$140M debt, which NTCL can't repay, could spread to Canadian North

Other Norterra subsidiaries guaranteed NTCL's debt... and are legally obligated to repay it

With Northern Transportation Company Ltd. unable to pay back an overwhelmingmajority of its debt, the balance may now fall on other Norterra companies, including Canadian North.

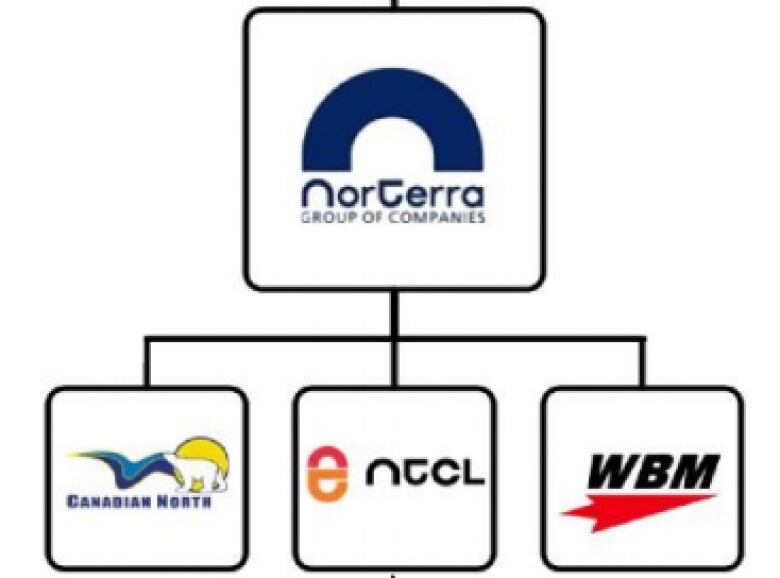

Norterra, NTCL's Inuvialuit-owned holding company, has borrowed $140 million (up from a previous estimate of $130 million) from a trio of banks: the Bank of Nova Scotia, HSBC Bank of Canada and Canadian Western Bank. Norterra advanced money from those loans to subsidiaries like Canadian North and Weldco-Beales Manufacturing.

According toan August 2016 report from NTCL's court-appointed monitor, all of the Norterra subsidiaries guaranteed that debt and "are legally obligated to pay the full amount of Norterra indebtedness."

"Based on that statement, it would appear that Canadian North, being one of the subsidiaries, could be liable for anything owing to the[banks]," saysAndy Fisher, a bankruptcy expert and licensed insolvency professional at A. Farber & Partners in Toronto.

"The banks, if they have other entities like in this case, subsidiaries that have guaranteed the bank's loans they will look to those other guarantors to try and recover the money that's owed."

- Canadian North calls First Air codeshare drop a 'sudden, unilateral' decision

- Competition Bureau goes to court to get information from Canadian North, First Air

Banks don't want costly legal battle

While the banks could send demand letters to Canadian North, they are unlikely to pounce aggressively initially, says Fisher.

"They're probably going to want to enter into a discussion with the subsidiaries to see what options are available for a repayment plan," he says. "If they can work out an agreement that's amicable for both sides, that's generally their first choice. They don't want to get into a legal battle and run up their legal costs."

And if an amicable agreement can't be reached? Canadian North and Weldco-Beales Manufacturing would have the option of filing for court protection from creditors (as NTCLhas), says Fisher.

For now, it's still "business as usual" at Canadian North, according to president Steve Hankirk, in a statement issued Friday afternoon, after this story was first published.

"Canadian North, one of NorTerra's most profitable subsidiaries, has supported the debt of NTCL for several years," Hankirk said. "The resolution of NTCL's financial obligations will allow Canadian North to come through this as an even stronger airline and position us for a return to growth."

"The other companies under the umbrella have not been affected," Kyle Barsi, NTCL's vice president of finance, wrote CBC News via email Wednesday. "The matter is before the courts and we can't comment any further at the time."

Tom Cumming, a lawyer with GowlingWLG who is representing the banks, would not comment on the banks' next steps,citing confidentiality obligations.

NTCL sold what it could, raising only $13M

Whether the banks begin circling Canadian North will become more and more pertinent now that NTCL has sold off what it could prior to its imminent bankruptcy or dissolution.

The company sold some ships and barges earlier this year to various groups for a combined $5.8 million. And on Thursday an Alberta court approved a further $7.5-million purchase by the N.W.T. government of the Hay River shipyard, 12 ships and 72 barges the last of NTCL's viable assets.

That makes for a total of $13.3 million which, according to a settlement reached Thursday, will be split between the banks andNTCLpensionholders. (That's well below what NTCL's assets were said to be worth in May: $44.9 million.)

If it's an even split between the banks and the pensioners, that still leaves more than $130 million owed to the banks,swinging the focus back to the otherNorterrasubsidiaries.

"They're not in play from us, but I suppose potentially by the syndicate," says Susan Philpott, the lawyer for one of the unions representing pension holders.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)