Want to know where your property taxes go? New City of Windsor tool provides a 'receipt'

City launches 2 online tools ahead of 2022 budget process

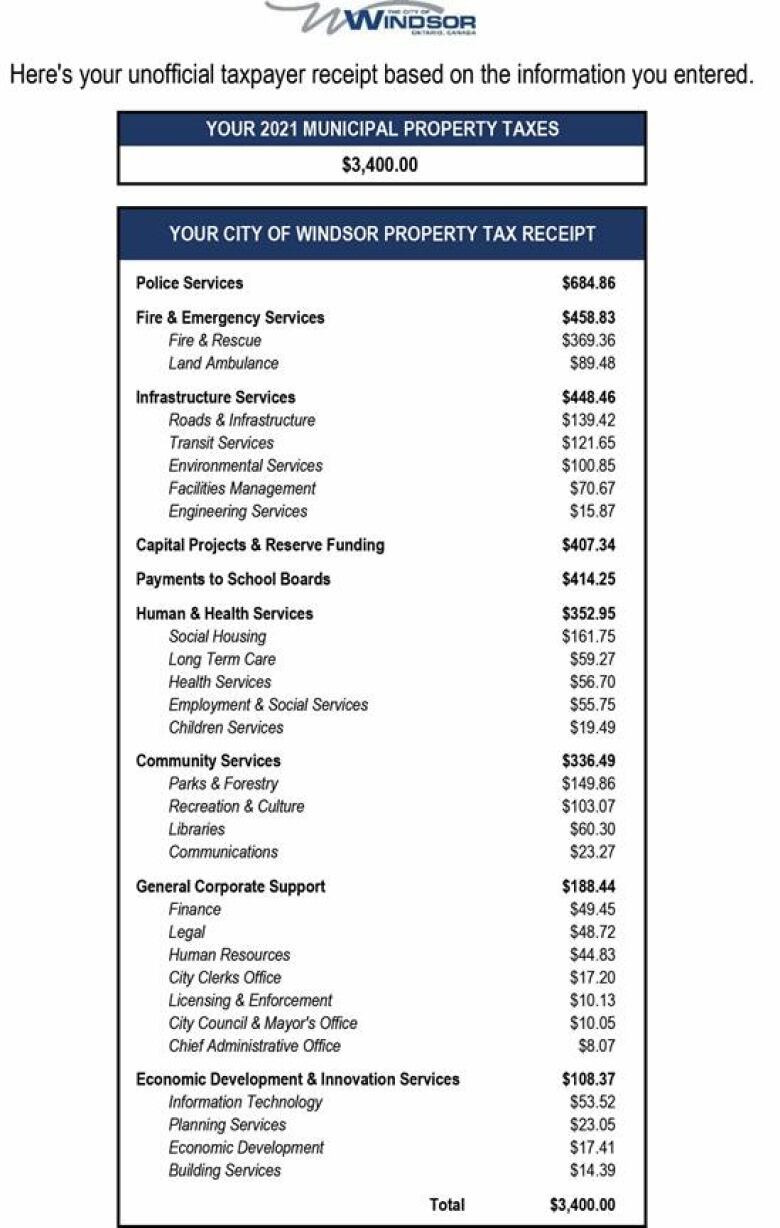

Ever wonder how, exactly, your tax dollars were spent? The City of Windsor has createda new online tool that brings residents closer to the answer.

The generator launched on Friday provides a detailed estimate just enter how much property taxyou paid in 2021.

Policing, emergency services infrastructure make up the largest portion of the unofficial "receipt."

The city is launching the tool, along with a 2022 budget simulator, as a way to get people involved in the budget process.

"These new engagement tools help keep residents informed and educated on where their property taxes are being spent," Windsor Mayor Drew Dilkenssaid in a media release.

"As we plan for the 2022 budget deliberations later this fall, this is also an excellent opportunity for residents to let council know what their spending priorities are, while experiencing the careful considerations that go into ensuring our budget remains balanced."

The budget simulator allows users to adjust the city's 2021 budget and make their own changes for line itemssuch as community services, infrastructure and payments to school boards.

Using the simulator, thebudget for each service can be tweakedby up to10 per cent in either direction.

Both tools will be available on the city's website until Nov. 12.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)