,000 in 2013 but is now assessed for taxes at less than $170,000.

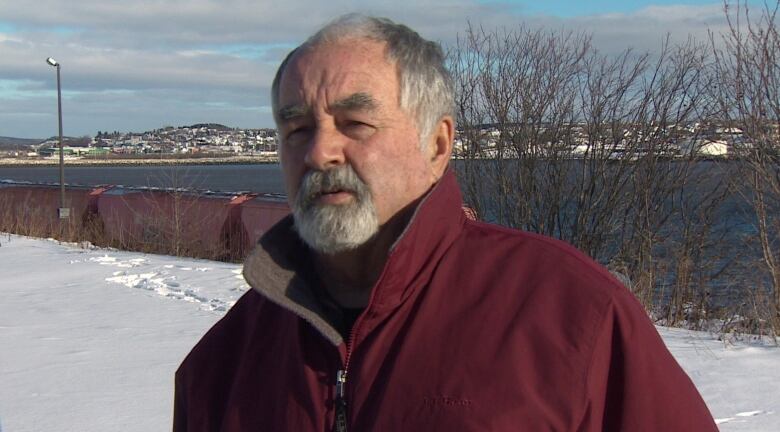

Gerry Lowe, a Saint John city councillor, thinks this is a sign New Brunswick government property assessors are not doing their jobs properly.

"I don't have any faith at all," Lowe said.

"If you buy a house for $240,000 it will be assessed at $240,000."

In a unanimous vote last month, Saint John common council agreed to Lowe's request that the city independently review whether assessments and taxes in the city are being calculated fairly by comparing them to similar properties in other provinces.

"It's the assessment that bothers me," Lowe said.

"Things that are assessed here in this province are assessed in other provinces (for more) I'm talking millions and millions and millions difference."

The parcel sits just off the coast from Irving's Canaport oil tank farm, close to where the company hopes to build a marine terminal for the Energy East pipeline.

Allsea floor property in and around New Brunswick is considered Crown land but occasionally parcels are carved out and sold to private owners. Irving Oil owns four separate lots atMispecPoint covering more than sixsquare kilometres of the sea floor surrounding its LNG and oil tank farm properties onshore.

In an email, Irving Oil spokesman Andrew Carson said he was travelling out of the country and could not immediately provide information on what the $800,000 underwater property was for, but the sale was agreed to by the province in 2013 and handled by the Department of Transportation and Infrastructure.

Sought independent appraisal

According to department spokesman Shawn Berry, the province commissioned a third party to help establish what it should charge for the land.

- Lopsided tax burden falls heaviest on commercial property owners

- Irving Oil's tank farm and the tax break that keeps on giving

- Property tax concessions have cost N.B. nearly $380M over 40 years

"As required by the Public Works Act, the Department of Transportation and Infrastructure had the property appraised by an accredited appraiser to determine fair market value in order to carry out the transaction," Berry said in an email for CBC News.

The department won't share that report, but based on it, the province and Irving Oil reached an agreement on a price for the land $816,750.

Councillor says city loses

Two months later, however, when property tax bills were prepared, the province assessed the new parcel to be worth, for tax purposes, $160,900. In the two years since, that assessment has increased one per cent, to $162,500

Lowe said the assessment has cost the city a significant amount of tax revenue and believes if the underwater property was independently appraised to be worth more than $800,000 and province and Irving Oil agreed on that as a sale price, the assessment should reflect that.

Stephen Ward, the province's director of property valuation, said he knows people do not always understand or agree with the property assessments his department calculates.

The one thing that really stands out in this sale is Irving needs that piece of property.- Stephen Ward, director of property valuation

But he insists it is all done according to professional standards and without any political or outside influences affecting decisions

"We don't feel any kind of intense pressure politically to put this value on or that value," Ward said. "We do our job based on what the market information tells us."

In the case of the sea floor property, Ward said Irving paid substantially more than what several other underwater lots in the harbour are assessed to be worth, so the purchase price was not considered a true market value.

Impressed by company's need

"The one thing that really stands out in this sale is Irving needs that piece of property," Ward said.

"They're willing to pay above and beyond to have ownership of that property. But just because they overpay for that property that we feel (they) have overpaid we just can't increase Irving's assessment up to that sale price because that's only one sale in the market place."

Ward said all underwater properties in the Saint John harbour have to be assessed as a group and the Irving purchase appeared to be an outlier.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)