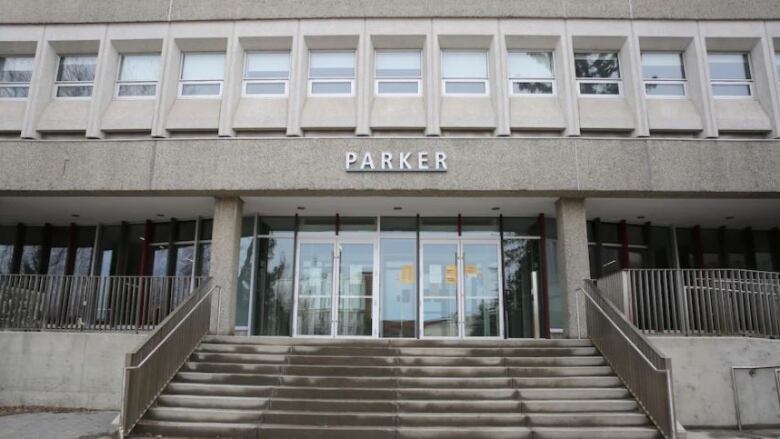

Laurentian University Faculty Association files claim against board of governors, senior administrators

Directors & Officers claim goes after insurance money covering senior administrators from litigation

The Laurentian University Faculty Association (LUFA)is looking at another avenue for compensation for its members as the Sudbury, Ont., university goes through restructuring under the Companies Creditors Arrangement Act (CCAA).

It has filed a claim parallel to the existing claims process to help recoup losses as a result of restructuring due to the university'sdeclaration of insolvency on Feb. 1.

Dozens of programs and well over 100 faculty members were cut to reduce costs.

LUFA has filed a Directors & Officers claimunder insurance the university now holds. The claimseeks access to funds in the insurance policies that cover senior officers, past and present, from lawsuits.

LUFA president Fabrice Colin saidin this case, that includes the board of governors and some senior administrators.

Lawsuits can't be filed against Laurentian University at this time as the university is still under the protection of the court throughCCAA proceedings, which allow it to operate while dealing with its financial issues.

Colin said the matters in dispute include possible misuse and loss of funds, such as the RHPB (Retiree Health Plan), research funds, professional allowance and loss of sabbatical credits for terminated faculty members.

The university is in the process of monetizing assets and finding efficiencies to ultimately determine how much it can put into a pool of money to satisfy creditors, of which the banks are first in line, with claims of at least $100 million.

Other creditors, such as faculty members, are considered unsecured creditors and expect to receive cents on the dollar for their claims.

The D&O claim is an effort to eke out a little more compensation in addition to the existing claims process.

"We're trying to make, you know, both our current and terminated members as whole as possible," Colin said. "We realize this won't be possible but this is the mechanism or the process at our disposal at this time."

The court monitor overseeing the CCAA process for Laurentian, Ernst & Young, has written that many of the funds that Colin describes as "mismanaged" were "co-mingled" in one account and then lost when the university declared insolvency Feb. 1.

It said Laurentian paid all its expenses out of this main operating account.

In addition, it said, this was not an uncommon practice among universities.

Ernst & Young further explained that most universities have sufficient cash reserves to cover these obligations. However, in Laurentian's case, as a result of its historical deficits and other issues, Laurentian didn't have enough money to cover everything.

Colin saidthe amount faculty members could ultimately receive depends on whether the insurance companydeems them valid,the number of valid claims and their corresponding amounts and the insurance policy limits.

He didn't have a settlement timeline.

Laurentiansays claim will be addressed in due course

Laurentian University sent a statement in response.

"The claims process is being administered by the court-appointed monitor pursuant to a Claims Process Order and a Compensation Claims Process Order that were issued by the court, the terms of which were developed by the monitor and Laurentian in discussions with our labour partners and other stakeholders," the statement said.

"All claims will be addressed as part of that court-supervised claims process."

Laurentian expects to have a plan to address creditors and exit CCAA by Jan.31.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)