Did Jean Chrtien balance budget with tax hikes?

Finance Minister Joe Oliver said '90s-era Liberals made 'some of the biggest tax hikes in Canada's history'

"JeanChrtienbalanced the budget by hiking taxes, cutting vital programs, and slashing billions in transfer payments..."

"[Former prime minister PierreTrudeau's] Liberal successors prevented disaster, but the way they did it was equally dangerous: through some of the biggest tax hikes in Canada's history, accompanied by unprecedented cuts to programs and transfers."

- Finance Minister Joe Oliver, April 8, 2015

When you're primpingbalanced budget legislation on the eve of anelection call, it's no time to foldon your fiscal appeal.

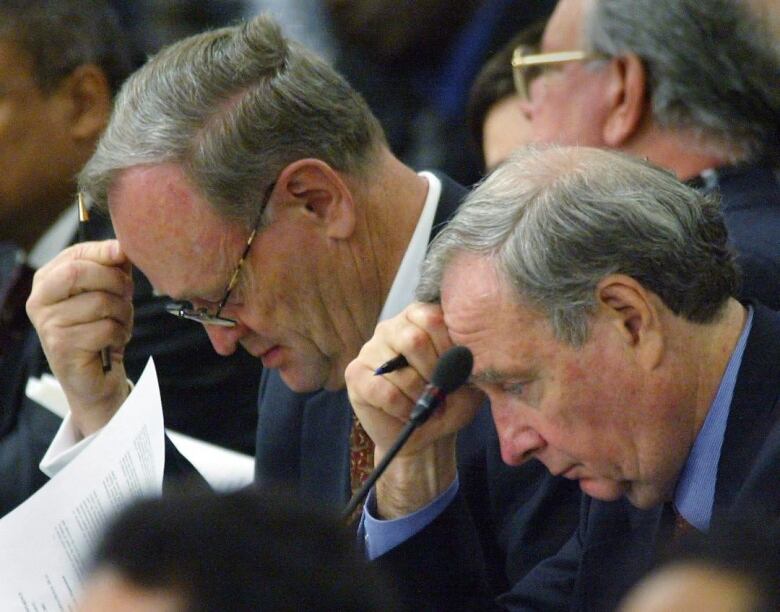

Which is why Joe Oliver stood before Toronto's Economic Club last week, focused not only on thebalanced budget in his own future, but also on how budgets wereor weren't balanced by past governments.

- Joe Oliver says 'balanced budget' legislation avoids 'mistakes'

- Analysis: The inherent problem with an election budget

- Oliver slashes growth projection, will still balance books

- Trudeau, Harper and oil: Fighting ghosts in the federal election

It'shardly the first time a Conservative (or a New Democrat, for that matter)slammed the Paul Martin budgets of the mid-'90s for "reckless" spending cuts orbalancing the federal books "on the backs of the provinces."

But the Conservatives are now knockingJean Chrtien's Liberal government fornot justcuts, buthigher taxes, too. Does that ring true?

The spin

Taxes went up to balance Chrtien'sbudgets.

"In nominal dollar terms, taxes increased from $123 billion in 1993 to $190 billion by the end of 2003," conservative author and policy consultant (and would-be Ottawa-area Conservativecandidate)BobPlamondonwroteCBC News when we asked for his help in understanding theselines in Oliver's speech.

"Of course [Chrtien]came in just after the GST was introduced, so he had that working for him," he said.

Economist DonDrummond, who worked on tax policy at the Finance Department back then, says numbers can be pickedto portraythe Liberals astax hikers.

"An argument could be made that over the prime years of the deficit correction, the revenue-to-GDP ratio rose," he wrote in an email to CBC News. That ratio in percentage terms, Drummond said, rose to 17.8 in 1997-98 from 16.6 in 1994-95.

"But even that one percentage point rise pales relative to the three percentage [point] decline in the program spending ratio over the same three years (to 12.7 from 15.7)."

Overall revenue relative to the size of the economy was quite stable. A stronger economy boosts taxrevenues.

As thisdeficit was reduced, the ratio of spending cuts to tax increases was about7:1.

But tobacco taxes, to cite oneexample, actually went down, to fight smuggling.

On the other hand, Canadians still pay 1995's"temporary" 10 cent/litre excisetax at gaspumps.

The counterspin

We also asked former Bank of Canada governor David Dodge, then-deputy minister of finance,aboutthe taxing claim.

"Borders on fiction," Dodge wroteCBC News.

"The big tax hikes were made by theMulroneygovernment.Chrtien'sgovernment simplybenefitedfrom the robustrevenue system that they inherited," he wrote.

"The key 'tax hike'was the failure to reduce the unemploymentinsurance premium from the elevated level they inherited from the Mulroney government," Dodge said.

As the economy improved and fewer Canadians collected EI(thanks, in part, to eligibility changes the Liberals made), contribution rates should have fallen according to a formula.

Martin lowered rates more slowly, pocketingextra revenue."But the argument here is over how slowly the contribution rates declined. They were not increased," Drummond said.

'Indisputable' payroll tax

So, what tax hikedidOliver mean?

"The Chretien/Martin Liberals were the authors of what is called 'the biggest tax hike in Canadian history'in the massive, near-doubling of [Canada Pension Plan premiums]from 5.85 per cent of pensionable earnings to 9.9 per cent of pensionable earnings," wrote spokesman Nicholas Bergamini.

"It is a payroll tax,"Bergaminiargued. "It was a massive tax hike on workers. Indisputable."

"The revenues do not go into a general purpose account but rather flow back to retirees through CPP pension payments. The CPP would have been bankrupted if the premiums were not increased," he wrote.

The final rinse

Bergaminiwrotethat "coupled with a series of other tax increases, along with bracket creep... [it] amountedto a huge income tax hike, year after year."

He also noted the minister qualified his statement with the word "some."

Bracket creepwhen inflation pushes incomes into higher tax ratesended in 2000 when Liberalsrestored fullindexationto personal income tax rates. Once insurplus, Liberals madetax cuts the final one reversed by Jim Flaherty's first budget.

The Harper government disagrees with people like Ontario Premier Kathleen Wynne, who argueCPP must be enhanced to help more Canadians in their retirement.

But payroll tax or not, if CPP premiums don't flowinto general revenue, they didn't help balance the budget.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)