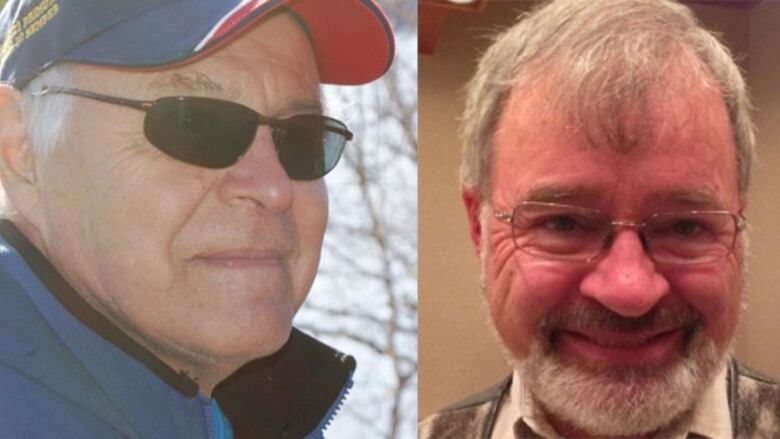

Senators Nick Sibbeston, Dennis Patterson named in auditor general's report

N.W.T. senator was found to have more than $50K in ineligible expenses; Nunavut senator had $22K

The senatorsfrom the Northwest Territories and Nunavut are among 30Canadian senators being audited for improper expenses, according to an auditor general's report released Tuesday afternoon.

Northwest Territories Senator Nick Sibbeston was found to have $50,102 in ineligible expenses, the seventh-most of any senator being audited and the second-most among sitting senators.

Nunavut Senator DennisPatterson was found to have $22,985 in ineligible expenses, though $6,200 of that has been repaid, according to the report.

In the Northwe don't do business by letter oremail.- Nick Sibbeston

Yukon Senator DanLangwas audited along with all the other senators but none of his expenses was flagged as ineligible.

In an interviewwith CBC, Patterson says that he is "at peace with [himself]" about his expense claims.

"I maintain all the errors were made in good faith, and I quickly acknowledged those that were improper and were repaid."

Travel expenses bulk of Sibbeston findings

Sibbeston'sineligible expenses were largely related to travel costs. The report found that the Northwest Territories Senator made several trips where "there was insufficient information to enable us to determine whether the travel claims... were for parliamentary business."

Those trips were made within western Canada and the territories at a cost of $27,629.

Additional expense claims ruled ineligible by the auditor general include hospitality expenses for undetermined business ($2,457), taxi trips in Ottawa for personal activities ($913), and the senator's cellphone being used by someone else as well as personal text-messaging charges from members of his staff ($1,534).

Sibbeston told CBC, "The reality isI did the work. There is no question. There is no fraud.

"I went to the communities and I saw people. I was not able to satisfy the auditor general on the documentation. So, that's what is at issue here.

"There is no documentation showing that I met so-and-so because I sayin the Northwe don't do business by letter or email. I make the preparations by phone.

"I did feel a little bit that the auditor general did not understand how business is done in the North."

'No surprise,' says Patterson

The $22,985 spent byPattersonthat the auditor general found violated Senate spending rules was broken into four expenses. The largest, at $13,762, was paid for legal services.

Underthe Constitution Act, a senator needs to own property in the jurisdiction he or she represents. However, theNunavutLand Claims Agreement says municipal land can only be held as a lease.

Patterson says in his response to the report that he was advised by the Law Clerk of the Senate to "ask about the unique situation of a senator representing the territory of Nunavut under the Constitution of Canada.

"He suggested an expert in constitutional law, who was also licensed to practice law in Nunavut."

Patterson says he owns property inIqaluit. Though he wouldn't say how much time he'd spent inNunavutduring the period in question, he told CBC thatclarifying the issue was more complex than expected, which led to the higher costs.

In his response to the report, he saidthat "It only became clear during the audit that I should not have had to use my research budget topay for legal advice on a major constitutional issue," and that he "informed and relied on the Senate administration for their advice on how to proceed."

Two travel expenseclaims were included in Patterson's report: $5,205 for a tripto Vancouver for a charity fundraising eventand $995 for a visit to Pangnirtung. Both of these amounts have beenrepaid in full.

The final expense, $3,023, was used to contract one of Patterson's staffers to provide media monitoring services, which the auditor general said were part of the employee's regular duties. Patterson said in his response that his employee had an "already established media monitoring firm," and that "it was never explained to me that an individual could not be both a contractor and an employee.

"This was done in good faith and was corrected as soon as it was pointed out to me," his response continues.

Patterson told CBC the revelation that he was being audited was "no surprise," and though he agreed to pay back some of the expenses, he will go throughthe arbitration process that was set up by the Senate.

Neither Patterson nor Sibbeston are among nine senators who face a possible investigation by the RCMP.

With files from Shaun Malley

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)