Should Canada have been more discreet about subsidizing Bombardier?

Boeing is at the trough too, but it has an advantage because it's in the U.S.

Every country that has an aerospace industry, subsidizes it.

That is the first thing that must be said when looking at Boeing's allegations against Bombardier.

Both Boeing and Bombardier have enjoyed the largesse of national and sub-national levels of government, repeatedly.

"The aircraft manufacturing industry is massively subsidized in the four countries where it's based," says Prof. Ian Lee of Carleton University's Sprott School of Business. "Boeing and Airbus on the big jet side, and Embraer and Bombardier on the under-150-seat side. They're all as guilty as sin."

Lee said neither Ottawa nor Quebec City bothered to pay lip service to the idea that subsidies are bad by trying to disguise or camouflage its subsidies as something else, as countries often do. He suggests it would have been politically canny to do so.

"We could have. Not just could have should have."

How Boeing does it

In 2003, Boeing engaged in what some have described as a shakedown of Seattle, toying publicly with the idea of abandoning the city and state most closely linked with the Boeing name, until Washington state offered enough incentives to get it to stay sweeteners worth an estimated $3.2 billion US over 20 years.

- U.S. imposing 220% duty on Bombardier CSeries planes

- Bombardier calls 220% U.S. duty on CSeries 'absurd,' says real fight now begins

At the same time, Boeing was inviting other states to offer incentives for it to move some of its operations there. No fewer than 21 states competed, although many expressed skepticism that the contest was really just part of Boeing's strategy to squeeze more money out of Washington state. (In the end, Boeing stayed in Washington, though it has headquarters and manufacturing operations in other states, including a plant that opened in 2011 in South Carolina.)

Boeing has received government supports in numerous different guises, according to industry observers, including:

- Income tax credits.

- Sales tax exemptions.

- Property tax abatements (some running for decades).

- Discounted utility rates.

- Grants to cover moving expenses.

- State funding to train its workforce.

- Energy grants.

- Improvements to roads, ports and airports demanded by Boeing.

- Interest-free loans and loan guarantees.

- Free or cut-price land and buildings.

- Wage rebates (governments helping Boeing pay salaries).

- Research and development grants.

Washington-based non-government organization Good Jobs First publishes the Subsidy Tracker, which documents government largesse to major corporations. It points out that no company has been as successful as Boeing in getting federal and state governments to backstop its business.

"The double-dipper that stands out from the rest is Boeing," itsays in the report Uncle Sam's Favourite Corporations. "Its more than $18 billion in [fiscal year 2014] contract awards, combined with the $457 million in federal grants and $64 billion in federal loans and loan guarantees since 2000, make it exceptionally favoured by Uncle Sam."

The loans allow Boeing to borrow money on terms not available from commercial banks, and every cent of interest Boeing avoids is effectively a subsidy from the taxpayers who loaned the money.

Bombardier could be more cautious

It's that overall financial advantage that Canada points to in arguing that Boeing's complaint about Bombardier's CSeries jets, and the 220-per-cent tariff slapped on Bombardier by the U.S. Department of Commerce, both reek of hypocrisy.

Canada is also fond of using loans and loan guarantees to support major industries.

But there's an important practical difference between Boeing and Bombardier: Boeing is a U.S. company, and as such it can't be shut out of one of the world's largest markets for civilian aircraft. Bombardier has no such advantage, and that behooves it to be cautious about the way it approaches the government trough, according to Lee.

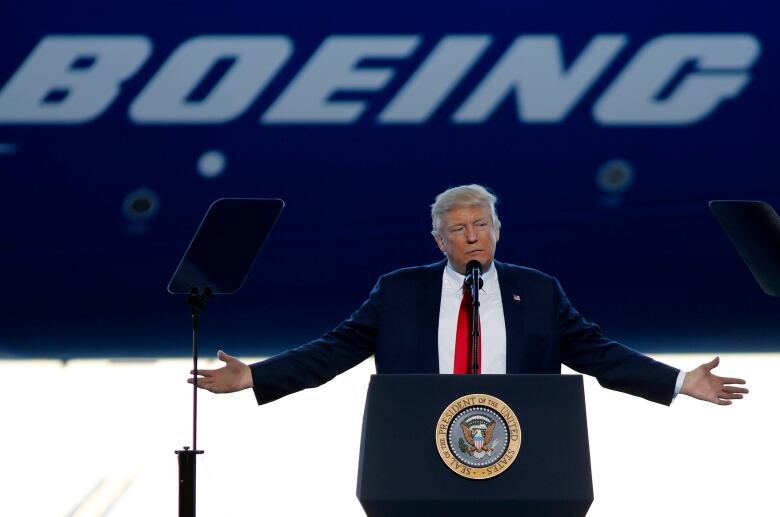

"I don't think we did a good job, either in Quebec or federally, of preparing our allies for this," Lee said. "As a consequence, we've awakened their ire at a very sensitive time when we have this person in the White House who is an uber-nationalist."

Bombardier's incentives drew much attention.

"It was so flagrant, it hit the headlines in the business media. And I don't just mean in Canada. Reuters was talking about it the moment Quebec did the deal and put the alleged capital investment into it, which many think was simply a shameless subsidy."

Dumping ruling yet to come

As if a 220-per-cent tariff were not enough, the Department of Commerce is not yet finished with the CSeries jet. On Oct. 5, it is expected to rule on a separate allegation of dumping against Bombardier.

"Dumping" is the practice of selling something into a foreign market at a price below cost, or at least well below normal market cost. It's often done to clear inventory, but in the case of Bombardier's deal with U.S. air carrier Delta, it may be more about securing a major deal with a prestigious customer that will help it sell the plane elsewhere.

Although the terms of the sale are confidential, analysts widely believe Bombardier gave Delta a whopping discount.

Analyst Benoit Poirier ofDesjardins Group told his clients following the sale to expect "steep discounts, given the size of the order and the quality of the customer," the purpose being to "create a snowball effect for further orders from marquee customers" such as JetBlue or British Airways.

Though such loss-leader tactics are common in the aerospace industry, they also opened Bombardier up to the charge of dumping.

The lesson

Because of geography, Boeing faces few consequences for its relentless reliance on government coffers, while Bombardier faces the potential loss of a major sale.

It doesn't matter that experts agree the CSeries represents a significant technological breakthrough. Indeed, that may well be why Boeing is targeting it so aggressively.

Lee says that as long as its competitors can get away with subsidies, while Canadian companies are penalized for the same behavior, it will remain in Canada's interest to try to create a subsidy-free marketplace.

"Instead of getting indignant at the U.S. and threatening retaliation, this shows the absolute urgent necessity of renegotiating a NAFTA to try to have safeguards so that this sort of behavior does not occur in the future."

- Bombardier CSeries jet - why you have a stake in its success

- In Bombardier fight, Boeing sees ghost of Airbus ascent

"We should be saying, 'look, we want a level playing-field. How can we stop the politicians from cheating on both sides of the border?'"

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)