Bank pays up after student scammed out of $3K twice

Scotiabank decides to partially reimburse Remy Bradley after being contacted by CBC

When Remy Bradley contacted his bank to report losing $3,000 in a phishing scam, the Nova Scotia university student thought he would be protected from further loss.

So the 19-year-old was shocked to discover another $3,000 missing from his account the following day, despite Scotiabank's customer service assuring him the problem would be handled.

"They never said they'd freeze my account, but they said they'd fix it and it would be all right," Bradley said of his initial phone call to the bank.

"Then they hung up, and I thought everything was fixed."

But it was only after CBC News asked Scotiabank about the situation that itagreed to take a second look at the case and partially reimbursed Bradley for his lost cash.

Thought he was getting CRA refund

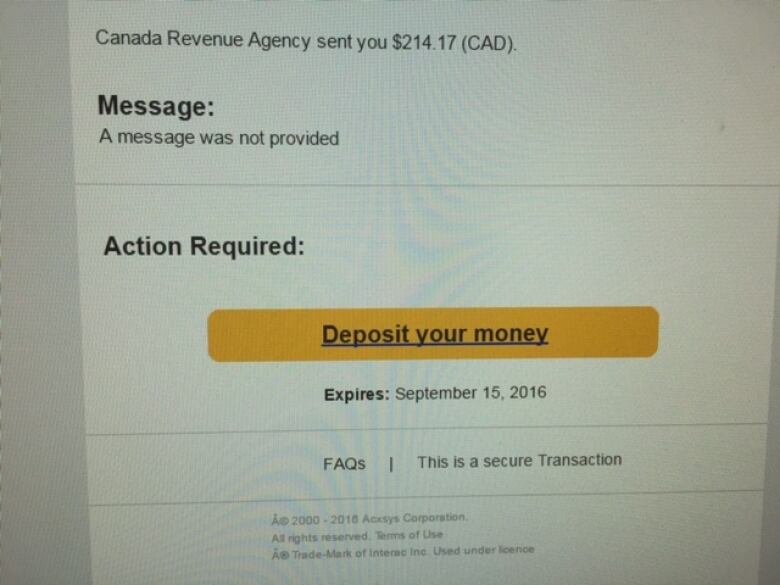

The Ellershouse, N.S., native said his troubles began Sept. 4 when he received an email with what looked like an Interac e-transfer for $214.17 from the Canada Revenue Agency.

"It did look pretty real," said Bradley, who has had an account at Scotiabank since he was 10.

He recalls clicking on a box that said "deposit your money," but doesn't recall what information he provided.

Weeks later, he discovered $3,000 had been removed from his bank account through an e-transfer on Oct. 13.

"When I thought back, I wondered if it was the CRA notice, because that was the only thing that made sense," said Bradley, who reported the incident immediately to Scotiabank's customer service phone line as his local branch was closed for the day.

Another $3K gone

Bradley said he felt reassured after speaking to a customer service representative until the next day, when he realized he was again $3,000 poorer thanks to another e-transfer from the same account.

The Acadia University student made another phone call to Scotiabank.

"They pretty much said the same stuff over again, only this time they said they'd freeze the account, which I thought they would have done the first time," he said.

"They said they didn't know why the first person didn't freeze it."

He filed a formal complaint, which is still under investigation, with the RCMP in Windsor, N.S.

Bradley also asked his bank to refund the second $3,000 withdrawal. It refused.

Bank 'unable to assume responsibility'

"I understand I lost the first $3,000 and I can't get that back," Bradley told CBC News.

But Bradley said he felt he should get the second $3,000 back, because he had notified the bank of the problem beforehand. "I feel they should take responsibility for that," he said.

In an Oct. 26 letter from his bank manager, Wendy Brown, Bradley was told since he gave out his bank card number and password, Scotiabank would not be refunding his money.

"We have now completed our investigation and regret we are unable to assume responsibility for this loss, as you advised us you willingly provided personal/account information."

The letter didn't address the issue of why the bank allowed another $3,000 to be removed from the account even though it had been notified of the problem.

Some money returned

Bradley subsequently filed a complaint through Scotiabank's complaint resolution process.

Again, he was informed the bank would not refund the second $3,000.

Bradley finally contacted CBC News, which asked the bank about the case, prompting it to take a second look.

The bank later called Bradley, informing him they would reimburse him $3,000 after he signs some paperwork.

"We further investigated the details surrounding the case in question and are pleased to have come to a satisfactory conclusion with the customer," Scotiabank spokesman Rick Roth said in an email to CBC News.

"Due to customer privacy, we are unable to comment further."

Roth said the bank encourages customers to report any suspicious activity immediately to the bank, as well as to the appropriate authorities.

Common scam

The scam that Bradley fell for is all too common.

Even Interac's website warns, "The Canada Revenue Agency (CRA) does not use the Interac e-transfer service to collect or disburse payments."

It advises people not to respond to the "known phishing scam, created by fraudsters."

As for Bradley, he's just happy to get some of his money back. He continues to work a part-time job in hopes of recouping the rest.

"[Scotiabank]pretty much said it was their mistake and they just didn't realize it until now," saidBradley.

"It's going to help a lot with tuition, gas to get to school, that kind of thing. It's great."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)