U.S. government suing Canadian resident for $1.1M over bank form

'This has been a friggin' nightmare,' says Jeffrey Pomerantz

The U.S. Justice Department is suing a Canadian resident for the equivalent of$1.1 million Cdn, saying he failed to file a form to the U.S. governmentlisting his bank accounts outside the United States.

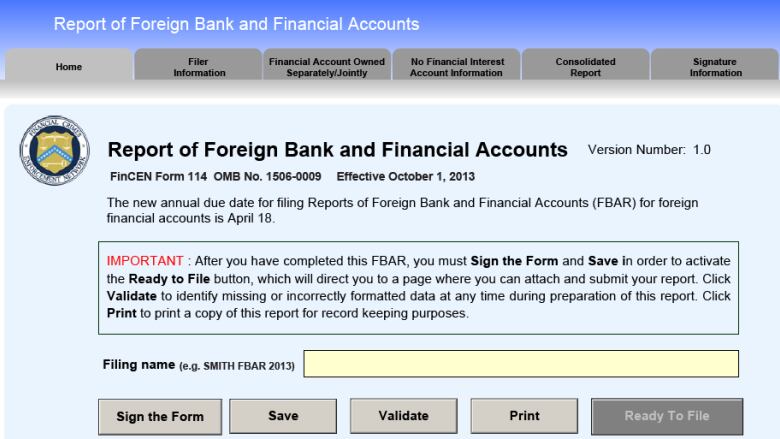

Jeffrey Pomerantz, a Vancouver-area resident with dual Canadian-U.S citizenship, filed his income tax returns to the IRS and the CRA during the three years in question but didn't file a second form called the Report of Foreign Bank and Financial Accounts (FBAR).

"This has been a friggin' nightmare," said Pomerantz when reached by CBC News.

- Canadian snowbirds could face U.S. taxman if they stick around too long

- FATCA has Americans renouncing citizenship

In the case filed in the United States District Court in Seattle, the U.S Justice Department is seeking $860,300 US in civil penalties, late payment penalties and interest.

Nor does Pomerantz appear to be an isolated case.

Toronto lawyer Hari Nesathurai says he is seeing an increase in the past couple of years in cases of the U.S. governmentgoing after Canadian residents subject to U.S. tax law who haven't filed FBAR reports.

"FBARs are a particular problem because a lot of Canadian [residents]don't realize that even an RRSP would require some sort of disclosure. Many people don't realize that and it's troubling because it's a penalty which applies on a non-disclosure even though there may be no tax payable."

"The FBARs are particularly concerning to Americans and people who are U.S. citizens or green card holders who probably don't understand that they have a reporting obligation."

According to the lawsuit,filed by aU.S. Justice Department lawyerin May 2016, the events that led to the U.S. governmentgoing after Pomerantz for not filing FBARs appear to have begun with an audit in 2010. That audit is currently before a different court.

"Prior to the commencement of the income tax examination, Pomerantz did not file a Treasury Form TD F 90-22.1 ("FBAR") for calendar year 2007, 2008 or 2009 to disclose the existence of any foreign accounts," wrote U.S. Department of Justice lawyer Paul Butler.

However, the Justice Department said Pomerantz had "at least two personal checkingaccounts" at the Canadian Imperial Bank of Commerce that were opened prior to Jan. 1, 2001 and which were open and active during the 2007-2009 period.

In addition, the Justice Department says Pomerantz formed a corporation in the Turks and Caicos Islands in 2003 named Chafford Ltd.to hold his personal investments and opened three bank accounts in Switzerland with Sal Oppenheim JR & Cie. In 2007, Pomerantz opened two more accounts in Switzerland with the same bank, the department says in its lawsuit.

During each of the three years, Pomerantz had balances in the CIBC bank accounts as well as in various Swiss accounts over $10,000, the Justice Department said.

While the Justice Department's complaint says Pomerantz lived in the United States during all three years, documents prepared by Pomerantz's side found in the court file say he and his wife, a Canadian-Norwegian dual citizen, only lived in California for part of 2008 and 2009 before moving back to Canada.

"The petitioners were residents of Canada during the tax years in question and cannot be liable to double taxation and are entitled to relief under the U.S.," says the document.

The documents prepared by Pomerantz's side which appear to be more closely tied to a challenge of the audit rather than the FBAR case allege several mistakes in the IRS's information and in its calculations related to his bank accounts.

Filed'to the best of his abilities'

It also suggests any mistakes or omissions in Pomerantz's filings to the IRS or the U.S. government were unintentional.

"The petitioners did not commit fraud. Jeffrey prepared his own tax returns incorrectly to the best of his abilities."

The last entry in the court file in the FBAR case was on March 3 when the Justice Department's lawyer sought an order to serve the summons and complaint on Pomerantz and his lawyer via international mail and courier.

Meanwhile, questions continue to swirl around a controversial agreement that has resulted in the Canada Revenue Agency transferring information about Canadian bank accounts to the IRS a transfer that could result in more Canadian residents being pursued by U.S. authorities for not filing FBAR reports.

Under the agreement, which is being challenged in Federal Court, the Canada Revenue Agency (CRA) has transferred information about thousands of Canadian bank accounts belonging to Canadian residents believed to qualify as U.S. persons under American tax law. While many are U.S. or dual citizens others may be born in the U.S. or simply spend enough time there to be subject to U.S. taxes.

Former Prime Minister Stephen Harper's government negotiated the information-sharing deal following the adoption of the Foreign Account Tax Compliance Act (FATCA) in the U.S.

Elizabeth Thompson can be reached at elizabeth.thompson@cbc.ca

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)