Federal government can spend $46B more a year and remain sustainable over long term: PBO report

5 provinces remain financially sustainable, but others do not

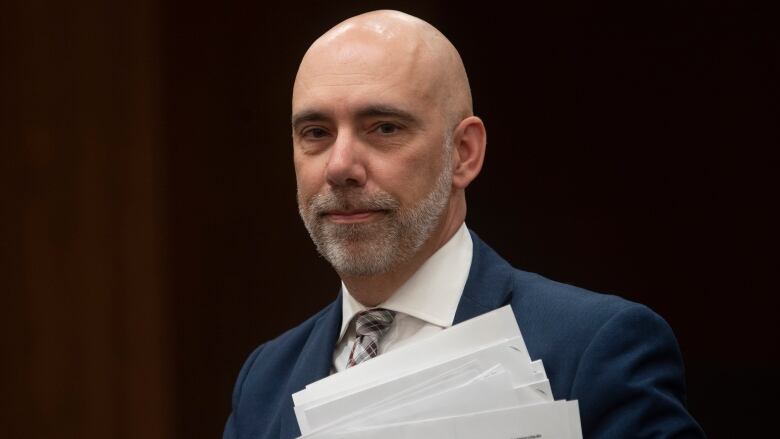

The federal government can afford to increase spending by $46 billion, or cut taxes by that amount, every year until 2098 and remain fiscally sustainable, according to a report from the Parliamentary Budget Officer Yves Giroux's office.

This year'sfiscal sustainability report also says that taken as a whole, Canada's provincial governments are sustainable but cannot collectively increase funding nor cut taxes over the same period.

Some provinces, namelyQuebec, Saskatchewan, Ontario and Nova Scotia, do have room to increase spending or cut taxes. Alberta remains sustainable but breaks even, the report says.

The remaining provinces and territoriesmust either raise taxes or cut spending in order to be able toremain sustainable until 2098, however.

The annual report's objective is to look at the growth of an economy over the long term and decide if fiscal policy changes are required in order to avoid accumulating unsustainable debt levels.

"From the perspective of the total general government sector, that is federal and subnational governments and public pension plans combined, current fiscal policy in Canada is sustainable over the long term," the report published Wednesday said.

When the report says a government's fiscal position is "sustainable" over time the PBO means the size of the debt held by a government does not "grow continuously as a share of the economy."

Sustainable growth means that while the debt continues togrow in size, so does the economy, so the debt doesn't become such a large portion of an economy that a government can no longer pay it.

Where the provinces stand

The fiscal flexibility that a government has to expand spending or cut taxes and remain sustainable is called the fiscal gap. The $46 billion the federal government can spend represents a fiscal gap equivalent to 1.5 per cent of Canada's annual GDP.

The fiscal gap in each province varies.In Quebec, the province could spend an amount equivalent to1.4 per cent of its annual GDP ($8.2 billion), or cut taxes by that amounteach yearand still remain sustainable. But inB.C., the province would need to spend$7.6 billion (1.8 per cent of GDP) less or increase taxes by that amount to become financially sustainable.

Of the sustainable provinces,Ontario has 0.3 per cent ofGDPor $3.4 billionin extra fiscal room, Saskatchewan has $700 million (0.6 per cent) and Nova Scotia has $200 million (0.3 per cent). Alberta breaks even.

Of the provinces with unsustainable long-term fiscal projections, the PBO report says Manitoba needs to spend $500 million (1.6 per cent) less a year, or raise revenues by that much to reach stability over the long term.

ForP.E.I.that number is $100 million (1.1 per cent), for New Brunswick it's $200 million(0.5 per cent), for Newfoundland and Labrador it's $200 million (0.5 per cent), and for the territories combined it's $900 million or 5.9 per cent of annual GDP.

The assessment in the PBO report takes into consideration all the spending announced in Budget 2024, including the expected revenues from the increase to the capital gains inclusion rate.

The model does not take into consideration promises to increase defence spending in order to reach the NATO target of two per cent.

The PBO takes into account estimated population growth, how demographics will change, how much debt will grow, and where interest rates will sit over the long term as part of its economic modelling.

Katherine Cuplinskas, a spokesperson for Deputy Prime Minister and Finance Minister Chrystia Freeland,responded to the PBO report saying her government is "committed to our fiscally responsible economic plan."

"We are investing in the priorities of Canadians in housing, economic growth, and generational fairness while maintaining the lowest net debt- and deficit-to-GDP ratios in the G7," she said.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)