Sask. producers disappointed by livestock tax deferral program coverage area

Agricultural Producers Association of Saskatchewan wanted entire province to be eligible

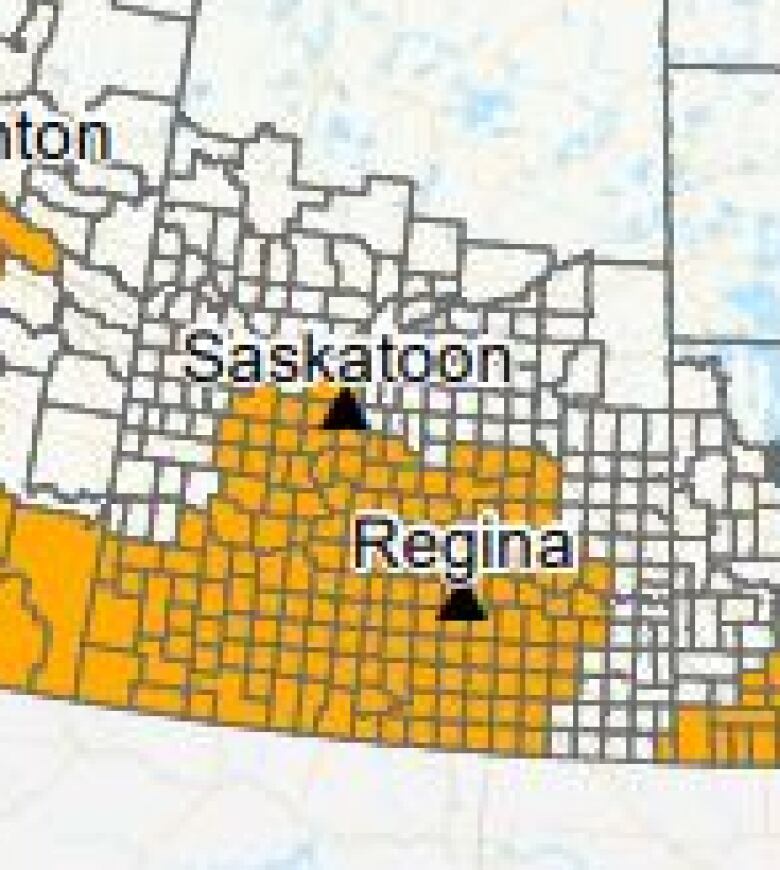

The federal Department of Agriculture and Agri-food has announcedwhich areasare eligible for the livestock tax deferral programbut it's not exactly what some producers in Saskatchewan were hoping for.

The livestock tax deferral program allows livestock producerswho are struggling due to drought or flood to defer paying income tax on the sale of some or all of their herds to the next year. This allows for more money to be put into restoring the herd in the following year.

Last month, the Agricultural Producers Association of Saskatchewanrequested that all producers in the province be eligible for the tax deferral. That didn't happen.

Instead, the department's map shows a swath of southern Saskatchewan, not including most of the eastern region of the province, will be covered.

"This is our second year of drought," said Todd Lewis, president of APAS. He farms near Gray, just southeast of Regina.

"There's a fair, sizeable [area] that is eligible, but there's areas that have been left out that we know there'd be producers in those areas that will be affected by the drought and will be short of feed this year, and they're going to be outside looking in."

The federal government lists eligible areas by census subdivisions, but Lewis said the variance of rainfall within those boundaries was so big that to him, it made more sense to make the entire province eligible forthe tax deferral.

"An area that had a thundershower, even within the single [rural municipality] boundary, there could be a great variance from one side of the RMto the other," he said.

Lewis did say he was happy with the timing of the announcement and said it was "good and early," asAPAShad called for. He called the decision a good start.

"This year's growing conditions across several provinces have brought many challenges to Canadian livestock producers," Agriculture MinisterLawrenceMacAulay said in a Friday media release.

"The government has prioritized the approval of the livestock tax deferral to give farmers more certainty about their financial situation and help them keep their businesses strong."

Lewis said he's now waiting on details for an appeal process for producers outside the designated areas.

"Hopefully they can have an appeal process and get into the program and hopefully the appeal process isn't too cumbersome," he said.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)