Dennis Oland was overspending by $14K a month just before father killed

$163K line of credit and $27K credit card maxed out, investments and RRSPs cleared out

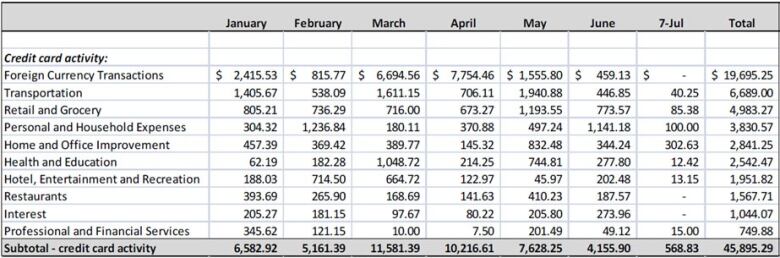

Dennis Olandwas spending about $14,000 a month more than he earned in the timeleading up to the July 2011 bludgeoning death of his father,Richard Oland,hismurder trial heard on Thursday.

The accused, a financial adviser, was living well beyond his means, exhausting the $27,000-limit on his credit card,$163,000-ceilingon his line of credit, and borrowing $16,000 from his employer.

But despite being deeply in debt, Olandspent more than $20,000 on taking three trips between November 2010 and April 2011, including 23 days in Hungary and Italy, 18 days in Englandand 12 days in Florida, a forensic accountant with the federal government testified.

- Live blog:Dennis Oland's second-degree murder trial: Nov. 5

- On mobile? Get live coverage here

EricJohnson, of Public Works Government Services Canada,said the Saint John Police Force contacted his office in August, 2011, seeking help with the investigation.

He looked at DennisOland'sfinances,including his main chequing account, Visa, line of credit, a collateral mortgage, investment account and RRSPs,focussing primarily on the periodbetween Jan. 1, 2011 andJuly 7, 2011.

That was the dayRichardOland'sbludgeoned body was discovered lying face down in a pool of blood in his Far End Corporation office.

DennisOland, 47, who was the last known person to see his father alive during a meeting at his office on Canterbury Street the night before, has pleaded not guilty to second-degree murder.

Lead Crown prosecutor P.J.Veniotpreviously suggested money was a possible motive,describingthe accused as being"on the edge financially."

He was two months behind in making monthly interest-only payments of $1,666.67 on a $500,000 loan he received from his father following a divorce from his first wife,Veniothad said.

Olandalsohad monthly child and spousal support payments of $4,233 to make, plus all of his other living expenses.

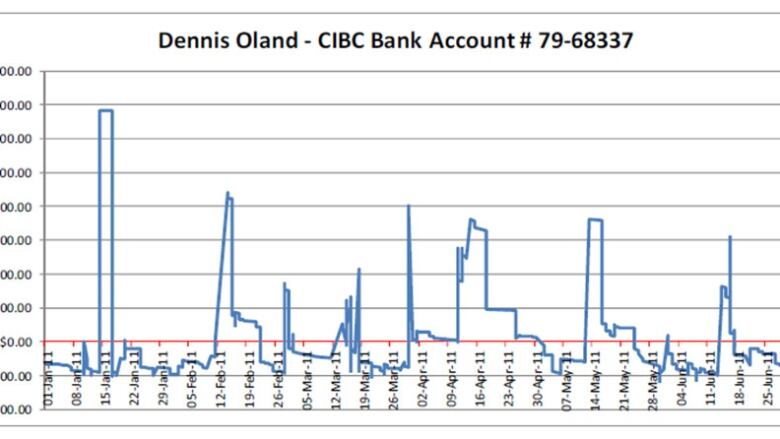

Account 'frequently overdrawn'

It showed Oland'schequing account, which hadoverdraft protection of $2,000,was in the red by $1,622.38 on July 7.

"The account was frequently overdrawn," Johnson stated in the PowerPoint."It rarely had a positive balance that lasted more than a month."

Oland's Visa limit increased from $5,000 in 2009 to $27,000 in 2011.

On July 7, 2011, his credit cardbalance was $31,210.

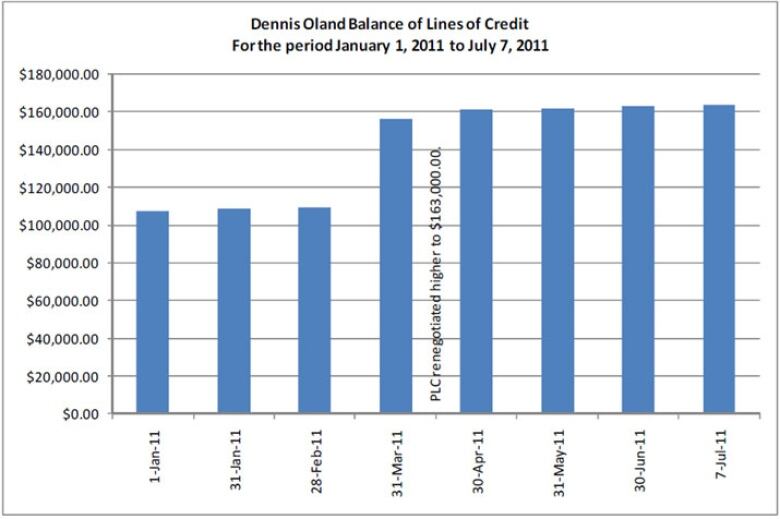

Hispersonal line of credit also increased from $15,000 in 2009 to $35,000 in February 2010.

In March 2011, with his line of creditbalancejust shy of his limit,Oland paid it offusing a newly-increased line of credit secured against his home in Rothesay.

On July 7, he was overdrawn on the line of credit by $939.68.

In early 2011,Oland had $13,676 in his CIBC Wood Gundy investment account, but he withdrew almost all of it, leaving a little over $100 behind.

His RRSP accounthad only onecent in January 2011.In February, during tax season, he deposited$4,600 into the account, but three days later, he cleared the account out.

Oland's income from CIBCWood Gundy was also steadily dropping, Johnson found.

He made about $180,000in 2008, $110,000 in 2009 and $100,000 in 2010.

Between Jan.1, 2011 and July 7, 2011Olandwas paid $34,124.

His spending ended up exceeding hisincome by $86,848 during that period, said Johnson.

Got $16K pay advance

In June, Oland requested a $16,000 advance on his pay.

His book of investments at the timewasbetween $200,000 and $300,000, "maybe more," branch manager John Travis testified.

But in an email dated June 1,Oland told Travis he expected to be bringing in new assets in the $10 million to $20 million range from his father and another client, the Saint John courtroom heard.

Itdoes look like I'm going to struggle with cash for the next few monthsand as a resultI wantedto revisit your offer to assist me to get through this crunch period.- Dennis Oland inemail to manager

"In the meantime, it does look like I'm going to struggle with cash for the next few monthsand as a resultI wantedto revisit your offer to assist me to get through this crunch period," Oland wrote.

"Summer is usually slower for meso I am a bit concerned. From what I can see at this point, two months of financial help (June and July)would be very helpful and most likely all that is required."

Oland told Travishis "minimum requirement" for an advance would be $7,500 in June and again in July, but$8,500 would be the "ideal amount" to enure all his expenses were covered.

On June 14, Oland sent Travis another email, saying he had only received $4,429.02 as a first paymentinstead of the $8,000 agreed upon, and asked him to look into the matter.

The following day, he emailed Travis again and attached his pay stub.

Both were set to be automatically withdrawn from his account and he didn't want them to "bounce," he said.

In late July, Oland was told to take a leave of absence from the firm, Travis confirmed under cross-examination by defence lawyer Gary Miller.

It was dictated by "higher-ups," suggested Miller. "In part, yes," replied Travis.

As word spread that Oland was a suspect in his father's death, some of his clients left, the court heard.

Returning to his advisory role became "increasingly difficult," as Miller put it, and he was forced to take a retirement buyout.

After his father's death, Olandreceived $100,000 for serving as co-executor of his will and $50,000 as trustee for a fund set up for his widowed mother, Connie, the trial heard on Wednesday.

He also became co-director of his father's three companies, and president of the main holding company.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)