Live at a tony address? Taxman targeting Canada's richest neighbourhoods to nab tax cheats

CRA is reviewing 1,150 wealthy households to nab cheaters who're richer than their income tax filings suggest

Canada's tax agency has launched a project to hit Canada's wealthiest citizens where they live literally.

The Canada Revenue Agency's Postal Code Project is targeting the wealthiest neighbourhoods in all regions of the country, those with gold-plated postal codes, where auditors will pore through the tax filings of every well-heeled resident, address by address.

They're looking for undeclared wealth, signs that a taxpayer is actually richer than their income tax filings suggest.

"Comparing someone's lifestyle cars, boats, houses to their reported income helps us identify people who are non-compliant," said CRA spokesperson Zoltan Csepregi.

Details of the initiative, launched in the summer, were obtained by CBC News under the Access to Information Act.

"The Postal Code Project is an innovative way for the CRA to use an indicator of wealth, high-priced real estate in this case, in a more systematic way as a starting point to initiate taxpayer reviews," says a briefing document.

'Residence focused approach'

The "residence focused approach to audit," says the memo, is to support the government's priority "that those who are wealthy pay the tax they owe."

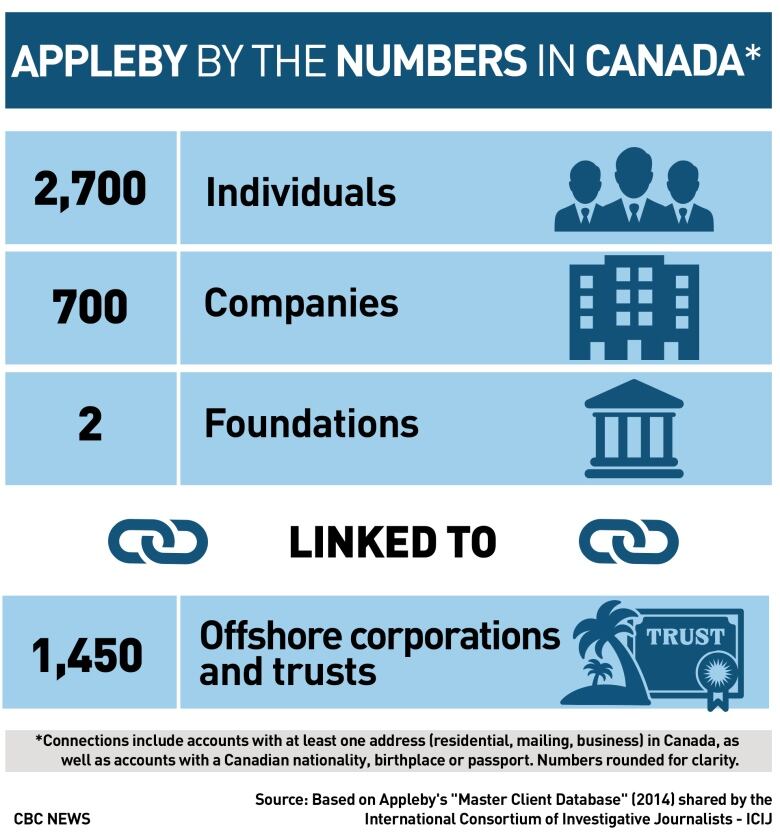

The Liberal government has been stung by tax-haven disclosures in recent years, including the so-called Panama Papers and most recently the Paradise Papers, leaked caches of financial documents from foreign low- and no-tax countries that cater to thousands of Canadians.

Many of the tax-haven schemes are perfectly legal, but have raised awkward questions about why Canadian tax laws allow such loopholes for the rich.

It's a good step. It's a small step.- Diana Gibson of Canadians for Tax Fairness, on a new CRA initiative targeting Canada's wealthy

The released sections of the internal CRA memo, redacted in key parts, do not refer directly to the leaks but do note the project will have a public-relations value: "The Postal Code Project also has the potential to demonstrate to the public that the CRA is actively working towards its fairness objective, which speaks to our integrity as an organization."

The document does not identify the rich neighbourhoods targeted. Csepregi declined to disclose the addresses.

"In order to encourage voluntary compliance, the CRA will only disclose that it has selected five neighbourhoods, one in each region (Pacific, Prairies, Ontario, Quebec and Atlantic)," he said. "Based on these findings, other neighbourhoods may be considered for review."

Csepregi said the wealthiest neighbourhoods are identified for close scrutiny by using the CRA's own databases, third-party data, as well as publicly available information, such as Statistics Canada census data.

Investigators have a variety of tools at their disposal, includingpublic-records checks and even inspecting properties in person.

Since the summer, the agency has put 1,150 wealthy households under review in those tony locations, and has directly contacted 33 rich taxpayers. The relatively small number of households may reflect the very large properties and low population counts in some of Canada's ultra-affluent enclaves, such as Toronto's Bridle Path neighbourhood.

CRA initiativewelcomed

Not every moneyed resident will be formally audited. Letters, notices and direct meetings with taxpayers will help determine how far the CRA goes, and biannual reports will compile the results. Canada's privacy commissioner has signed off on the project, the memo says.

Csepregi confirmed that the project is linked to the agency's efforts to catch offshore tax cheats, saying the initiative is intended to "reassure Canadians that the CRA devotes more attention to taxpayers who have proportionally high net worth, to confirm their compliance." He added there is no end date for the project.

A group that has long criticized the Canada Revenue Agency for letting rich tax cheats off the hook welcomed news of the project, though said it deals with only a small part of the problem.

"It's a good step. It's a small step," said Diana Gibson of the Ottawa-based Canadians for Tax Fairness, arguing that Canada's big corporations are responsible for about two-thirds of the country's tax avoidance problems.

"We applaud it, even if it's small," she said. "It's nowhere near adequate."

Follow @DeanBeeby on Twitter

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)