New Brunswick tax breaks: Who gets what

A brief roundup of which sectors get what and how they get it

Tax break: Agricultural land

Amount: $7.1 million per year

The method: Tax deferral and forgiveness

Created in 1978, provincial (and some local) property taxes can be deferred for 15 years and then forgiven.

Tax deferred under the program in 2016 was $7.1 million, a 70 per cent increase since 2000.About $4 million deferred 15 years earlier in 2001 was forgiven.

Tax break: Timberland

Amount: $7.5 million

The method:Assessment freeze

Adjusting for inflation and metric land measurements, that amount is equivalent to a 2016 tax of $4.55 per hectare. Because of assessment freezes over the years, actual taxes on forest properties in New Brunswick are currently less than half of that, an average of about $1.90 per hectare.

Acadian Timber paid as little as $1.82 per hectare this year on a forest block it owns in the Saint Jacques local service district in Madawaska County.

Based on three million hectares of private forest in New Brunswick, the difference between where taxes are now and where they started 50 years ago saves landowners about $7.5 million a year.

However, there is an argument that savings are considerably higher than that since the market value of forest property has increased considerably more than inflation over the last 50 years.

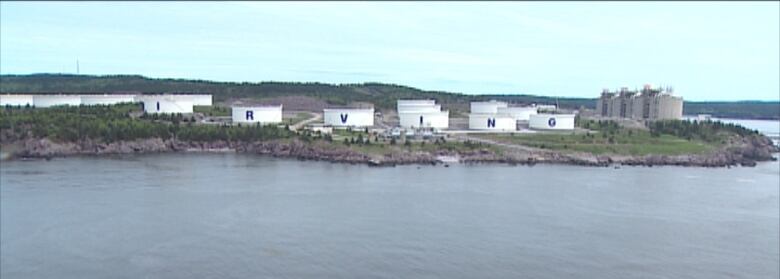

Tax break:Canaportoil terminal

Amount:$500,000 to $1 million

The method: Tax exemption

It was estimated to cost between $400,000 and $500,000 in 1980, and although the province will not update that number, it does say it is now "substantially more" than that.

Tax break: Airports/ports/railway rights-of-way

Amount: $10 million

The method:Tax exemption

"The tax reduction is largely aimed at non-profit local authorities, from airports to ports, for saving jobs in those communities," said the finance minister at the time, Edmond Blanchard.

He put the cost at $3 million.

However, the benefits soon ballooned, and most of those went to larger corporations such as Canadian National, PotashCorp and Irving Oil.

The province included non-port property owned by Irving Oil at Mispec Point in the program, which by 2009 had become home to the LNG terminal.

That made what would have been $6.5 million in provincial property tax on the terminal uncollectable and pushed the total value of the tax break to $10 million. Although Saint John has repealed its municipal tax break at the LNG site, the province's tax break continues.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)