Trans Mountain blames massive spike in project cost on natural disasters, debt costs and frogs

TMX now expected to cost $21.4 billion to build because of cost overruns and construction delays

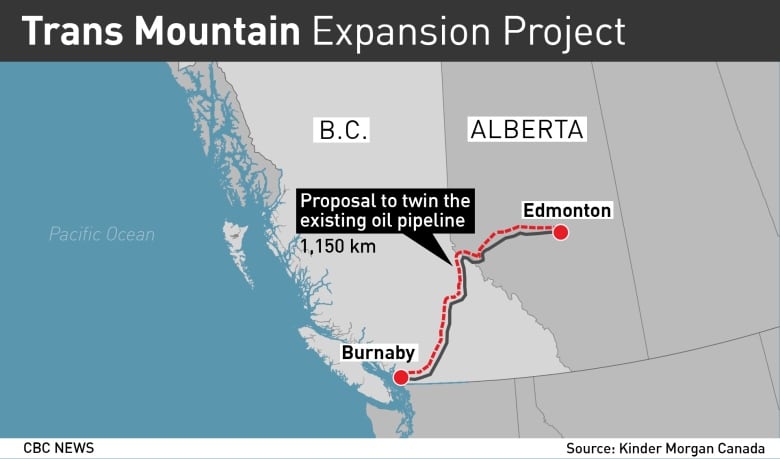

The projected cost of twinning the Trans Mountain pipeline has nearly tripled because of natural disasters, environmental protection measures and rising debt payments, according to the government-owned pipeline corporation.

The latest figures show TMX's initial $7.4 billion price tag projected whenthe federal government purchased the projectin 2018 has since ballooned to $21.4 billion.

The federal Department of Finance updated those figures in February during a Friday news conference held on a day when media outlets were distracted by Ottawa police beginningto clear out an entrenched anti-vaccine mandateconvoy protest on Parliament Hill.

"[The federal government has]done a horrible job of communicating how the costs are going up and [by] keeping things secret that don'tneed to be kept secret," said Blair King, an environmental scientist who argues thatTMX is in the public interest. Hewrites a blog that occasionally debunks myths about the project.

In the weeks after that news conference, more details have emerged. Documents posted online corporate plans, earnings reports and a recent project update break down where costs have increased and when TMX expects to start earning money.

Why the higher costs and delays?

Trans Mountain has faced cost increases before. Before February, the most recent project cost estimate was $12.6 billion.

Trans Mountain blames itslatest cost overruns and delays on "schedule pressures" and "productivity challenges." According to a recent project update posted online, those issues account for $4.3 billion of the new cost increases.

The thousands of permits from municipal, provincial and federal governments that TMX requires took longer than expected to obtain, the company said.

The construction area's landscapehas also changed dramatically since the project began. In November, floodinghit the Hope, CoquihallaandFraser Valley construction segments in B.C. In an amended corporate plan, Trans Mountain said that the flooding alone would add $500 million to the final price tag.

Contractors also share some of the blame, Trans Mountain said.

"Some contractors' work productivity did not perform at previously estimated levels," it said. "This can be attributed to experienced worker availability, inefficient work start-up due to permit delays, and in some cases unforeseen ground and geotechnical conditions."

Trans Mountain also may have to compensate a contractorit severed ties with after a workplace fatality. In 2020, equipment struck and killed an employee working forSA Energy. The former contractor is "entitled to reimbursement" for costs before its contract was terminated, according to a quarterly earnings report from the Canada Development Investment Corporation, the Crown corporation which owns Trans Mountain.

Protecting ants, frogs, fish and snakes

The need toprotectculturally and environmentally sensitive areasadded $2.8 billion to the project's cost, Trans Mountain said.

The company saidmore money is needed to add "state-of-the-art leak detection" equipment and re-route the pipeline away from an aquifer in B.C.'s Coldwater Valley. It also said its crews have gone to great lengths to protect rare species in the construction zone removing raremoss by hand andrelocating100 anthills, 150,000 frogs and variousfish, snailsand snakes.

"These unplanned efforts," Trans Mountain said, have added $50 million to the project.

The pandemic is adding to project costs as well. Trans Mountain said the cost of COVID testing, personal protective equipment (PPE), changes to work camp accommodations and other health and safety measuresincreased its financial burden. It now counts more than 3,000 COVID-19 cases among its 13,500 employees.

Trans Mountain's president and CEO Ian Anderson did not make himself available for an interview.He has said in the past thathe hopes the project leaves behind a positive legacy for localcommunities, especially Indigenous ones along the pipeline route. Trans Mountain has signed mutual benefit agreements with almost 70 First Nations.

These agreements include money for education, jobs training, skills enhancement, business opportunities and improved community infrastructure. Trans Mountain estimates it isspending over $580 million on these agreements $200 million more than its previousestimate.

The company saidit also needs $1.7 billionto finance the debt that ithas accumulated along the way.

Who pays for the cost overruns?

As Trans Mountain recalculated the new construction costs, it assumed in its amended corporate plan "that 100% of the financing"would come from the government.But in February, Finance Minister Chrystia Freeland said the federal government wouldn't give any more money to the pipeline.

"I want to assure Canadians that there will be no additional public money invested in (Trans Mountain)," Freeland said.

"(Trans Mountain) will secure necessary funding to complete the project through third-party financing, either in the public debt markets or with financial institutions."

But as long as taxpayers own Trans Mountain, they'll be on the hook for whatever the company borrows. Trans Mountain hasconfirmed that only 20 to 25 per cent of TMX's total cost increases would be passed on to shippers through pipeline tolls.

Is the projectstill commercially viable?

One expert says no.

"The Trans Mountain expansion is not commercially viable. It is not going to return to Canadians as if it was a sound investment," said Robyn Allan, an independent economist and former president and CEO of the Insurance Corporation of British Columbia. "This is a huge taxpayer burden that we're facing."

Allan has been researching TMX for years and has spoken at various regulatory hearings. Since Trans Mountain has said it will only pass on 20 to 25 per cent of the cost increases to its customers, she said, the project probably will deliver a negative return on taxpayers' investment over its lifetime.

The government, meanwhile, insists thatTrans Mountain remains commercially viable. Freeland said in February thatthe government has studies from two major banks BMO Capital Markets and TD Securities showing the project will make money. When CBC Newsasked Wednesday for copies of these documents,the Department of Financesaid no.

"Owners of a corporation have the right to know that information," Allan said. "And if Canadians can't see that information, Canadians shouldn't believe it."

Trans Mountain also maintains that once the twinned TMX starts moving oil,its earnings will be "significant" enough to repay loans. Once in service, the pipeline expects to generate more than $1.7 billionannually, backed by shipper contracts over 15 to 20 years.

But that revenue forecast depends heavily on whether Trans Mountain can avoid furtherdelays and cost increases.

"Ongoing and uninterrupted execution of (the Trans Mountain expansion) is required to minimize cost and protect project returns and economics to Canada," Trans Mountain said in its amended corporate plan.

Blair King an environmental scientist and chemist who arguesTMX is in the national interest said he doesn't believe a negative return on investment should justify scrapping the project. He said Canadians need to remember that the twinnedTMX will boost tax revenues,government royalties and GDP, while reducingthe oil price differential and the amount of oil shipped by rail.

"As someone who deals with human and ecological risk, that's a really big thing for me, not having oil trains running through my communities and lowering greenhouse gas emissions,"King said."Those are pretty darn important."

When will it be finished?

According to the amended corporate plan, construction should be complete by June 30, 2023, nine months behind the revised schedule. The pipeline was supposed to be finished by Sept 30, 2022.

The pipeline won't start shipping oil until the Canadian Energy Regulator gives itfinal permission to operate. Trans Mountain saidthe pipeline won't see its first revenueuntil Sept. 30, 2023.

As of February, the project was close to 50 per cent complete. When it's finished, it will increase the pipeline's output from about 300,000 to 890,000 barrels a day.

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)