P.E.I. woman told to repay $18,500 in CERB by year's end

Charlottetown cake-maker disputes CRA letter saying she didn't qualify for benefits

Christine MacDonald says she did everything possible to make sure she actually qualified for the Canada emergency response benefit (CERB) before she applied in March.

Her home-based custom cake business which relied on people ordering cakes for weddings and birthday parties was in the process of falling flat thanks to the COVID-19 pandemic restrictions being imposed.

That left her household with only the income from her husband's construction job.

"I said to my husband, 'There's no way I'm applying for this if I don't qualify,' and I researched and researched and researched," MacDonald said.

Everything she saw told her she would qualify for CERB because she mademore than $5,000 in self-employment income in 2019.

So she applied, receiving her first payment on April 16. Between CERB and the Canada recovery benefit that replaced it, her benefits thus far in 2020 have totalled $18,500.

But on Nov. 26, MacDonald received a letter from the Canada Revenue Agency (CRA) saying she never actually qualified and would have to pay back all of the money she received with the suggestion she do so by Dec. 31 to avoid tax penalties.

"I'm in my bed at 11 o'clock at night reading this, and I'm starting to cry," MacDonald said.

"How can you pay them back $18,500 when you have no income?"

Net versus gross income

The reason the CRA is saying MacDonald didn't qualify? It all comes down to the word "net."

She applied based on her gross income for 2019 before deducting allowable business expenses such asbaking supplies and a portion of her household heat and electric bills.

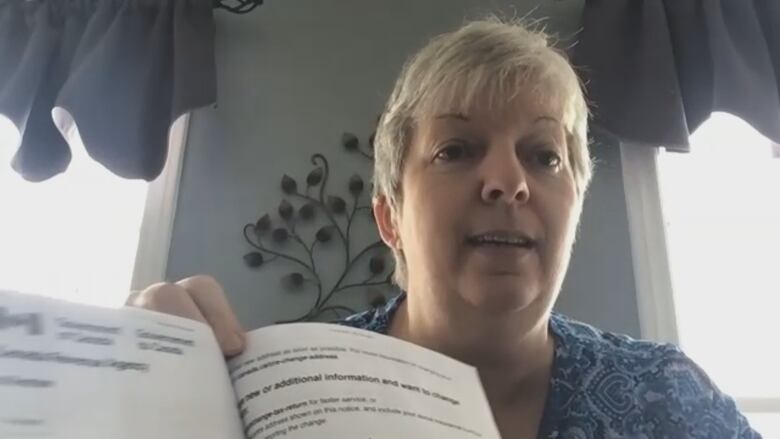

WATCH | 'They are now expecting me to pay back $18,500,' P.E.I. woman says:

But the CRA says that in order to qualify, small business operators like MacDonald needed to have net earnings for the year of over $5,000 in other words, that much in earnings after expenses were factored in.

MacDonald didn't meet that bar.

I faithfully did everything that I was supposed to do under the emergency situation. I did nothing wrong, so I don't know why I should have to pay back this emergency fund. Christine MacDonald

But she insists that when she applied, there was no indication that qualifying would be based on net income. At the time, the federal government was pumping out payments as fast as possible to keep Canadians from floundering financially, with officials planning to perform due diligence on applications after the fact.

The landing page detailing the eligibility requirements on Canada.ca still does not mention the word "net"when referring to income from self-employment.

However, a spokesperson for the Canada Revenue Agency told CBC News that eligibility has always been based on net income from self-employment. The agency provided CBC with a link to a different Q&A web page, which includes the information, and said those details had been available on that page "since the beginning."

However, a CBC News search of archived internet pages shows that information was added sometime after April 21 almost a month after MacDonald applied.

"It's the one three-letter word that's putting the screws to everybody, is that word 'net,'" she said.

"I faithfully did everything that I was supposed to do under the emergency situation. I did nothing wrong, so I don't know why I should have to pay back this emergency fund."

Complaints reaching Charlottetown MP

Charlottetown MP Sean Casey says his office has received a dozen calls and emails from constituents in a situation similar to MacDonald's.

"We have to show some compassion on this," the Liberal MP said. "We erred on the side of getting the money out quickly. I think there needs to be some humanity shown in the collection efforts."

Casey said he's been advising people that they're allowed to file an amendment to their 2019 tax returns, where they could shift some eligible expenses to another tax year or simply not claim them.

That, he explained, could boost their declared net incomes and "retroactively make them eligible" for CERB.

Casey also reiterated comments that Prime Minister Justin Trudeau made on Thursday, saying "government has no interest in penalizing people who acted in good faith."

But it's not clear to MacDonald exactly what that means.

'You may have made an honest mistake'

In MacDonald's letter from the CRA, the agency says it understands "that you may have made an honest mistake by applying for the CERB, and we want to assure you that we will not charge any penalties or interest for your CERB payments."

But the agency goes on to say that she should repay the money by Dec. 31 "so that we don't send you a tax slip for the amount you received."

In a followup interaction with CBC, the CRA said the Dec. 31 date isn't an actual payment deadline. It said parameters for payment arrangements "have been expanded to give Canadians more time and flexibility to repay based on their ability to pay."

But MacDonald says she has no ability to pay.

Without the emergency benefits, she said, she has no income, and her husband has just taken a$4-an-hour pay cut he absorbs every December, when his work shifts from construction to snow removal.

"I'm texting my daughters saying, 'Girls, you know, we're not going to have a Christmas. I'm sorry,'" MacDonald said. "I don't know where I'm going to come up with this money to pay them back."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)