Why the failure to repeal Obamacare throws the rest of Donald Trump's agenda in doubt

U.S. president claimed tax reform would be 'so easy' after health-care repeal

"So easy," Donald Trump boasted last month, hyping the odds his Republican Party would pass tax reform after repealing the Affordable Care Act.

Then, a surprise: The health care law,also known as Obamacare, survived in the Senate last week, carrying on like a zombie in a Republican nightmare.

Perhaps even scarier for conservative lawmakers, though, is what that setback bodes for delivering on Trump's biggest promises to come, particularly given the looming legislative monster ahead.

Tax reform.

- Trump to decide soon if he will let 'Obamacare implode'

- Senate rejects partial Obamacare repeal in 'twilight zone' overnight vote

"If I get what I want," Trump told a crowd last week in Youngstown, Ohio, "it will be the single biggest tax cut in American history."

More than six months into his presidency, that remains a big "if."

"This failure has to focus the collective mind now on the absolute need to get something done, to deliver the policy promises that Trump made," said Ilona Nickels, a former parliamentary adviser for the non-partisan Congressional Research Service.

'Crashed the momentum'

Repealing Obamacare was the Holy Grail of conservative health-care policy, while tax reform was the second major pillar on which Trump campaigned. But familiar partisan divisions look likely to crop up.

Nickels, author of Why Congress Matters, believes the collapse of the health-care efforts points to a level of "congressional dysfunction" that spells trouble for an administration yet to have scored any major legislative achievements.

"It's a rare opportunity to have the executive, the Senate and the House" under unified party control, she said. "They have so much opportunity to get so much done, but they're squandering it."

Nickels wonders whether first tackling tax reform or an infrastructure spending bill might have gone down easier than health care, which has turned out not to be the low-hanging fruit it was believed to be.

"To blow it like this, it can't be undone. It just crashed the momentum for anything going forward and it's hard to rebuild."

A quick win will matter greatly to congressional Republicans as the 2018 mid-term elections near.

It's been a tumultuous year in Washington. The party, desperate to retain its slim majorities in the House and Senate, will want something to show for it.

Early test before tax reform

That's why the defeat on health-care reform is bad news for both Trump and the Republican Party, said Jim Thurber, founder of the Center for Congressional and Presidential Studies at American University in Washington.

"It's clear they're in a weak position," he said. "It's likely that after this, they're not going to be very successful with tax reform."

Pulling off "tax simplification" involves navigating complex loopholes, a tangle of powerful special interests that hold dear their tax breaks, and policies that can pit fairness against the goal of helping the economy as much as possible.

The president still needs Congress to help him pass a $1-trillion US infrastructure spending package, as well as to move forward on appropriating the estimated $20 billion US for his wall along the Mexico border.

Advancing a health-care repeal bill something Republicans were, in theory, united on was seen to be a test of Trump's ability to get things done on Capitol Hill.

The Trump administration is pushing to slash the corporate tax rate to 15 per cent, from its current 35 per cent.

"But tax reform, in many ways, is more difficult," Thurber said. "It can take years to do it, and there's no cross-party bipartisanship on this at all."

There's a reason comprehensive tax reform hasn't come about since 1986, said former Treasury Department official Michael Graetz, a Columbia University specialist on U.S. tax law.

Republicans are at least united on the broad idea that rates should be cut for businesses and individuals. For the most part, the party "has been singing from the same hymnal for years," Graetz said.

Still, a shared overall goal can be torpedoed by factions within the party, as the Senate's health-care flameout showed.

"The original health-care bill had also been designed with this idea of making tax reform easier," Graetz noted.

Legislative limits

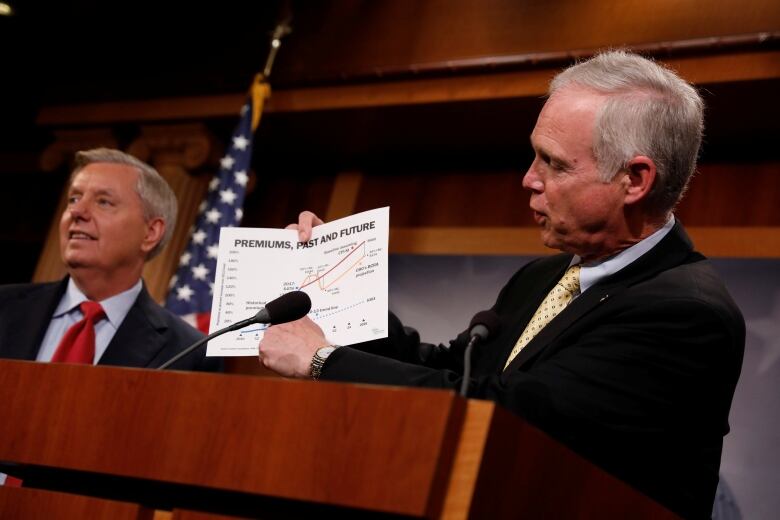

To a degree, the no-go on quashing Obamacare complicates plans for rewriting the tax code. A new health-care bill might have cut about $1 trillion in Obamacare-related taxes over 10 years. That lower tax revenue baseline would have helped Republicans craft a tax bill that's revenue neutral, meaning it wouldn't increase the deficit.

Senate Republicans originally used a budget procedure called "reconciliation" to try to pass Obamacare repeal with just 51 votes, relying on the party's 52-seat majorityinstead of the usual 60 votes required. They plan to take advantage of the same process to sidestep a Democratic filibuster to pass a tax bill.

The hitch is that using the reconciliation process means limiting what can be done legislatively. If the bill isn't revenue neutral, for example, the tax cuts would have to be temporary, potentially upsetting Republicans who are seeking permanent changes to the tax code.

Consensus, in other words, isn't guaranteed if Republicans are considering a less ambitious tax-reform push.

Treasury Secretary Steve Mnuchin originally wanted a bill outlining a historic tax cut to appear on the president's desk this summer. At this point, any major legislative victories seem unlikely before the August congressional recess.

Trump had promised to repeal Obamacare on "Day One" in office back in January.

"The fact we would be here now, with this outcome, is unthinkable to me," said Rachel Bovard, director of policy at the Conservative Partnership Institute, an organization committed to training Washington conservatives.

'Shiny unicorn'

Bovard hopes the health-care collapse can serve as a teachable moment when it comes to tax reform, which she calls "the shiny unicorn of Republican politics." Achieving that may depend on consensus over core principles, a more modest plan, and not getting caught up in special interests.

"Build the legislation around core goals," Bovard argued, "not at all these little wonky loopholes, these niche points, like homing in on the border-adjustment tax," she said, referencing a former sticking point.

- How to lose a chief of staff in 189 days

- Trump's next legislative fight could be more taxing than health care

Whether or not the health-care setback ultimately portends problems for tax reform, tax policy expert and Heritage Foundation senior fellow David Burton anticipates a long and complex process ahead.

"I've got to think members of Congress would rather go home with an accomplishment than not," he said, noting a revised timeline for a tax bill is now the end of this year.

That now sounds optimistic to Burton though not impossible.

"They need to start if they're ever going to finish."

_(720p).jpg)

OFFICIAL HD MUSIC VIDEO.jpg)

.jpg)