Daughter doesn't want other seniors to fall for the same scam that cost her mom nearly $7K

Maureen Mulligan says a scammer fooled her mom into thinking she needed to pay bail for her son

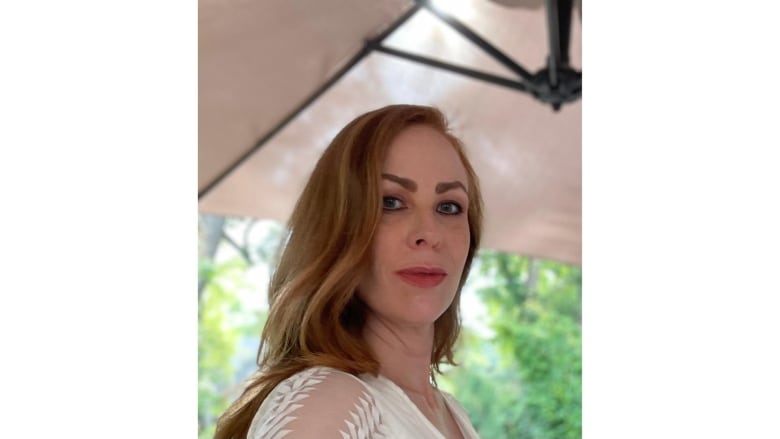

Maureen Mulligan wants to make sure seniors don't fall for the same scam that cost her 80-year-old mother $6,800.

She says her mother got a call from a man who claimed to be her son's lawyer.

"She answers the phone and there's the muffled sounds of someone hysterically crying and gasping for breath, and she took a guess about who it might be," Mulligan said.

"She asked if it was her son. She had no clue, and immediately they had her son's name."

Once they had her son's name, the scammer, claiming to be his lawyer, said he was in a serious car crash that injured a six-year-old child. They said he was at fault in the crash and was above the legal limit for alcohol in his system.

They're sophisticated. They know psychology. They know exactly how to instill panic in you. Maureen Mulligan

"The lawyer claimed he couldn't put (her son) on the phone," Mulligan said.

"The claim was because there was this is so ridiculous there was a child involved in the accident."

The scammers told Mulligan's mother that theyneeded $6,800 to pay for his bail.

Mulligan noted the American system where people need to pay to make bail does not exist in Canada.

She said the scammers kept up a sense of panic and immediacy during the call, and asked that she immediately deposit the funds at her nearest TD Bank branch.

90-minute drive to deposit cash

But Mulligan said her mother lives in the small northern Ontario town of Cochrane, which doesn't have a TD Bank.

So they asked her to drive 90 minutes to Timmins, Ont., so she could deposit the money.

At her local Scotiabank branch, Mulligan said her mother lied to the teller and said she needed to withdraw the money to pay for home renovations. The scammers had warned her not to tell anyone of her son might not get bail.

After a 90-minute drive to Timmins, she was able to deposit it into the TD bank account the scammers provided her.

During the drive, Mulligan said the scammers constantly called her mother to keep up that sense of panic and urgency.

'They're sophisticated'

"These guys are not stupid," she said.

"They're sophisticated. They know psychology. They know exactly how to instill panic in you and how to keep you keyed up at that crazy level of panic that prevents rational thought."

It was only after the ordeal that Mulligan said her mother texted her sonto let him know she sent him the money and everything would be OK.

When the sonasked her what she was talking about she learned it was all a scam.

"It was just, you know, like a tidal wave of realization," Mulligan said. "Everything was a lie."

Mulligan said her mother is very independent, but scammers have gotten so sophisticated they were able to get thousands of dollars from her.

In an email to CBC News, the Canadian Bankers Association said bank tellers are trained to help protect seniors from fraud.

"Bank staff are aware of different fraud types and tactics, including the grandparent scam, and are trained to ask probing questions if a customer makes an unusual transaction," the statement said.

"However, as the owners of the account, the customer is responsible for any funds that they withdraw from their bank account. Ultimately, banks must strike an appropriate balance between helping to prevent and detect fraud, while also protecting the rights of their customers to access their money."

TD Bank spokesperson Ashleigh Murphy said banksprovide resources to educate customers about common scams.

"There are limits to how much cash can be deposited per transaction by a non-TD customer, and our branch colleagues follow policies and protocols accordingly," Murphy said in an email. She says their policy is for the teller to ask the non-customer for their name and phone number, but the onus is on the customer's bank where she withdrew the funds.

Murphy says TD will be following up on the transaction to make sure policies were followed.

The incident has been reported to police who are investigating.

With files from Kate Rutherford

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)