Ontario credit rating downgraded by S&P, Fitch over budget 'underperformance'

Province maintains a stable outlook in the eyes of financial firms

A New York ratings company has affirmed Ontario's debt rating at AA- and says the rating outlook for the province is stable.

Fitch Ratings says Ontario has demonstrated "the ability to exert considerable, ongoing expenditure restraint while instituting revenue changes as necessary to achieve its deficit reduction objectives."

However, it notes Ontario had an accumulated deficit equal to 157 per cent of operating revenues in fiscal 2015 due to slow revenue growth.

The Fitch rating on Tuesday follows Standard & Poor's(S&P)move on Monday to lower Ontario's financial rating to A+ from AA-.

S&Pcited Ontario's heavy debt burden and budgetary "underperformance" compared with peers in other jurisdictions as reasons for the downgrade.

The rating agencysaid Monday that while Ontario continues to beat its fiscal targets and expects to close its operating budget gap by fiscal 2018, it will still have to contend with sizable yearly after-capital deficits given its large net capital spending plans.

Both rating agencies said the downgrade comes with a stable outlook, reflecting theirbelief that Ontario will continue to make slow progress in reducing its deficit.

Derek Burleton, TD Bank's vice president and deputy chief economist, told CBC Radio's Metro Morning the downgrade is "significant" but it won't likely have any near-term implications for the province.

Burleton said Ontario's lower credit rating lines it up with Quebec and the Maritime provinces, but it won't likely affect the province's ability to borrow money.

While the report questioned Ontario's ability to keep spending down, Burleton said a lot of the report was positive, including S&P's observation that Ontario's overall economy is doing well.

Province defends infrastructure investments

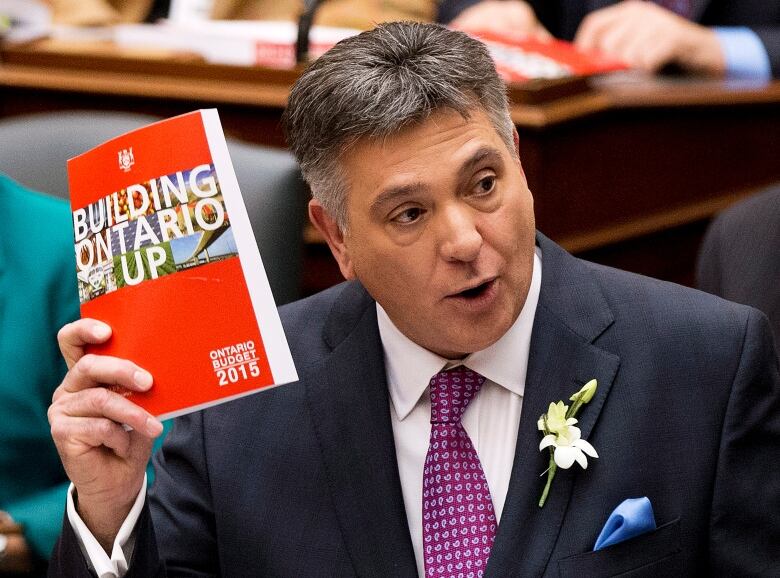

Ontario Finance Minister Charles Sousawelcomed the Fitch and S&P rating, saying in a statement that it is "an expression of confidence" in the government's plan to eliminate the deficit by 2017-18 while investing in the economy to create jobs.

The S&P assessment views Ontario as having a very strong, wealthy and well-diversified economy despite recent slow growth.

Sousa shot back at the slow growth accusation, however, saying every major Canadian bank projects the province's economy to grow faster than the national economy.

Progressive Conservative Leader Patrick Brown said the rating decline is proof that the government is mismanaging the economy.

The province is investing more than $130 billion over a decade in infrastructure programs and says it remains "committed to managing program expense growth to support a balanced and thoughtful approach to eliminating the deficit."

Ontario adds the current economic environment makes it an "ideal time to invest in infrastructure" despite being saddled with debt, which is projected to be $298.9 billion in 2015-2016.

With files from CBC News

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)