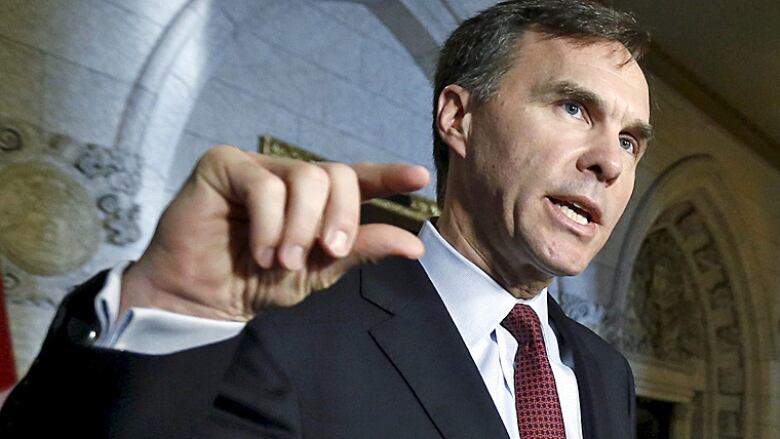

Finance Minister Bill Morneau may have enough provincial support to boost CPP

Federal finance minister and 7 of his counterparts are relatively new to the job

As the federal, provincial, and territorial finance ministers gather in Ottawa for a meeting today and tomorrow there will be some new faces around the table.

Eight of the 14 have been appointed to their portfolios since the finance ministerslast held a meeting.

- Analysis: CPP expansion may be cheapest federal concession

- CPP reform could find mixed support at finance ministers meeting

More importantly, three key players are not only new but are from different political parties than their predecessors and seem to hold different views on key issues especially when it comes to enriching the Canada Pension Plan.

Alberta, New Brunswick, Newfoundland and Labrador, and the federal government all switched hands in the last year,moving from conservative parties to liberal ones (if notby party name, thenby ideology).

With that has come a change in the dynamics around the table. Alberta, once among the staunchest opponents of CPP enhancement, is now pushing for it.

Change in the air

Alberta Finance Minister Joe Cecisaid ahead of his government's first budget last October that he was open to "responsible, phased-in, enhancements to the CPP."

New Brunswick's new finance minister is also decidedly more supportive ofthe idea than his predecessor. In a statement released ahead of Sunday and Monday's meetings, Roger Melanson saidhe is "supportive of further work on potential options to enhance the Canada Pension Plan."

"But," he continues in the statement, "we must recognize the state of the economy as part of these discussions."

Currently, the CPP is structured such that contributions are mandatory and deductedfrom employees' pay at a rate of 4.95 per cent of earnings up to $50,600 in 2015 after the personal exemption is applied.

On top of that, employers must match the contributions of each of their employees dollar for dollar,which is where a number of concerns arise.

"We can't tax our way to prosperity, we can't tax our way to income security in our retirement years," saidKevin Doherty, Saskatchewan's finance minister, in an interview with CBC News ahead of the meetings.

In the wake of the financial crisis, a number of Canadian governments argued the economy needed time to recover and strengthen before making any changes that would mean more expense for businesses and less money for consumers to spend now.

Economic ripples

With the oil-shock still rippling through the economy, Doherty saidnow still isn't the time to move on the issue. In the meantime, he said, there are plenty of other savings options on the table including RRSPs, tax-free savings accounts, and the newly created pooled registered pension plans some national insurance companies will be offering.

"We think these kinds of tools should have an opportunityto work in the marketplace before we look at another mandatory payroll tax on the business community," hesaid.

British Columbia may be the only other provincial government left with clear objections to moving on this issue, and it also cites the state of the economy.

The federal government says it needs at least seven provinces, including Quebec, representing at least two-thirds of the population of the country onside to move ahead.

Although critical mass seems to be in hand, it doesn't mean the measure will move forward quickly. Most provinces havepriorities of their ownat the moment.

The finance ministers are to get a private briefing from Bank of Canada governor Stephen Poloz who is expected to provide a clearer picture as to where the central bank seeks the national economy headed which obviously affects provincial economies and coffers.

The Liberal government has also promised $125billion in infrastructure spending projects that will ultimately involve the provinces in terms of financing, but also job creation and possibly legacy projects.

It is details of this and promised increases to health-care transfers that most of the provinces consider to be more urgent thanpension reform.

Clarifications

- This story has been revised from an earlier version to clarify the formula required to make changes to Canada Pension Plan. In fact, the federal government needs the agreement of seven provinces, including Quebec, representing two-thirds of the country's population.Dec 21, 2015 5:34 PM ET

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)